Successful process improvement planning and implementation requires effective change management.

Key takeaways

Family offices should consider two common methods for building a process improvement road map.

Use a baseline metric approach to identify and prioritize the biggest risks to your family office.

Out of the four pillars of operational excellence—people, process, technology and data—process serves as the blueprint for how work gets done.

While process may seem more like a subset of the other pillars, and less critical than the others, its continuous improvement helps propel family office operational excellence forward.

RSM works with hundreds of family office clients worldwide, and a common request we hear is, “Help us improve just one area of our operations.” But as we start to uncover the issues, it often becomes apparent that more than one area needs attention.

Focusing on any one operational pillar without understanding how they all fit together is an exercise in futility; therefore, every pillar must be addressed to optimize family office operations. In our latest insight, we will discuss the role of process improvement in helping family offices achieve operational excellence.

Family offices’ most pressing process challenges

During our quarterly family office webcast series, held in 2023, we asked participants about their most pressing challenges related to process. They rated their top three challenges to be resource constraints and a lack of documented policies (40%), technology adoption (30.9%), and operational governance and family dynamics (27.9%). Here’s our take on each of these issues:

Resource constraints, such as a skilled labor shortage, make process improvements, including documentation of policies and procedures, more challenging. This issue poses a problem for family office succession and transition planning, as many family office employees possess institutional knowledge that isn’t well documented.

As such, we encourage family offices to hold conversations with key personnel to understand what their plans are and to start planning for the transition. Determine whether internal staff members are available to fill their shoes or if going external is necessary. If the latter, start developing a recruiting strategy along with compensation and development plans.

Technology adoption is a pain point for many family offices, especially those that still rely on Excel spreadsheets to perform multiple tasks or on out-of-date, on-premises servers. Issues arise when family offices stretch a tool’s capabilities beyond what it was designed to do. Using the appropriate tools for business-critical functions is important, and a variety of accounting systems are available to meet a family office’s unique needs; look for a system with built-in control features to allow for smaller teams while providing the appropriate control structure.

When evaluating a new accounting system, consider the capabilities needed today and for the next few years, and verify the system’s industry focus, size and complexity. Once a system is selected, the family office’s accounting policies and procedures must be reviewed and realigned with how the technology solution is designed to work. It is important to provide adequate education and training related to the new system, and to invite your implementation partner to return to answer questions after team members become familiar with the tool.

To ensure proper management of technologies, family offices may want to consider outsourcing resource-intensive and highly specialized functions such as cybersecurity and IT help desk support to a managed services provider, in addition to revisiting the approach annually.

Operational governance can mean different things to different people, but one way to think about it is as a framework for family office cohesion, decision making and alignment with strategic goals. Essentially, you are creating guidelines and standards for how the family will make decisions for future generations.

Strategic approaches for planning process improvements

When a family office decides it is ready to make process improvements, the first step is identifying the best path forward to achieve success. Two common approaches family offices can leverage to build their strategy road map are a detailed process review and an operational excellence assessment; below we look at both in more detail.

Detailed process review

In our experience working with family offices, business process reviews tend to focus on threats that have already surfaced, which is a reactionary approach. While reactive reviews are common, proactive reviews are crucial. Today’s successful family offices will empower their management team to serve as an informal risk committee to institute, at least annually, a detailed process review focused on the mission-critical systems of the organization.

The benefit of using this approach, which targets specific processes, is the opportunity to make focused improvements and mitigate risk using technology solutions; the potential drawback is possible misalignment with the long-term vision of the family office. When leveraging this approach, consider whether you are putting a temporary bandage on an issue that might continue to arise for the family office in the long term.

A detailed process review is particularly suited for family office leaders or process owners because it emphasizes a tactical focus on the “business of today” rather than a strategic view of the future—distinguishing it from the strategic planning activities of an advisory board or executive committee.

Operational excellence assessment

As an alternative to a detailed process review, the operational excellence assessment is more strategic and holistic. This approach encompasses the family office’s comprehensive operating model, including its people, processes, data and technology, as well as governance and decision making. It requires examining key functions across the organization—including information technology, human resources, accounting and finance, and wealth management—to determine where the family office stands operationally and where it wants to be, and then supports closure of the gap between the current and future states.

This assessment tends to be done at key inflection points along a family office’s operational excellence journey, perhaps during a turnover in key leadership or a generational transition in the family. It is resource-intensive, not from a hard-dollar standpoint but from the executive-team commitment required. Therefore, many family offices engage a third-party provider with key market insights to provide an independent perspective and big-picture solutions. An operational excellence assessment can be done in two- or three-year cycles to allow a family office time to design, implement and evaluate initiatives between strategic planning sessions.

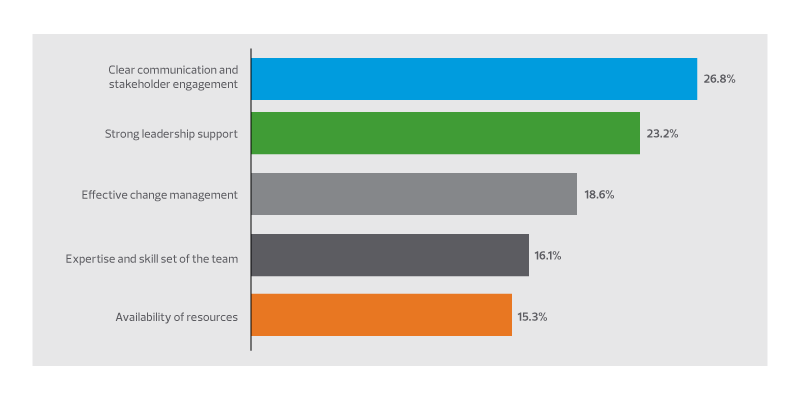

We asked family office stakeholders: “What challenges are most critical to navigate for the successful implementation of strategic initiatives within your family office?” Here’s what they said:

As these responses show, communication is key to the success of family office strategic initiatives. Process improvement is often difficult because it involves people who may be resistant to change or may not understand the effort’s strategic value. Indeed, RSM’s recent work with family office clients has focused increasingly on improving communication among family office stakeholders. To break down any barriers, it is critical to hold discussions with family office stakeholders to understand different perspectives and build consensus and alignment toward goals. Bringing in an objective third party with experience facilitating such discussions can help.

Managing risk while making process improvements

Family office staff members face the challenge of balancing business priorities with family demands and needs, which often puts process improvement, including documentation of policies and procedures, at the bottom of the to-do list. Family offices also tend to be lean and agile organizations with employees who typically have long tenures. While this dynamic often creates an environment of trust, it also creates “key person risk,” which is the potential loss of value, performance or reputation of an organization due to the departure, disability or death of a critical individual. For all these reasons, risk management across the organization is crucial to family offices.

How to measure and respond to risk

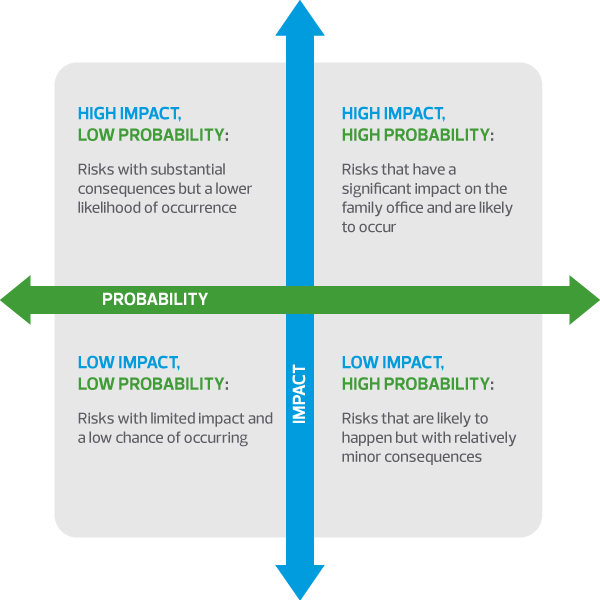

To manage risk effectively, you must first measure it; but how do you begin to identify the biggest risks to your family office? RSM recommends using a baseline metrics approach to understand your operational complexity, in conjunction with a framework, such as the 2x2 contingency table pictured here, that enables you to classify the different types of risks you might face.

High impact, low probability events: Think of the COVID-19 pandemic. This is a very disruptive event that calls for having a contingency and incident response plan in place to take some uncertainty out of the equation.

High impact, high probability events: Think of a leadership succession or transition. Family offices should focus on mitigating risk by putting a succession plan in place and actively working toward achieving it.

Low impact, high probability events: Think of market volatility and market fluctuations. This is all about implementing monitoring and control measures. Family offices should have the right technology in place to gain visibility into how their portfolio is doing, so they can respond accordingly.

Low impact, low probability events: Think of minor IT glitches. Family offices shouldn’t dedicate substantial resources to keep watch, but they also shouldn’t take their eyes off the ball. Here’s where outsourcing your IT function to a managed services provider might make sense, so you don’t have to dedicate family office personnel to support it.

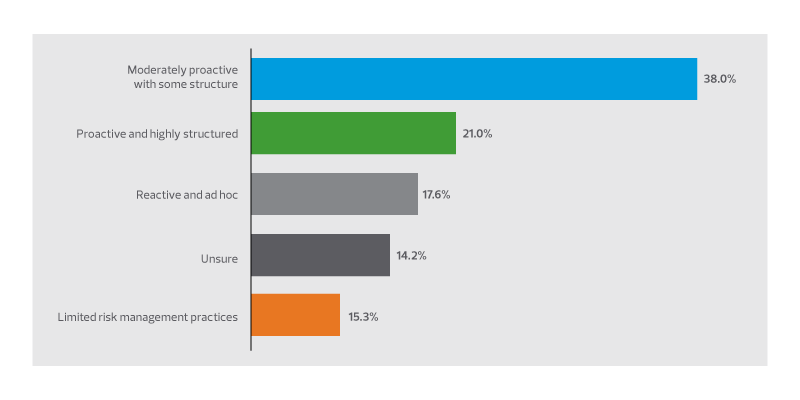

We asked family office stakeholders: “Which of the following best describes your family office’s approach to risk management?” Here’s what they said:

The takeaway

While process is a key pillar of family office operational excellence, getting buy-in with stakeholders to make process improvements can be challenging. To facilitate alignment and collaboration, be clear about what you aim to achieve and how. Encourage multigenerational involvement to help identify potential risks and process improvement opportunities, and then plan the journey together. Creating a process improvement road map for your family office is critical, and requires a balancing act between tactical efficiency and risk management. The important thing to remember is that initiating positive change, no matter how small, puts you a step closer to achieving operational excellence.