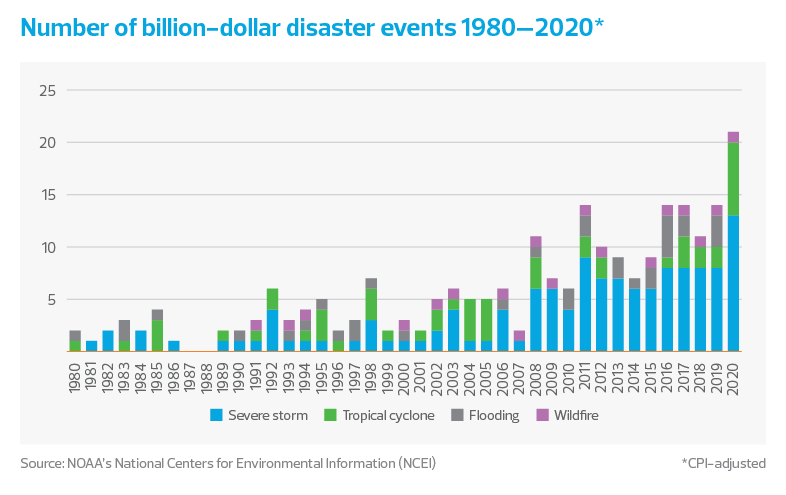

With climate events expected to continue increasing in severity and frequency, and loss frequency predicted to rise as well, insurance companies must understand climate risks and the implications greater exposures can have on their business.

Climate factors affecting insurance

Insurers prepare for the potential impact of climate risk factors and incorporate climate mitigation as part of their enterprise-wide corporate strategies, risk management and investment portfolios. Climate change risk factors that may affect the insurance industry typically fall into three main categories: physical, transition, and liability.

- Physical risks arise from extreme changes in weather and the climate. They are categorized as either chronic (droughts, landslides, rising sea levels) or acute (wildfires, heat waves, storms, floods) and may increase in severity or frequency over time.

- Transition risks relate to the process of adjusting to a low-carbon economy, a shift that companies and governments are making to address the impacts of climate change. For example, regulatory changes and policies around corporate climate-risk disclosures can potentially advance, accelerate, slow or disrupt the transition toward a low-carbon economy.

- Liability risk is a type of operational risk that a company or its directors and officers assume if failing to demonstrate they have taken actions to mitigate climate change risks or failing to fairly represent asset values in the context of weather-related events. Common claimant allegations could be a breach of fiduciary duties, failure to comply with regulations, or reporting errors.

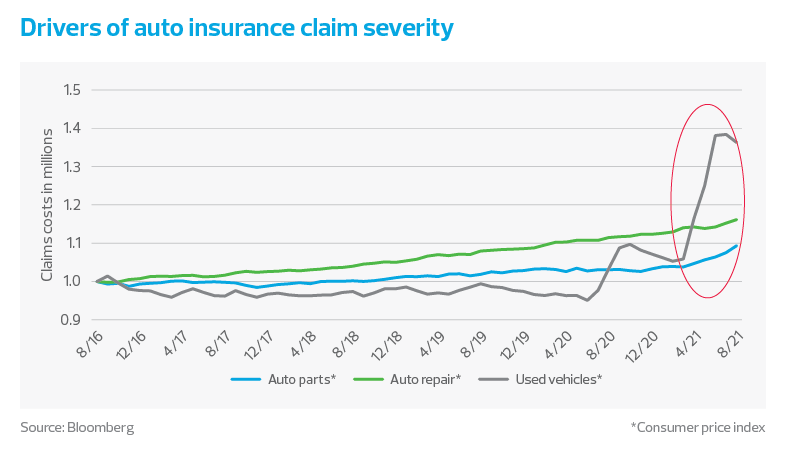

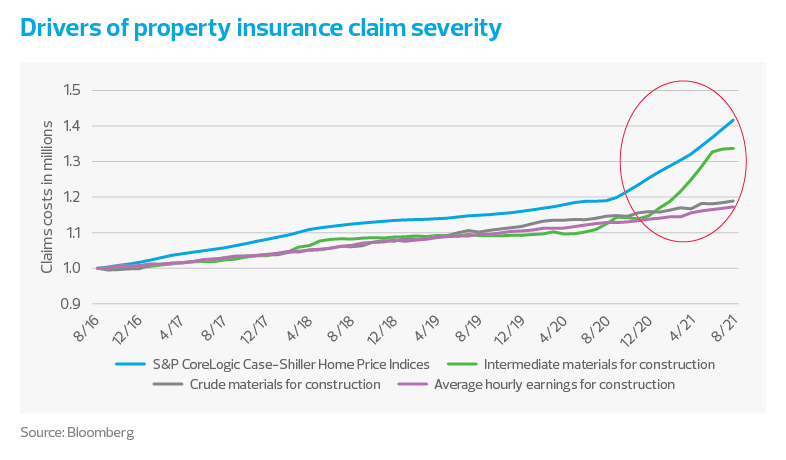

These risk factors related to climate change pose threats to the insurance industry on a macroeconomic scale from both supply and demand perspectives. Supply-side shocks affect the productive capacity of the economy in the form of shortages of commodities, diminished labor supply or damage to capital stock due to extreme weather events. Raw material and commodity price increases have been further exacerbated by the pandemic, and for insurers, this can directly contribute to rising claim costs for catastrophic events.

Climate change risk factors that may affect the insurance industry typically fall into three main categories: physical, transition, and liability.