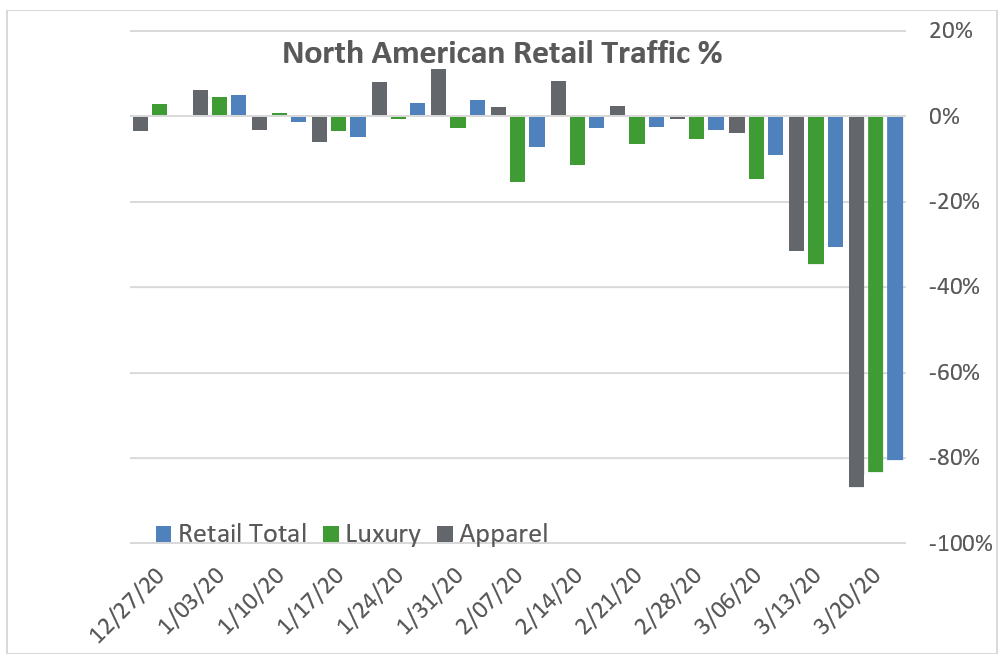

Although middle market apparel companies lack Nike’s global platform, most have invested in omnichannel capabilities for years. It has never been more important to allow customers to access products digitally as bricks-and-mortar retail traffic falls by more than 80 percent year over year.

Now is the time to invest in loyalty programs, email campaigns, social media and digital marketing to draw consumers to websites, Facebook pages and Instagram feeds.

Apparel companies have an opportunity to hold off Amazon’s push into higher-end fashion categories because Amazon, for now, has said it would not focus on essential items, leaving a door open for smaller online retailers. The digital experience should be tailored with enticing loyalty programs that will help apparel companies gather meaningful consumer data.

Staying relevant

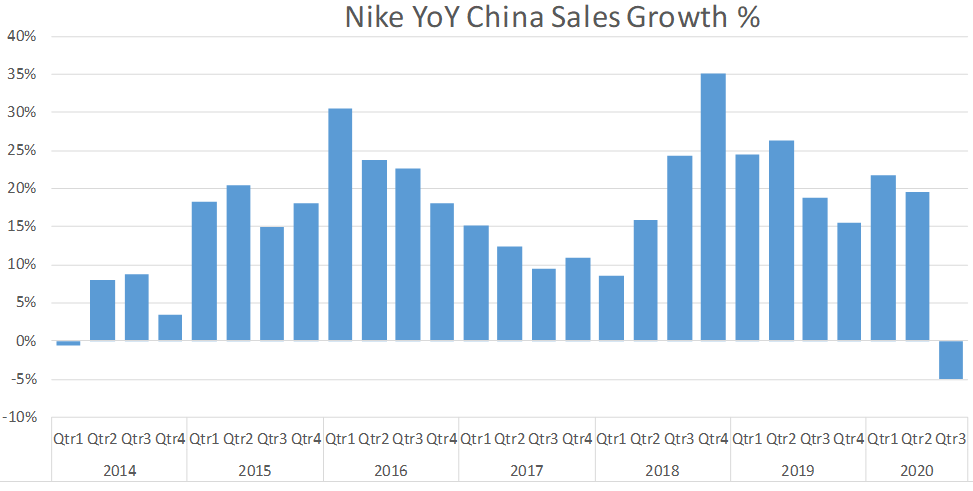

Nike’s digital sales growth can be attributed not only to its e-commerce platform, but also to its lifestyle platforms as well. In China, Nike constantly reminded consumers that even under quarantine, a healthy lifestyle is important.

It offered free access to its activity app network that had an increase in average daily users of 80 percent. The free access not only drew users to the e-commerce platform, but also reaffirmed the brand’s position as a lifestyle brand in addition to an apparel brand at a time when consumers’ lifestyles were significantly disrupted.

Businesses, no matter the size, need to give customers a way of engaging with the brand beyond routine transactions.

While middle market apparel businesses may not have the resources to create such an experience, the principle still applies—businesses, no matter the size, need to give customers a way of engaging with the brand beyond routine transactions.

Apparel companies should start by fine-tuning their marketing. With so many consumers working from home, direct-to-consumer marketing such as informal email touch points that show empathy for the lifestyle disruption may be more effective than traditional methods.

For fashion brands, creating content such as Instagram filters or informational content that can be shared through social media allows consumers to be ambassadors for the brand even though they may be confined to their own homes.

Creating a social message is another way to engage consumers. This can be as simple as telling consumers how your business is dealing with the virus and promoting a commitment to the workforce and community stakeholders.

Some apparel companies have begun producing personal protective equipment to help workers in the medical, food delivery or other essential industries. Other brands that have already associated themselves with a social cause or message should promote how that specific cause has been affected by the global pandemic and give consumers a way to help or raise awareness from quarantine.

Continuing to innovate

Nike has not delayed any of its highly touted product launches and has used its deep pockets to keep the innovation engine pumping. The apparel company’s commitment to innovation, even through periods of uncertainty, has contributed to the company’s position as an industry leader.

Without the resources of Nike, middle market companies may have a harder time delivering on innovation goals, particularly in light of the supply chain disruption still being felt as China recovers from the virus. But apparel companies should not entirely sacrifice innovation as they navigate through the pandemic.

Right now, consumers are more focused on how they will get their grocery staples than what they will wear this weekend. How will that mindset change during an eventual recovery? Successful brands should contemplate how their product offerings should be adjusted to capitalize on changing customer preference.

The push to direct-to-consumer and e-commerce will be accelerated as consumers are forced to make more purchases online. Apparel companies should look to take advantage of low interest rates to revisit digital strategies and tailor them for the consumer of the future.

The takeaway

On the same earnings call that announced Nike’s better than expected sales, the company’s chief executive, John Donahoe, said, “It’s times like these that strong brands get even stronger.” Middle market apparel companies should make investments now to strengthen their brand for their short-term and long-term futures.