Increased margin pressure will lead more companies to change their risk appetite.

Key takeaways

Businesses must prioritize investment in core products and explore ways to repurpose them.

Technology solutions to boost productivity throughout operations will be critical.

Across the sectors hardest hit by the rising costs of materials and labor, middle market businesses need to shift their focus from the dominant “grow at all costs” corporate strategy of the last decade-plus to a more foundational emphasis on profitability.

Increased margin pressure will lead more companies to change their risk appetite, prioritize investments in productivity-enhancing projects, and consider slowing down or postponing big bet investments with a less certain payoff.

This is not to say organizations should do away with efforts around innovation; deprioritizing longer-term projects carries its own risk that competitors may trounce companies in the next few years through new products or services. Businesses need to carefully balance spending on core revenue-generating functions with zeroing in on operational efficiencies and decide where it makes most sense to double down. In either scenario, this shift will likely require embracing technology in new ways and accepting lower margins for a period of time while waiting for investments to show return.

Inflation and margin erosion

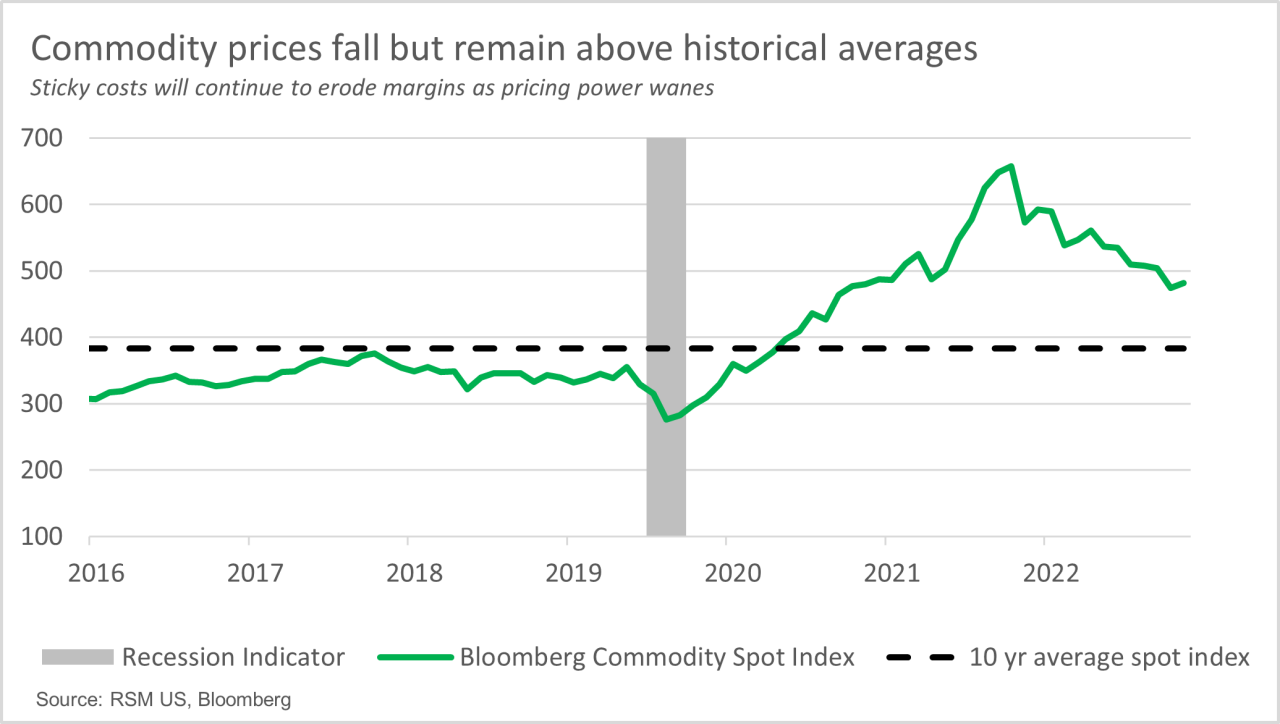

A slower-growth economy characterized by persistent inflation, the higher cost of capital and weakening demand has created the perfect storm for numerous sectors, even as some supply chains have stabilized. The environment may be even more challenging for middle market companies, which often do not have the pricing power of larger firms.

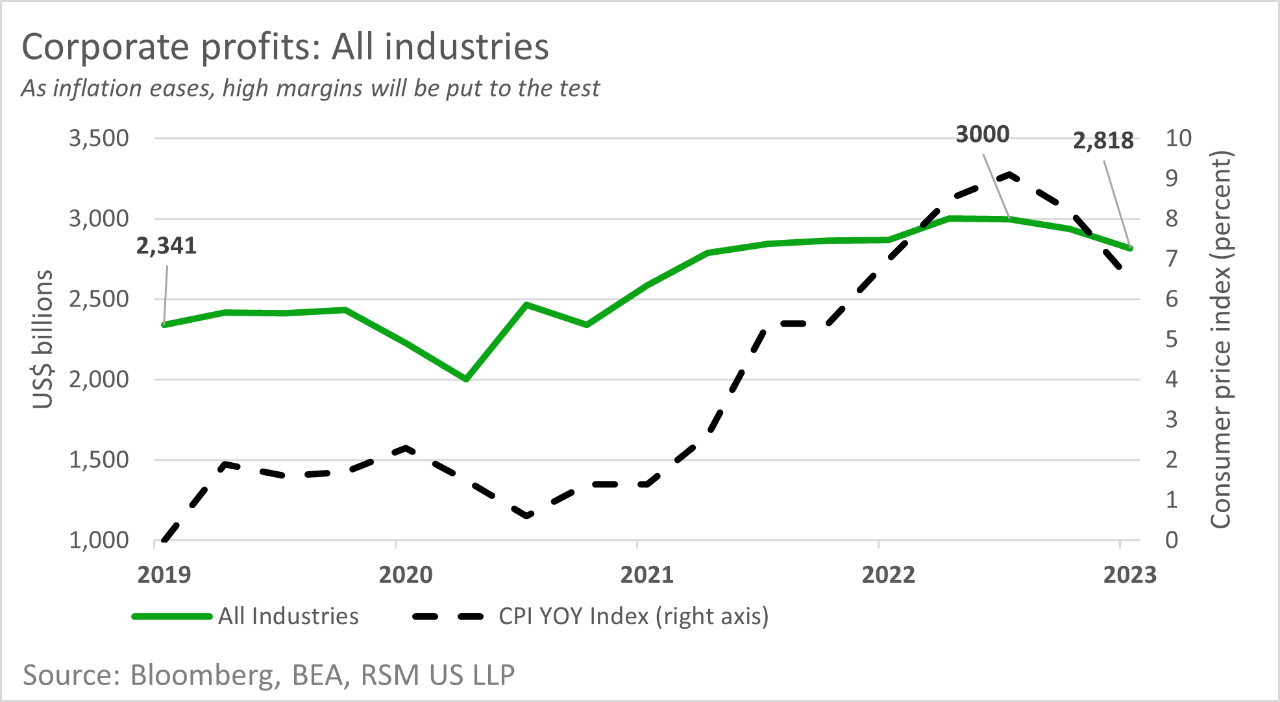

That said, it’s not all doom and gloom. Expectations on revenues and net earnings remained strong for midsize companies amid a modest deterioration in the second quarter of 2023, according to June data from the firm’s proprietary RSM US Middle Market Business Index survey, which tracks business sentiment. However, RSM Chief Economist Joe Brusuelas cited general compression in profit margins across the economy as lingering inflation continues to increase business costs and higher borrowing costs cut into firms’ bottom lines.

Want a real-time view of your company’s financial picture?

One continuing sign of strength in RSM’s MMBI survey has been firms’ willingness to invest in productivity-enhancing capital expenditures. Almost half, or 46%, of respondents said they increased business investment in the second quarter, and 60% expect to do so through the end of the year, according to June survey data.

Profits continue to show softness in part due to inflationary pressures, which are persisting despite expectations among buyers that prices should be deflating. The margin picture varies, however, depending on the industry.

Commodity prices continue to slide, but overall remain elevated and sticky. Price reductions will require time to work their way through the economy and will remain a drag on profits.

Pressure points by sector

Margin pressures show up differently depending on the sector, and as such, often require different solutions. Consumer products companies have faced a variety of challenges since the start of the pandemic. Along with inventory overhang, businesses have dealt with supply chain uncertainty and shifting consumer preferences. For instance, many retailers plagued with excess inventories have leaned heavily on discounting to move product, resolving to absorb a short-term margin hit.

In the construction sector, where the prices of materials are moderating, labor costs continue to present a challenge, and builders are hard-pressed to leverage technology to gain efficiencies. The construction worker shortage continues, pushing wages higher; job openings have increased for much of the past decade within the sector, with a significant increase beginning in 2021. Meanwhile, contractors have seen an increase in project demand from government infrastructure initiatives and the housing boom; home prices have risen amid a limited supply of new homes.

Some industrial companies—which have faced recruitment and retention challenges for years—are hoarding labor in the tight job market while looking elsewhere in the business to reduce costs. The industrial space is also hampered by higher inventory levels. Manufacturers of durable goods are now operating with an inventory-sales ratio of 1.4, higher than 1.33 at the same time a year ago. Inventory accumulation weighs down margins due to increased inventory management costs, potential write-downs of obsolete goods and the need to sell excess inventory at a discount.

In the biopharmaceutical space, fundraising challenges in the capital markets have companies looking to larger industry players for funding, whether through mergers and acquisitions or other deals. M&A activity was significantly lower in 2022 compared to prior years, according to Bloomberg and PitchBook, attributable in part to margin decreases at many large commercial pharmaceutical companies.

Like businesses across other industries, pre-revenue biopharma companies have felt the negative impact of wage inflation and global supply chain issues. The rising costs of salaries and contract research as well as a variety of macroeconomic issues continue to affect margins at these growing companies.

Need a scalable model to offset rising labor costs?

Shifting the focus

Even with these pressures, companies should not abandon innovation efforts altogether. Rather—for the immediate future—they must prioritize investment around core products and services and explore potential ways of repurposing those core offerings. For many middle market businesses, meeting financial targets by making intentional, incremental improvements—rather than implementing disruptive innovations—will be important for short-term survival and success.

Businesses across sectors should investigate every opportunity to optimize operations, including:

- Diversifying and optimizing product offerings with a focus on high-margin products

- Enhancing marketing strategies and post-sales support to differentiate from competitors

- Focusing on production efficiencies across the entire value chain, with continued investment in automation and productivity-boosting technologies, and in improving supply chain and inventory management

- Considering where reductions might make sense within the research and development budget

- Using technology to identify inefficiencies and opportunities for cost cuts

- Renegotiating contracts with suppliers and working with customers to negotiate cost reimbursements

- Streamlining processes and upskilling employees to improve efficiencies

- Exploring where it makes sense to work with a third-party advisor for outsourced or managed services

Technology solutions are key in any optimization strategy. Digital twins, for instance, can help manufacturers build simulations to understand how various supply and demand scenarios would affect operations. Construction firms can benefit from deploying tech solutions to assist in project planning and work site oversight. Consumer products companies should explore investments in predictive analytic tools to ensure future purchasing decisions are based on the most accurate data on consumer spending.

Investments in the appropriate inventory management and sales forecasting tools will be critical for companies across many sectors to limit future exposure and improve profitability. Embracing these and other technologies and educating employees on how to use them will be critical as companies continue adapting to the impact of economic headwinds.

RSM contributors

The Real Economy

The Real Economy Canada

A quarterly economic report for middle market business leaders.

Industry insights

Industry-specific insights for the middle market.