What is the Corporate Sustainability Reporting Directive?

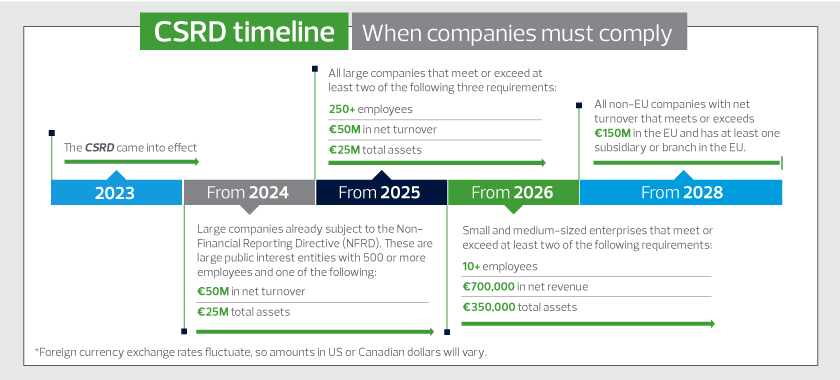

The Corporate Sustainability Reporting Directive (CSRD) is a European Union (EU) directive that replaces the Non-Financial Reporting Directive (NFRD) as the standard for environmental, social and governance (ESG) reporting in the EU. The CSRD requirements expand and enhance the existing requirements of the NFRD to establish a unified and comparable approach for ESG reporting across nations and industries. This requirement will affect listed and privately held companies, requiring them to disclose information on how they monitor a wide range of ESG issues and their impact on our planet.

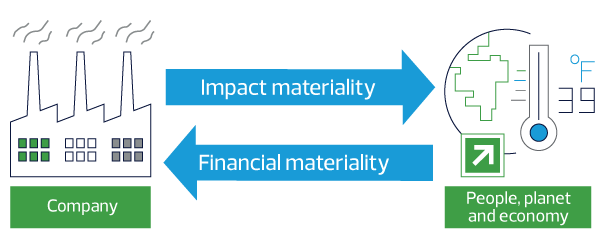

The primary objective of the CSRD is to foster transparency and accountability while advancing sustainable practices and investments. Under heightened stakeholder scrutiny and expanded reporting obligations, companies are compelled to disclose a broader spectrum of ESG metrics, offering stakeholders greater insight into their sustainability endeavours.

The CSRD requirements present a unique opportunity to deepen an organization’s understanding of sustainability risks and opportunities. By integrating reporting into their business strategy, companies can unlock the dual benefits of profit and purpose, safeguard their reputation, and drive sustainable growth.