As the energy transition gains momentum, demand for critical minerals will continue to surge.

Key takeaways

Companies along the industrial supply chain need to assess what this means for operations.

Implications for the future include ESG considerations, human capital needs, and supply issues.

As the energy transition gains momentum and drives major economies to shift from carbon-intensive to mineral-intensive energy and transportation systems, demand for critical minerals will continue to surge.

If countries reach their net-zero goals, annual demand for metals for energy-transition technologies will jump an estimated 242 metric tons by 2050 from the current 52 metric tons, according to BloombergNEF, creating a tremendous opportunity for the metals industry.

Given this outlook, many countries are taking steps to secure a reliable supply of these minerals. The United States has been developing a strategy to increase sustainable domestic production and invest in access to global supplies while diversifying foreign sources of critical minerals. In Canada, mining and processing of critical minerals has emerged as a focus sector for federal and provincial governments and private investment.

Companies along the entire industrial supply chain will need to assess what this means for their current and future operations and take a balanced approach to both energy security and near-term sustainability.

The energy transition

The energy transition at scale—including transportation electrification, clean power adoption, power grid modernization, and decarbonization of the industrial sector—will require a reliable and secure supply of critical minerals and metals. BloombergNEF estimates that the world economy will need $6 trillion to $10 trillion (in 2022 real dollars) worth of metals between now and 2050 to reach net-zero emission targets.

The U.S. Department of the Interior defines a critical mineral as one “identified to be (i) a non-fuel mineral or mineral material essential to the economic and national security of the United States, (ii) the supply chain of which is vulnerable to disruption, and (iii) that serves an essential function in the manufacturing of a product, the absence of which would have significant consequences for our economy or our national security.”

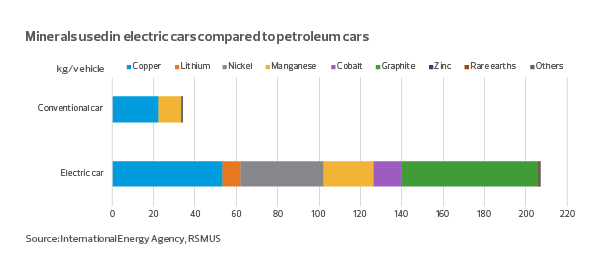

The 2022 list of 50 critical minerals released by the United States Geological Survey includes aluminum, nickel, lithium, graphite, manganese, cobalt, and rare earth minerals crucial for the energy transition. While consistent demand from the manufacturing and construction sectors will continue, the energy sector is emerging as a major driver of demand for minerals. For instance, according to the International Energy Agency, the production of electric vehicles (including lithium-ion batteries) requires roughly six times the amount of critical minerals of the internal combustion engine car, and an onshore wind plant requires nine times more minerals than a fossil fuel plant.

Implications for the future

The entire industrial ecosystem is affected by the rising demand for critical minerals. The mining, metallurgy, energy, utilities, chemicals, automotive and other sectors have plenty to navigate.

While growing a new supply of metals, the industry should continue to scale up technologies aimed at optimizing the mining and processing of metals and increasing metals recycling and secondary production. Alongside that technology implication, here are some of the biggest factors driving future growth and what they mean for organizations:

1. Limited supply of critical minerals:

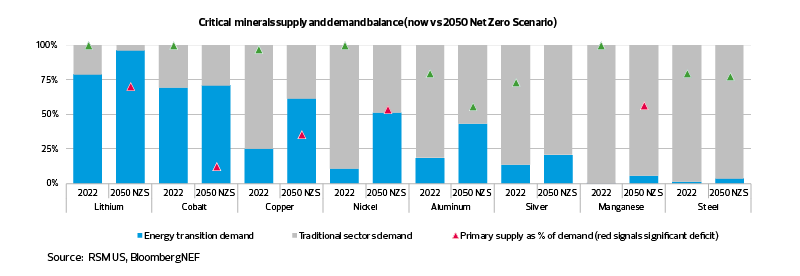

The chart below reflects the supply and demand for primary energy transition metals under the net-zero scenario modeled by BloombergNEF. Under this aspirational scenario, a significant undersupply is projected for lithium, cobalt, copper, nickel, and manganese; and the portion of metals consumed for energy transition technologies increases with the evolution of energy and transport sectors.

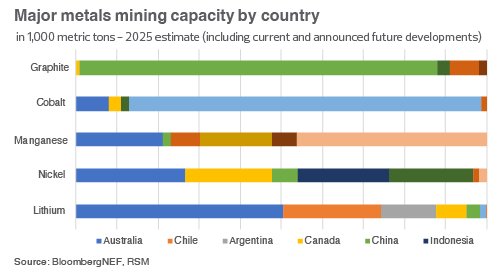

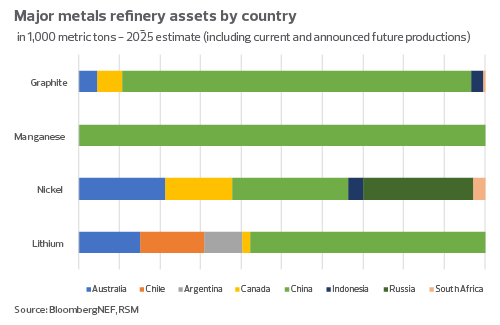

A handful of countries hold more than 50% of the mining capacity of major critical minerals, and the geography of refinery assets is even more concentrated, with China dominating the refining industry.

With the surging demand for critical minerals, resource nationalism is gaining attention in some resource-rich countries. In contrast, some countries such as Canada and Australia have created strategies and frameworks around critical minerals to incentivize and support domestic and foreign direct investment in minerals mining.

The Inflation Reduction Act aims to catalyze domestic mining and production and develop a supply chain of critical minerals domestically or from U.S. allies. While a mix of tax credits and incentives will stimulate investments in mining and production, the sourcing requirements for EV tax credits will put additional pressure on the already strained EV minerals supply chain.

2. Complex, time-intensive processes:

Mining is a very capital-intensive and highly regulated industry, which is why the market is heavily centralized; the top 50 mining companies collectively hold $1.23 trillion of market capitalization as of the end of 2022. Also, the production chain of mining, smelting, and refining minerals is a technologically complex and time-consuming process—it takes a minimum of 10 years to develop and launch a mining project.

All of this creates a gap between elastic demand and inelastic supply. Miners and metallurgy producers tend to act cautiously in their investment decisions as they wait for a clearer indication of future demand and price trends. As of early 2023, price volatility, recession fears, uncertainties around geopolitical conditions, and China’s recovery following its “zero-COVID” policy are all factors affecting supply.

Economic stability, government support, and clear policies will be key to reducing the costs and risks of launching new mines and production, in turn, incentivizing private sector investment in the development of supply chains for critical minerals.

3. The need for human capital:

Building out critical minerals supply chains will require a highly trained workforce of geologists, mining engineers, environmental scientists, chemists, and supply chain and logistics professionals. The tight labor market will also pose continued challenges, including aging and retiring personnel, the skills gap, lack of training programs, public perception of the mining industry, and recruitment competition with other sectors of the economy. These challenges will only intensify with the efforts to onshore mining and metal production.

Companies will need to double down on attracting, training, and retaining key talent. Governments and educational institutions will also play a key role in advancing education in STEM fields and developing technical training programs and apprenticeships specific to mining and metallurgy, as well as attracting a skilled immigration workforce.

4. ESG considerations:

Mining and metallurgy operations have historically been associated with significant environmental impacts such as pollution, habitat destruction, and hazardous waste. As environmental, social, and governance issues become more important to various stakeholders, mining and metallurgy companies should focus on developing sustainable and responsible mining and processing operations, improving supply chain transparency, and minimizing their environmental footprint.

ESG measures can help with:

- Lowering the cost of capital and gaining access to larger pools of capital: Investors will increasingly look at ESG practices when assessing companies’ overall performance.

- Boosting employee morale and retention: ESG scores will be vital in attracting and retaining a younger workforce conscious of their employers’ environmental and socioeconomic footprint.

- Improving operational efficiency: On multiple fronts, decarbonization of mining and production operations can lead to operational cost savings as well as more favorable qualitative metrics of the company’s performance.

- Enhancing reputation and brand image: This outcome can enable strong relationships with internal and external stakeholders, such as employees, investors, partners, regulators, and customers.

Conclusion

In the short term, there will be much volatility in the supply and demand of critical minerals due to an anticipated economic slowdown globally, continued supply chain disruptions, geopolitical tensions, and uncertainties around China’s reopening. However, in the long run, the demand for critical minerals is expected to grow as the global energy transition continues.

Private sector investors and governments will need to cooperate in order to build an environmentally and socially responsible framework for mining and processing critical minerals, an effort that should include convening industry stakeholders to expand exploration and production.

Companies in this space should closely monitor industry developments and policy evolution, continue investing in research and development as well as workforce and technological advancements, and understand the ins and outs of government incentives to maximize the benefits of government support.