Finance and accounting are essential aspects of every business, but they’re historically reliant on time-consuming and error-prone manual processes. Finance automation seeks to replace these processes with fully automated and modernized ones. Understanding the five levels of automation and the four key steps you can take toward digital transformation will help you ensure your efforts deliver the best possible results for your business.

What transformation looks like

Finance automation has the power to transform your entire finance and accounting function, from the staffing levels you need to the reporting you deliver, to your overall growth and efficiency. Here are some ways finance automation can benefit your business:

- Increased efficiency: Develop efficiencies by automating processes within finance functions to eliminate manual tasks, data entry and human errors while improving accuracy and operational performance.

- Data accuracy and consistency: Integrated and connected systems ensure you get consistent answers irrespective of the data’s source.

- Improved customer and employee experience: Customers enjoy a frictionless experience and employees are freed from transaction processing to focus on financial analysis and meaningful insights benefitting the organization and fulfilling resources.

- Reduced costs: Automating processes increases the productivity of existing staff and can provide future cost avoidance in the form of staffing and/or risk reduction.

- Powerful insights/increased transparency: Artificial intelligence (AI) and machine learning (ML) embedded in finance and accounting applications use historical data to offer recommendations to drive strategic decision making.

- Scalability for future growth: Many of today’s finance automation solutions are managed in the public or private cloud. For middle market businesses, the cloud offers the ability to scale up or down as business needs evolve without purchasing additional hardware or software. Cloud applications also provide the infrastructure to support a digital workforce, providing the ability to locate talent remotely.

Adjusting to change and challenges

In addition to building efficiency and optimizing processes, automation can adapt to trends that may influence the finance function at your organization. Some examples include:

- Disruption: Whether it’s due to changing customer expectations, new technologies, regulatory updates, economic conditions or new market entrants, moving your finance function toward a fully automated, data-driven approach will enable you to take preemptive action to meet industry disruption head-on.

- Regulatory shifts: Regulatory agencies are increasing their focus on customer protections, data retention policies and more fair treatment of disadvantaged communities. Automating regulatory compliance enables you to make centralized updates and ensure that these changes are reflected across your tools and applications.

- Skilled labor shortage: In a recent RSM survey, 58% of middle market businesses say that hiring is “very” or “extremely” challenging, and 68% say they are struggling to attract experienced talent. Automating processes reduces staffing requirements and can boost employee retention by engaging your existing talent in more interesting, fulfilling work.

- Process innovation: A plethora of new technologies such as generative AI, ML and big data can transform the finance function. Taking advantage of automation today will lay the foundation to make the most out of these new technologies as they become more widely utilized.

Finance automation maturity: A continuum

Many businesses have implemented a variety of finance automation solutions but haven’t achieved the nirvana of transformation. Often teams are overwhelmed by their options and/or have difficulty gaining the necessary stakeholder buy-in.

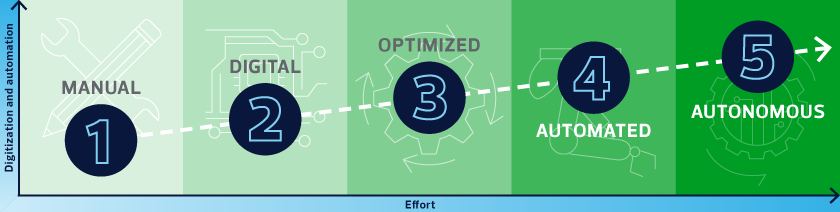

Remember that finance automation exists on a continuum. It’s important to keep moving forward, building momentum as you go, until you arrive at the highest level of finance automation: autonomous finance and accounting processes.

Here’s how RSM defines the five levels of finance automation maturity: