Modular homes are an attractive alternative to traditional construction in wildfire-prone areas.

Developers may be eligible for tax credits through business assistance programs.

Modular homes appeal to insurance firms looking to mitigate high-risk properties.

As climate change-induced wildfires in Canada escalate in frequency and intensity, modular homes emerge as an attractive alternative to traditional construction in burn-prone regions.

By enabling real estate developers and insurance firms to rebuild quickly and sustainably while mitigating risk, modular homes are reshaping the housing landscape and fostering community resilience in the face of natural disasters.

Canada’s wildfires are worsening

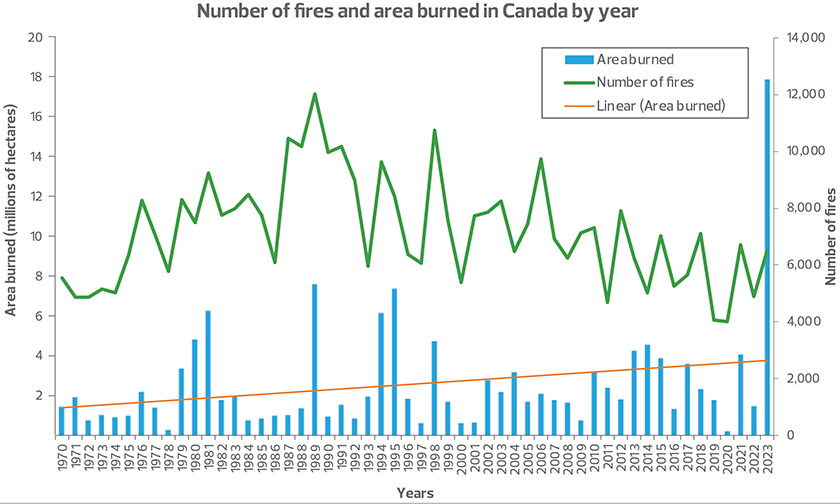

In 2023 alone, Canada’s wildfires obliterated more than 17.9 million hectares of land, shattering a previous record set in 1989 of 7.6 million hectares per the Canada’s National Forestry Database (NFD). For context,17.9 million hectares is approximately equal to 13.55 million American NFL fields. Recent wildfires surpassed even the 10-year average of 2.5 million hectares, defying predictions by climate experts.

Source: Canadian National Fire Database (1970-2021 data)

Source: Canadian Interagency Forest Fire Centre Inc. (2022-2023 data)

Modular housing to the rescue

Modular homes are factory-built structures that offer various benefits, especially in disaster-prone areas. Construction takes place off-site, with builders responsible for site preparation while manufacturers create individual modules. These modules are later transported and installed on a prepared foundation, resulting in faster construction and cost savings. Some designs allow easy disassembly and relocation in case of floods. In disaster-prone regions, modular homes provide a practical, customizable and resilient housing solution.

Modular homes offer significant advantages over traditional construction. While traditional homes take 9 to 12 months to build, modular construction requires three to four months, according to the National Association of Homebuilders. The faster build time results in earlier rental income for multifamily investments and reduces construction costs by about 20 to 30 per cent. Labour expenses drop because modular construction relies on factory workers over individual tradespeople. Working indoors in a controlled factory environment allows year-round operation, independent of weather conditions. Amid supply chain disruptions, rising construction costs and labour shortages, modular construction stands out for its predictable and controlled pricing.

Sourcing and consuming materials for modular homes on a larger scale not only promotes material efficiency but also reduces waste through factory-based processes, and the waste that is generated is more readily separated and recycled. This approach increases access to housing and affordability in costly markets while enabling the widespread adoption of low-energy and sustainable design practices including smart homes and passive house principles. Amid housing affordability challenges, modular construction emerges as an eco-friendly, cost-effective solution optimizing materials and energy efficiency.

Tax incentives for developers

It is possible for modular home factories to capitalize on tax incentives from business assistance programs administered by the federal and provincial governments. For instance, Canada’s Scientific Research and Experimental Development (SR&ED) tax credit is intended to encourage and support organizations to undertake research and development activities; testing new methods of sustainability may apply. For specific Canadian-controlled private corporations, enhanced SR&ED credits can generate a cash refund to the company if no taxes are owed. Eligible expenditures include work focused on:

- Developing methods to improve structural strength and life of structure

- Developing methods to improve failure prediction of materials and structure

- Developing new methods for the application of cementitious products and surface coating that improve cohesion and strength resilience, and reduce material waste

- Developing new products such as lighter weight, stronger, more resilient or easier-to-process building materials

- Developing new manufacturing and modularization techniques to improve delivery time and reduce cost

- Integrating renewable energy technology in buildings or reducing energy losses to reduce carbon footprint

- Designing using composite building materials to improve the energy efficiency of a building

- Integrating new materials to improve product performance, energy efficiencies and manufacturing processes

The draw for insurance companies

The repercussions of Canadian forest fires extend beyond the immediate destruction of forests and homes. The Canadian insurance industry faces immense pressure to grapple with the escalating costs of insuring properties in high-risk areas. Property owners and real estate investors in North America have been hit hard by rising insurance costs. Renewal rate increases have surged by a staggering 20 per cent year-over-year. In the first quarter of 2023, property insurance pricing spiked by 17 per cent, marking 22 consecutive quarters of price hikes. The impact of inflation further compounds the situation, necessitating higher retentions and resulting in increased costs and more restrictive coverage options.

Insurance firms are increasingly compelled to address climate risk and disclose relevant information in accordance with the Office of the Superintendent of Financial Institutions. These mandates necessitate the disclosure of financial exposure to climate risks and strategies for risk mitigation. Similar expectations are emerging in the United States, where the U.S. Securities and Exchange Commission’s proposed rules on climate disclosure may affect major insurance companies.

Modular homes, recognized for their disaster resilience, align closely with climate risk mitigation efforts. While this alignment may boost the appeal of modular housing by fostering climate-resilient construction practices and cutting insurance expenses, most homeowner insurance policies present a major barrier to entry for builders. Replacement cost coverage typically requires rebuilding damaged homes exactly as they were before a catastrophic event, essentially eliminating any incentive to switch to modular housing.

The takeaway

As Canada faces the ongoing threat of forest fires, real estate developers and insurance providers may look to capitalize on modular homes for their many benefits; however, insurance policy changes are needed to encourage adoption. Through the promise of increased production, reduced risk and lower costs, this alternative to traditional construction offers hope for sustainable real estate development and community resilience.

RSM Canada associate Ruji Feng contributed to this article.