What began out of necessity early in the pandemic has become a preference among workers.

Key takeaways

Facing a tight labor market, employers have had little choice but to accommodate workers’ demands for flexibility.

Larger middle market firms have handled the transition better, both from a technological and human resources standpoint.

Remote work allows businesses to source talent from a bigger geographical area.

Three years after the start of the pandemic, remote work is becoming a permanent fixture among American middle market businesses, according to a recent survey from RSM US LLP.

What began out of necessity early in the pandemic has become a preference—and middle market businesses, desperate to attract and retain employees, are going along.

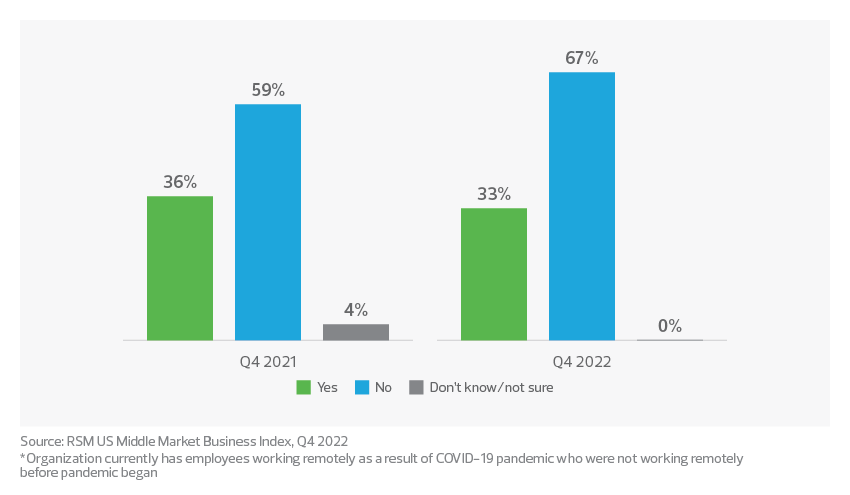

In the fourth quarter, 33% of middle market executives responding to the RSM survey reported having employees working remotely due to COVID-19 who were not doing so before.

That is only slightly below the 36% who responded similarly to the same question a year earlier when COVID-19 infections were higher.

The Harris Poll conducted the RSM US Middle Market Business Index survey from Oct. 3 to Oct. 21; it incorporates the responses of 408 senior leaders at middle market businesses from a panel of about 1,500 executives. The survey is published four times a year.

A third of middle market executives reported having employees working remotely due to COVID-19 who were not doing so before.

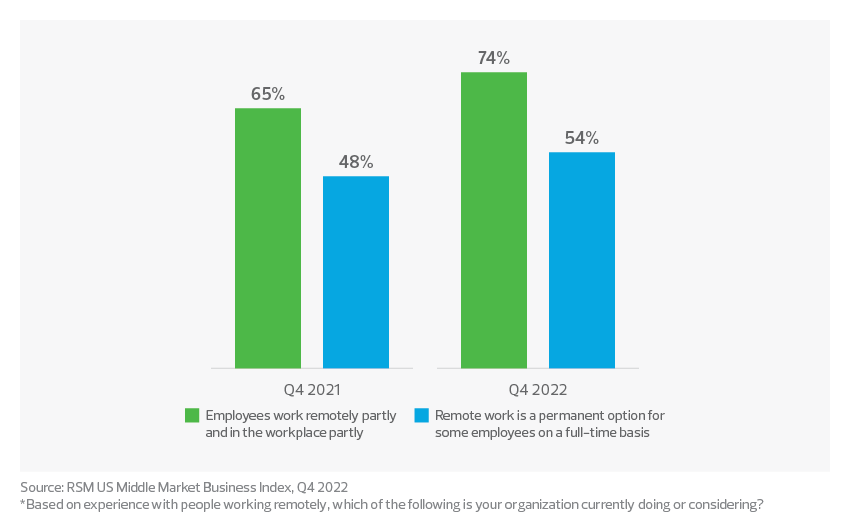

Whether a company’s new work arrangement offers a fully remote option, or a hybrid choice that allows workers to split time between the workplace and somewhere off-site, employers are showing a high level of flexibility toward their workers.

Among senior middle market executives in the survey:

74%

allow for hybrid work

54%

provide an option to work full-time off-site

The middle market’s embrace of remote work represents a dramatic change in the way midsize businesses operate, affecting everything from operations to recruiting and culture.

Before the pandemic, the option to work remotely may have been available to only a few workers on a limited basis, if at all. But as the pandemic has dragged on, middle market companies have been scrambling to adapt to new demands from workers, the survey found.

American workers experienced profound shocks during the pandemic, and that altered their preferences and behavior. Firms, as a result, have chosen to accommodate employees.

We have seen middle market businesses ramping up incentives to attract and retain talent, including flexibility in work hours, remote work options, education and training, childcare benefits, and more.

“There are many innovative options businesses can consider to keep up with changing workforce patterns and remain competitive,” said Jenna Shrove, senior director of strategic advocacy and advisor to the chief policy officer at the U.S. Chamber of Commerce.

None of these changes are easy. Enabling remote work requires up-front investment in technology and infrastructure and places higher demands on human resources departments for mentoring and career development. These costs are perhaps one reason that firms at the larger end of the middle market—with more abundant resources—have been more able to make the investments necessary to accommodate remote work, the survey found.

Whether procuring the right technology, hosting remote work events, or improving mentor training, firms in the larger end of the middle market—the ones that the survey defines as having $50 million to $1 billion in annual revenue—have more readily adapted to remote or hybrid work.

Smaller firms, by contrast, are less optimistic about the changes taking place. About half as many firms as those in the larger category see remote work as having a positive impact on their culture. In addition, these smaller firms, with $10 million to $50 million in annual revenue, are having more difficulty coming up with the resources necessary to accommodate this new approach to work.

WORKFORCE TREND:

Strengthen your workforce strategy by applying tax law implications

Most compensation methods and benefits—whether traditional or new to the equation—affect an employer’s or employee’s tax obligation in some way. Taking those implications into account helps establish a sustainable approach to workforce objectives.

The changing labor market

There is little mystery that the need to attract and retain employees is driving the adoption of remote work. With job openings near all-time highs, employers have had little choice but to accommodate workers’ demands for flexibility.

“We have had a very tight labor market,” said Tuan Nguyen, RSM’s economist. “The demand for labor has been high, while the supply of labor has been a lot lower than the pre-pandemic level. That imbalance provides a lot more bargaining power to the workers.”

Consider the response of a real estate executive in the RSM survey when asked to name the greatest staffing challenge for the next year: “Balancing the remote working process for the organization,” the executive wrote.

For many executives, today’s workplace is not one of crowded offices with people chatting around the watercooler about their favorite show. Instead, those workers often log in from home, happy that they do not have to commute to the office. They may still engage in small talk, just not in person.

People are not inclined to spend an hour and a half commuting to work. It’s just not appealing to workers.

That doesn’t mean some chief executives don’t want to bring back the days of cubicles and conference rooms. Some high-profile companies, including technology stalwarts known for innovation, have issued decrees that workers return to the office.

It has become clear that not all workers were in a position to return to the working life that they had before. Many, especially women, faced new demands at home, whether helping children cope with new school protocols for at-home learning or caring for elderly parents.

“You can say, come back in five days a week,” Rozen said. “But then people don’t show up. Ultimately, mandates don’t work.”

Now, middle market businesses are embracing this new reality. And the survey found that offering flexibility has not been particularly damaging to the firms.

When RSM asked executives about the impact remote or hybrid work has had on their business’s culture, 39% said it had a positive effect. That view was especially pronounced among the larger middle market firms, with 55% of executives citing a positive outcome on the firm’s culture.

The impact of remote or hybrid work on business’s culture:

39%

had a positive effect

Smaller firms, by contrast, had a dimmer view: Just 28% said remote work had a positive impact.

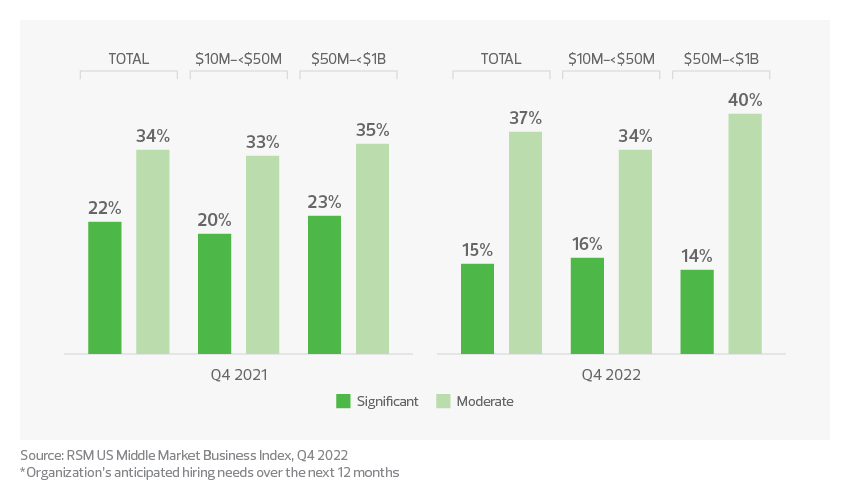

Remote work trends are evolving as hiring remains robust, even with the prospect of a possible recession. Just more than half of the executives surveyed, or 51%, said their hiring needs over the next year would be significantly to moderately higher. While that figure has declined compared to a year earlier, it remains high.

Making the transition

Accommodating remote and hybrid work is more than just setting up a Zoom call. It requires sophisticated technologies and infrastructure, and it places new challenges on human resources departments and senior staff around mentoring and developing employees.

Larger middle market firms have handled the transition better, both from a technological and human resources standpoint, the survey found.

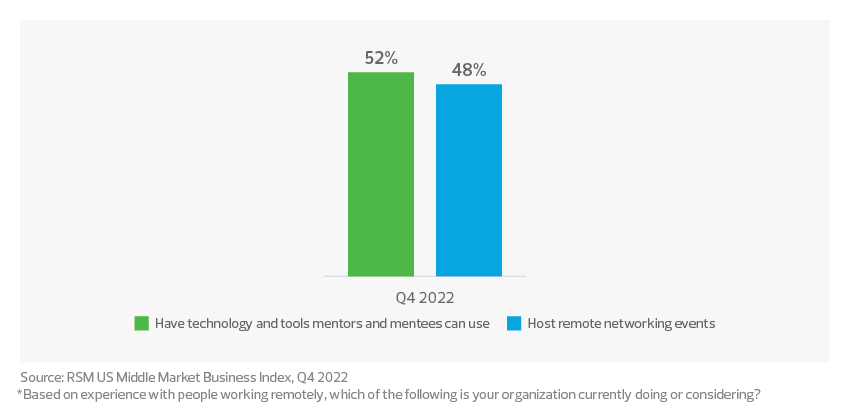

The presentation of online programs for employees offers one example. Nearly half, or 48%, of senior middle market executives said they were hosting remote networking events. Among larger firms in the middle market, this figure rose to 53%, and among smaller middle market firms, it was 46%.

Nearly half, or 48%, of senior middle market executives said they were hosting remote networking events.

Then there is mentoring. When the survey asked the middle market executives if their companies have the technology and tools for online mentoring, 66% of larger middle market firms said they did, compared to 41% of smaller middle market firms

It’s clear that methods to support and foster employee growth will have to change in the new work environment.

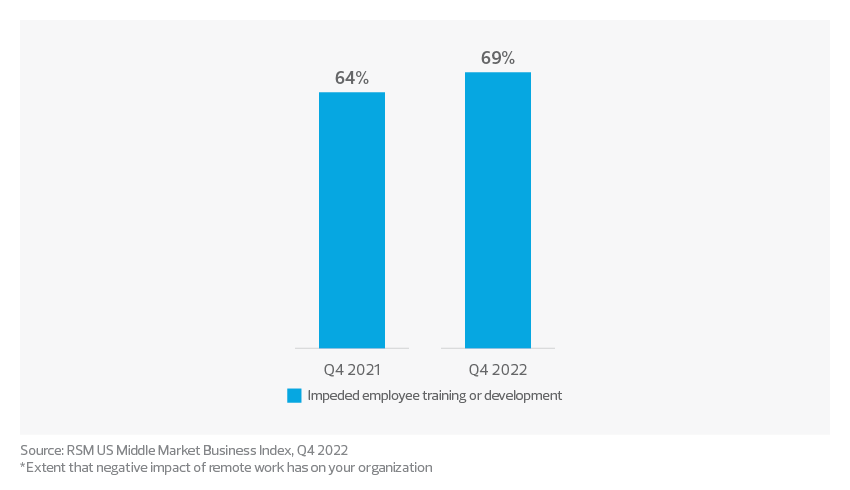

More than two-thirds, or 69%, of middle market firms with employees working outside the office said that remote and hybrid work had impeded employee training and development. That’s up from 64% a year ago.

“There has been a challenge in being able to develop and train people in a remote environment,” Rozen said.

Consider the case of new employees, who are eager to get to know their colleagues and learn about the company.

“For new hires who are in their first job, they really want community; they need that camaraderie,” Rozen said. But not all workers want to be in the office, she added. “So for those workers, will their development suffer compared to the colleagues who are there?“

In the end, organizations need to objectively measure workers’ performances, regardless of where they are working, Rozen said.

“One of the things I worry about is how you are rewarding development and high performance,” she said. “If you are not seeing someone in the office every day, and you have a hybrid environment, how do you calibrate performance across those two groups without having the inclination to reward those who show up?”

Executives seem to recognize these hurdles. Two-thirds, or 66%, of middle market firms with remote employees said that remote work had created challenges with onboarding or orienting new employees. That’s up slightly from 64% a year ago.

Companies planning to increase their physical offices for employees:

35%

larger middle market firms

17%

smaller middle market firms

The physical office

As companies shift to remote work, they face another challenge: What to do with all that commercial square footage that characterized the pre-pandemic workplace?

By any measure, the contrast between pre- and post-pandemic office use is stark. A recent survey conducted by the Partnership for New York City, a business advocacy group, found that 9% of employees were working in the office five days a week. In San Francisco, foot traffic is 31% of where it was before the pandemic, according to a recent study conducted by the University of California at Berkeley using cellphone data.

For middle market businesses, the answer of what to do with their physical space is still evolving as firms wrestle with how much space and what kind they need.

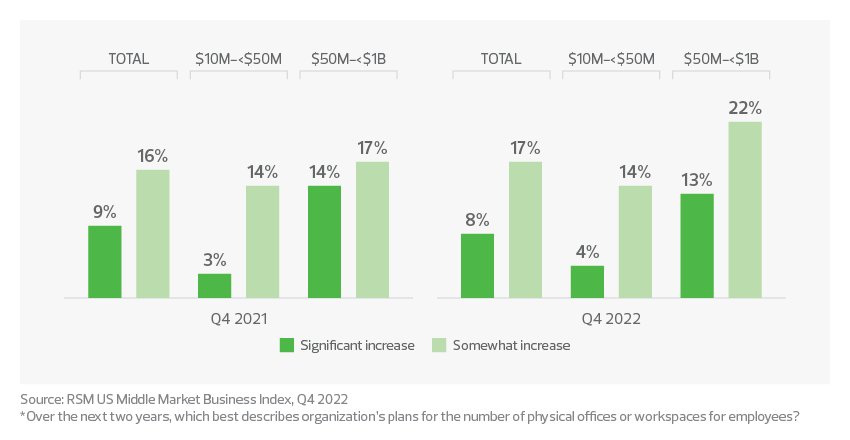

Only one-quarter of middle market firms in the MMBI survey said they were planning to expand their physical footprint, either significantly or somewhat, over the next two years. Larger, more well-resourced companies at the upper end of the middle market took the lead, with 35% planning to increase their physical offices significantly or somewhat for employees. That compares to just 17% of smaller middle market companies.

The responses were much the same as a year ago, with larger middle market firms coming in slightly lower, at 31%, but still higher than smaller firms, at 17%.

Though executives did not give specific reasons behind their planned expansion, the pandemic’s lessons suggest that businesses need different kinds of offices better suited for hybrid gatherings.

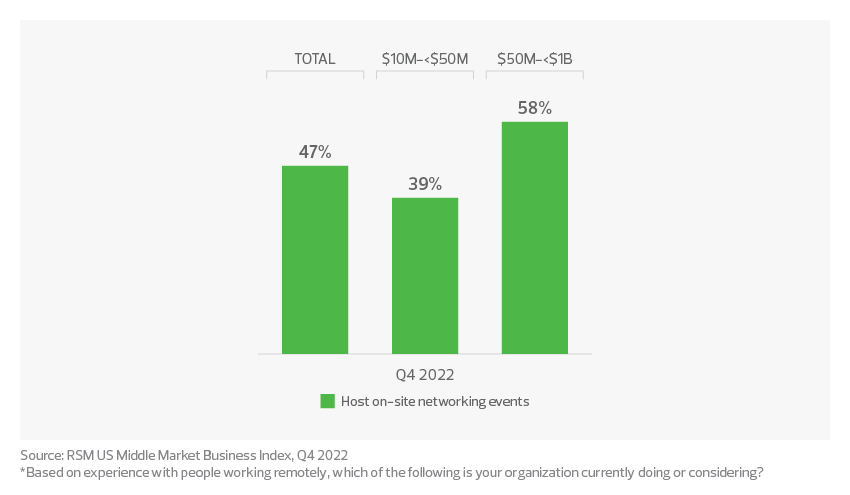

For example, nearly half, or 47%, of executives are hosting on-site networking events, with that figure rising to 58% in the larger end of the middle market. It fell to 39% in the smaller end of the middle market.

Smaller firms have become increasingly aware of the challenges of their physical space when accommodating their workers, the survey found. When asked if their physical work location will pose challenges to staffing plans over the next year, 71% said they had some level of concern, compared to the 46% who gave a similar response a year earlier. For the middle market as a whole, the figure stood at 78%, up from 63% a year ago.

Among larger middle market firms, the challenge of physical space remains high, with 88% of firms citing some degree of challenge compared to 84% a year earlier.

An executive of the arts, entertainment and recreation sector expressed concern in a written response when asked to elaborate on the challenges in staffing: “Focusing on the flexibility of the workspace to deliver a better experience for employees to work in.”

Attracting and retaining workers

None of the concerns about physical space will matter if firms cannot attract and retain workers. It’s a competitive landscape, and workers know it.

RSM conducted an online survey in the fall of 2022 of more than 4,000 workers in the United States and Canada to gain the perspective of employees of middle market and large organizations. The data from the workers, who were split evenly between the two markets, offers a deeper understanding of how employees feel about their current employer, their role in the workplace and what factors could build greater satisfaction moving forward.

The survey—separate from the MMBI poll of senior executives conducted in October—found that U.S. middle market employees are significantly more likely than those working at larger organizations to desire more flexibility to set their own hours and schedule (62% vs. 56%).

In addition, U.S. middle market employees are significantly more likely than those at larger organizations to report actively applying for new roles outside their organizations (26% vs. 14%).

It all adds up to the challenge of retention. And one important way to improve retention is to offer employees more options, RSM’s survey of executives found.

Tuan Nguyen, the RSM economist, said that greater flexibility around remote work can be a win-win for both employers and employees.

“Remote work can be beneficial to workers because they can be more flexible with their work-life balance,” he said. “But businesses also benefit because they can save money. And because of this new flexibility, businesses can hire from a broader geographic region.”

Indeed, the chance to offer remote work has broadened the potential pool of recruits for middle market firms.

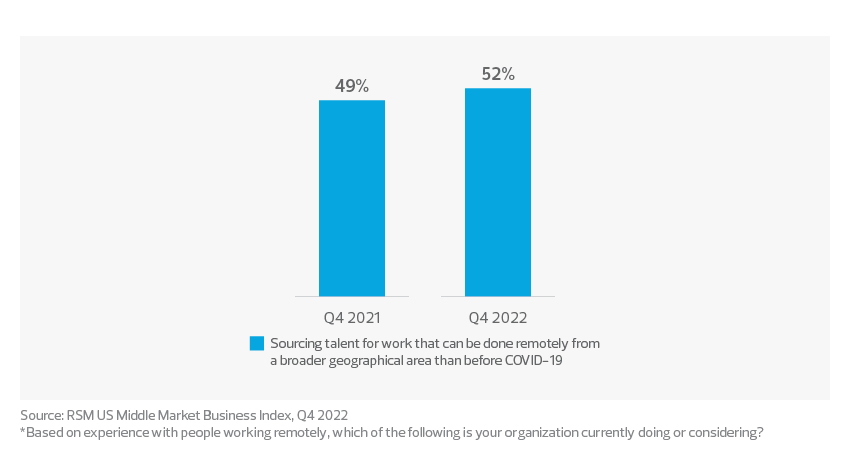

More than half, or 52%, of executives at middle market firms from the MMBI survey said they were sourcing talent for work that can be done remotely from a broader geographical area than before COVID-19. This number is up from the 49% of executives who responded similarly to the same question a year earlier.

A big factor behind this shift is that a candidate’s decision to work at a firm is about much more than just money. Pay and equity are important, of course, but so are having a good mentor, fulfilling career goals and now, having the flexibility to maintain a balance with life outside of work.

Anne Bushman, partner and head of the Washington national tax compensation and benefits group at RSM, said that remote and hybrid work allows employees to better manage their hours, including the time of day they work. For parents of small children, this is no small matter.

“Employees care a lot about flexibility,” Bushman said. “How do you turn that into part of a compensation package when it’s not directly part of compensation, but it is value? Flexibility is value to a lot of people.”

Middle market executives are aware of the change, which is evident in their written responses to the survey questions.

“Employees are asking for more flexibility and better compensation to work for us after these hard times of the pandemic,” wrote one middle market executive in the retail industry.

Some businesses, though, cannot be as accommodative to workers’ new demands. For one executive in the finance and insurance industries, it posed a challenge in recruiting: “Labor availability to work in a hybrid environment without flexible hours.” Indeed, these pressures are changing the face of recruiting as firms cast a wider geographical net for new hires, Rozen said.

“You are no longer tethered to just seeking out talent within 30 miles of your headquarters,” she said. “You have the ability to look more broadly for talent if you can offer a remote option, potentially at a cost savings.”

More than half, or 52%, of executives at middle market firms from the MMBI survey said they were sourcing talent for work that can be done remotely from a broader geographical area than before COVID-19.

The downsides of remote work

But remote work also has its challenges. In addition to having to rethink mentoring and staff development, there are concerns about collaboration and the effect of isolation on workers’ mental health.

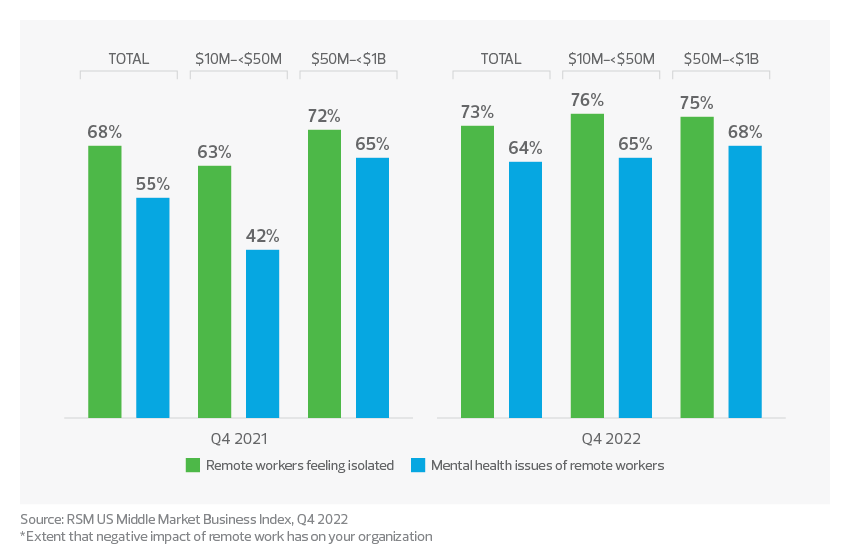

When asked if remote work has had a negative impact on their employees’ mental health, 64% of executives in the MMBI survey said that it was anywhere from a minor to a major issue, up from 55% a year ago. The impact was more pronounced in the smaller end of the middle market, with 65% recently reporting that mental health was an issue, compared to 42% a year ago.

A related challenge was a feeling of isolation among workers. Nearly three-quarters, or 73%, of middle market executives reported that workers felt isolated in the recent survey, up from 68% a year ago.

The takeaway

The pandemic has brought about profound changes in the workplace, many of which are only starting to be understood. But it’s clear that if middle market firms want to remain competitive, they will have to make concessions and adjustments that only five years ago would have been hard to imagine.

One of the biggest adjustments involves workplace culture and how firms can preserve it in a world where workers are spread out across a region or even the world.

The key, Brusuelas said, is to have an open mind.

“Culture is an evolving concept, and it is important, but it’s not going to trump the overall changes and the structure of the American workforce,” he said. “That’s really what is driving a lot of this—the competition for workers, especially skilled workers.”

This MMBI special report was created by RSM US LLP in partnership with the U.S. Chamber of Commerce. Learn more about the MMBI here.