Supporting multinational middle market businesses with global VAT and indirect tax compliance

Value-added tax (VAT) obligations across multiple countries often increase complexity and risk for growing businesses. As global regulations evolve and digital commerce expands, indirect tax requirements become more demanding—especially for organizations operating in unfamiliar jurisdictions or managing cross-border transactions.

Frequent changes in VAT rules, real-time reporting mandates and e-invoicing requirements can stretch internal resources and create uncertainty. Even minor mistakes in VAT compliance or process management can result in penalties, audits and operational disruptions.

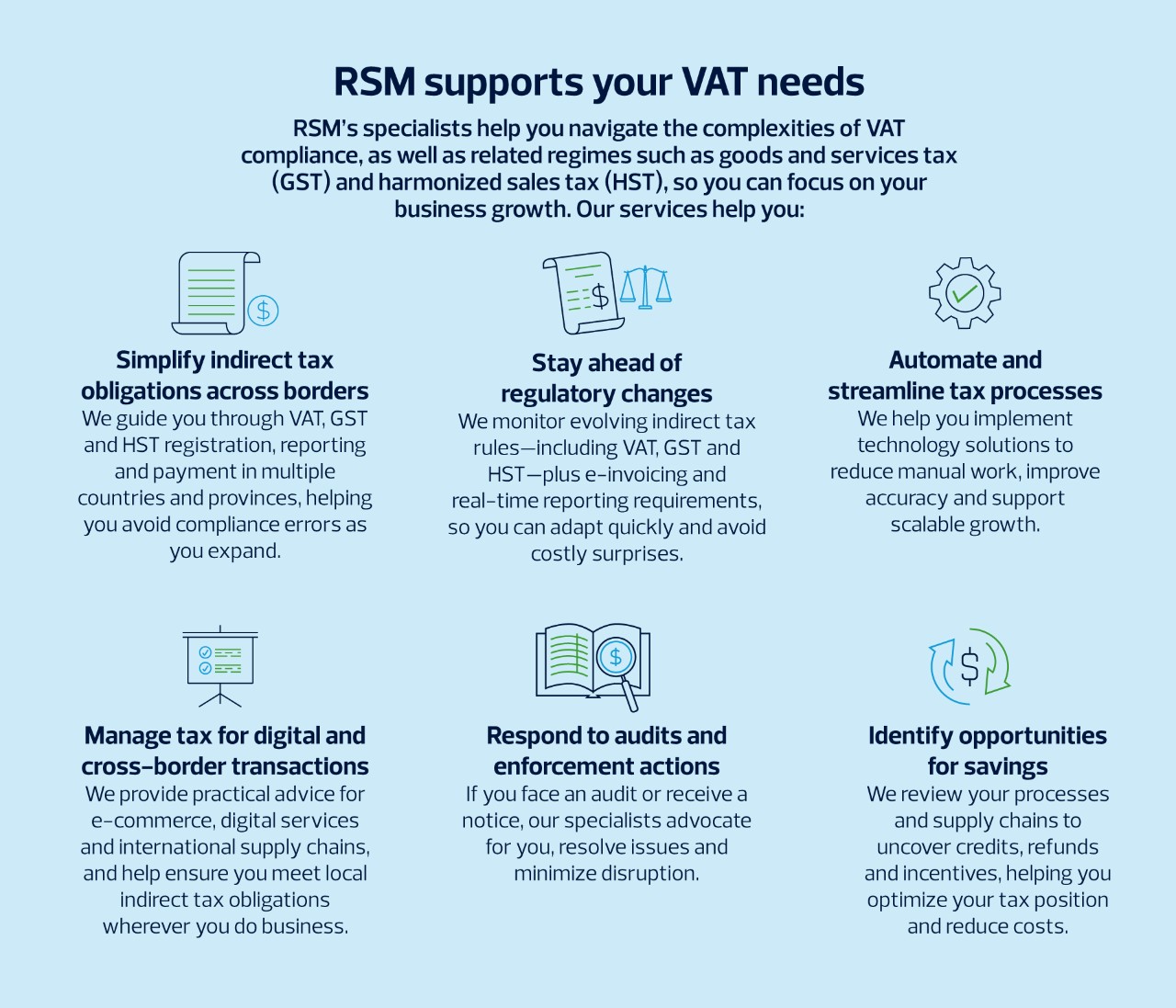

RSM’s global indirect tax team helps you to simplify VAT compliance, resolve issues and keep your business ahead of regulatory changes. Our technology-driven solutions help you reduce risk, save time and gain confidence that your VAT obligations are managed accurately—no matter how complex your operations become.

We operate in more than 120 countries with over 900 offices and more than 65,000 professionals worldwide, so we can support your business just about anywhere.