A slower-growth environment, persistent inflation, a higher cost of capital and volatile demand have created the perfect storm.

Key takeaways

The situation may be even more challenging for middle market companies.

Optimizing offerings with a focus on high-margin products is one of several actions to take.

Actions companies can take to optimize operations

With the slowing economy, elevated production costs and rising inventory levels, manufacturers’ focus is shifting from navigating supply constraints—a prevailing theme of the past three years—to supporting revenue and protecting margins.

Each subsector of the industrial world experiences economic headwinds differently, given the diversity of the consumer end market and the specifics of each ecosystem. However, operational efficiencies and margin protection came up as key near-term priorities on most manufacturing companies' earnings calls for the fourth quarter of 2022.

Demand implications

Economic activity in the manufacturing sector has been contracting since December, according to the Institute for Supply Management’s purchasing manager index, with a February reading at 47.7 (figures below 48.7 indicate contraction). Both new orders and production subindexes are in contraction territory, with survey participants reporting sluggish sales growth and a corresponding slowdown in production output.

Manufacturers will need to be strategic about capital allocation and continue investing not only in product development but also in advanced production technologies that can enable them to emerge from a recession in a position of strength.

In particular, sectors vulnerable to interest rate hikes and dependent on consumer discretionary spending (e.g., residential building materials, consumer electronics, plastic and other materials, and automotive manufacturers and suppliers) face softening demand. On the other hand, suppliers for the service sector continue to see robust orders supported by consumers’ shift from goods to services and recovery of the underlying sectors. Original equipment manufacturers and suppliers for the commercial aerospace sector, for instance, are getting a lift from air-travel recovery, further boosted by China’s reopening.

Certain industrial sectors will also benefit from global industry trends, unfolding U.S. industrial policy, investment from the Inflation Reduction Act and increased national defense spending. Industrial machinery producers for energy and utility markets are supported by the tailwinds of high oil and gas prices, energy producers’ capital spending, and investment in energy transition projects. Construction materials and equipment manufacturers, although significantly affected by the weakening residential market, see support from government infrastructure investments. And another tailwind for the industrial sector is the structural trend toward an advanced technology economy with automation and electrification, creating long-term growth in many sectors.

Margins across subsectors

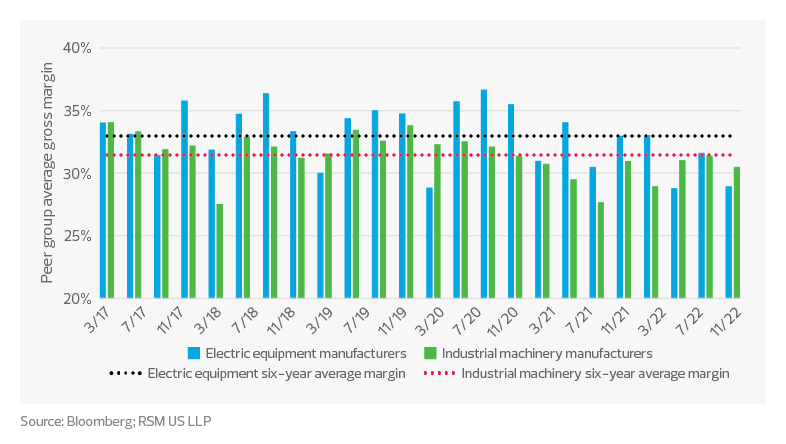

Our analysis of gross margins across industrial peer groups shows that the electric equipment sector, which maintained higher margins throughout the pandemic backed by a work-from-home shift and strong pricing power due to inventory shortages, started to lose momentum in mid-2022 amid a slower economic outlook, tightened consumer spending and moderating capital investments by firms. In contrast, industrial machinery manufacturers’ earnings were more resilient, supported by infrastructure investments; strong end markets in the energy, national defense and agriculture sectors; and accumulated backlogs created by supply disruptions.

North America electric equipment and industrial machinery manufacturers

gross margins

Production costs

While inflation is moderating from its all-time peak last year, production costs remain elevated. Material prices are easing but still significantly exceed the 10-year average. The slowdown in the global economy, moderating fuel prices, and normalization of transportation and logistics disruptions also resulted in a drop in marine and ground freight rates.

The challenge that will persist in the foreseeable future is rising labor costs in a tight labor market. Although the manufacturing sector lost 4,000 jobs in February—the first net reduction in payrolls since April 2021—the sector’s unemployment is at a historically low level of 3%, and there are still 803,000 open jobs.

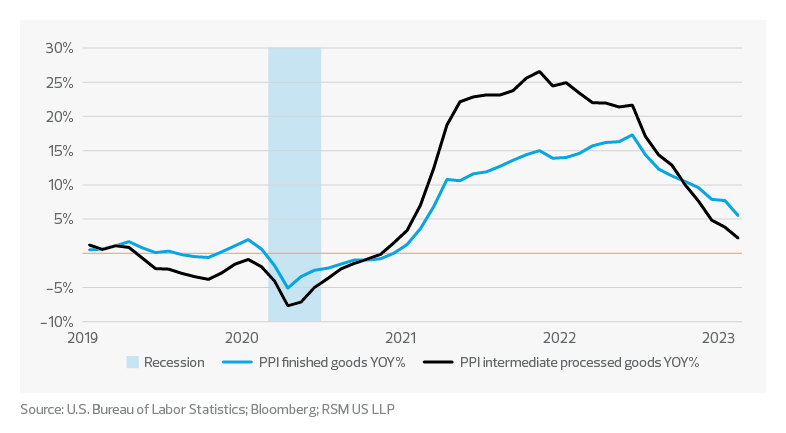

U.S. producer price indexes, reflecting prices companies pay for finished and intermediate goods, have declined since mid-2022. And since October of last year, the pace of price gains for finished goods outpaced the inflation of intermediate goods, indicating easing input prices and improved pricing power for end manufacturers.

TAX TREND: Manufacturing

As companies develop new equipment, processes and products to enhance productivity and margins, the clean energy tax credits and incentives available in the United States may reduce their tax obligations and improve cash flow.

U.S. producer price indices: Finished and intermediate goods YOY%

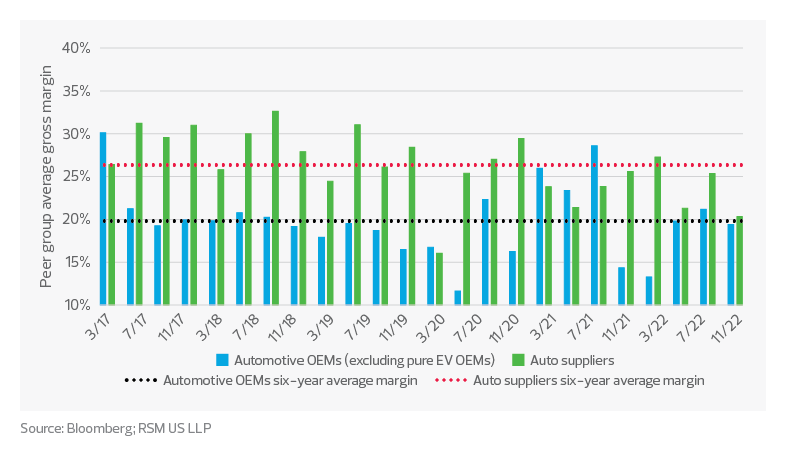

Supply chain snarls, one of the drivers of cost inflation, have mostly normalized—the RSM US Supply Chain Index is back in positive territory at 0.15. While production disruptions persist in some sectors due to shortages of certain components, this normalization has had a positive effect. Margins of legacy automotive OEMs (excluding pure EV producers), for instance, have bounced back after taking a hit in late 2021 due to severe supply chain disruptions and production shutdowns. Still, OEM and supplier margins remain under stress due to volatile demand and production, elevated production costs, and the need for substantial capital investments in EV production capabilities and autonomous driving technologies.

North America automotive OEMs (excluding pure EV producers) and automotive suppliers–gross margins

Inventories

Resolving supply and production constraints and moderating sales have led to rising inventory levels. Based on composite data from the U.S. Census Bureau, manufacturing inventories now are growing at twice the sales rate. Manufacturers of durable goods operate with an inventory-to-sales ratio of 1.8, significantly higher than the nonrecessionary period average of 1.6. Inventory accumulation will weigh down on margins due to increased inventory management costs, potential write-downs of obsolete goods and the need to sell excess inventory at a discount.

Inventory management based on accurate sales forecasts and capacity planning, stock keeping unit rationalization, and product costing optimization will be essential in middle market companies’ efforts to protect their margins. In addition, manufacturers will need to be strategic about capital allocation in the current tight financial conditions and continue investing not only in product development but also in advanced production technologies that can help fill labor gaps, boost productivity, and enable them to emerge from a recession in a position of strength.

TAX TREND: Manufacturing

A component of total enterprise efficiency is the optimization of tax structure and planning, along with the efficient utilization of tax function resources. A company that outsources or co-sources its tax function can augment the strengths of its in-house professionals with labor and technology without having to add full-time employees.

Actions to take

A slower-growth environment, persistent inflation, a higher cost of capital and volatile demand have created the perfect storm for the manufacturing sector. The situation may be even more challenging for middle market companies, which may not have the same pricing power as larger firms. In such an environment, businesses should investigate every opportunity to optimize operations, including:

- Diversifying and optimizing product offerings with a focus on high-margin products

- Enhancing marketing strategies and post-sales support to differentiate from competitors

- Focusing on production efficiencies across the entire value chain, with continued investment in automation and productivity-boosting technologies, and in improving supply chain and inventory management

- Using technology to identify inefficiencies and opportunities for cost cuts

- Renegotiating contracts with suppliers and working with customers to negotiate cost reimbursements

- Streamlining processes and upskilling employees to improve efficiencies

This article was originally published on RSM US LLP.