AI can have tremendous value in corporate treasury, but limitations remain.

Key takeaways

Despite AI’s advancements, human oversight remains essential in cash management.

Treasury must balance leveraging AI for operational efficiency and applying strategic judgment.

Artificial intelligence is making waves in corporate treasury, promising to enhance efficiency, improve decision making and streamline risk management. However, while AI brings valuable capabilities to treasury operations, not all AI applications live up to the hype. It's crucial to understand where AI can genuinely provide value and where its limitations remain.

AI in cash flow forecasting: Beyond the hype

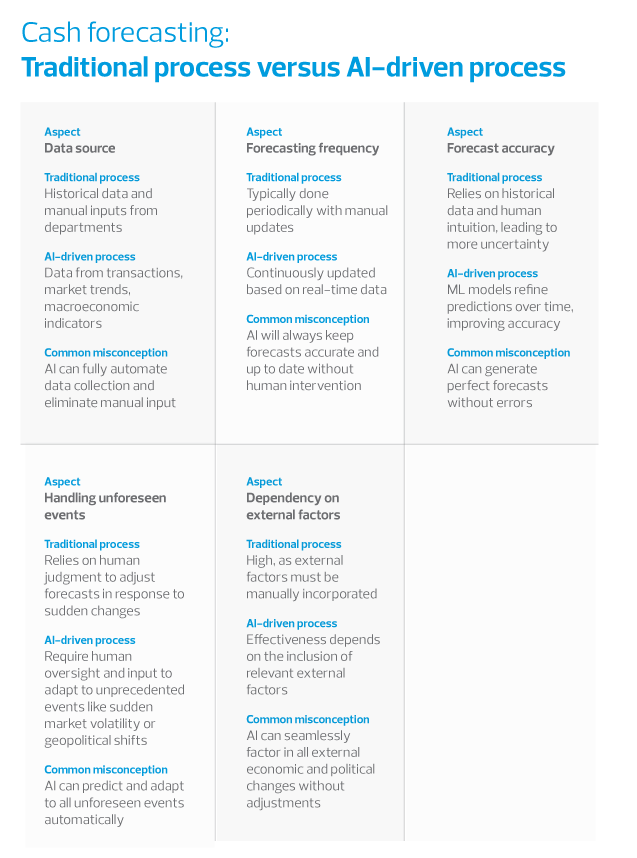

Cash flow forecasting is a critical task for treasury departments. Traditional forecasting relies on historical data, often requiring treasury teams to manually input data and make adjustments based on intuition. AI, particularly machine learning (ML), which is a subset of AI, can significantly improve forecasting by analyzing vast amounts of data from various sources like transactions, market trends and macroeconomic indicators. ML can also act as an independent tool, utilizing algorithms to identify patterns and make predictions without the need for explicit programming for each scenario.

AI models learn from historical data and refine their predictions over time. They can automatically update forecasts based on new data inputs, and by recognizing patterns, they provide more accurate cash flow predictions than traditional models.

While AI can enhance the accuracy of cash flow forecasts, it is not a crystal ball. One common misconception is that AI can predict cash flow with 100% accuracy, regardless of market conditions. In reality, AI models still rely on historical data and trends. They struggle when faced with unprecedented events such as a sudden market shift or a geopolitical crisis, which AI systems are not equipped to predict.

While AI improves the quality of forecasts, it still cannot eliminate uncertainty. Treasury teams must use their judgment to consider external factors that AI cannot foresee, such as government policy changes or natural disasters.

Automation of routine tasks: Efficiency gains without the full replacement

AI significantly enhances efficiency in treasury operations by automating routine and repetitive tasks. Processes such as bank reconciliations, transaction matching and reporting benefit from AI’s ability to identify patterns and process large data sets with greater accuracy than manual efforts.

For instance, AI-driven reconciliation tools use ML algorithms to detect patterns and match transactions across multiple accounts, reducing errors and the time spent on manual reconciliation. Similarly, AI-powered reporting tools can extract and structure relevant cash management data, helping treasury teams generate insights more efficiently.

However, AI is not a one-size-fits-all solution. While it can handle structured, rule-based tasks with high accuracy, it is not yet capable of managing complex exceptions that require human judgment. Treasury teams still need to oversee AI-driven processes to manage discrepancies, interpret anomalies and make strategic decisions about liquidity and working capital. Rather than replacing treasury professionals, AI serves as an enabler, freeing up time for higher-value activities such as cash optimization and scenario planning.

The human element: Where AI needs assistance

Despite AI’s advancements, human oversight remains essential in cash management. AI models are only as effective as the data they receive, and poor data quality can lead to inaccurate results. Moreover, AI lacks the ability to interpret broader business contexts, regulatory shifts or strategic objectives that influence cash management decisions.

For example, while AI can analyze transaction data and predict future cash positions, it does not possess the strategic foresight needed to navigate economic downturns, negotiate banking terms or align cash management strategies with broader corporate goals. Treasury professionals provide the critical thinking, context and adaptability that AI lacks.

The takeaway: AI’s true impact on corporate treasury

AI is having a meaningful impact on cash management by enhancing forecasting accuracy, automating repetitive processes and improving efficiency. However, it is not a replacement for human expertise. Treasury teams must strike a balance between leveraging AI for operational efficiency and applying strategic judgment to ensure sound financial decision making.

By understanding AI’s strengths and limitations, treasury departments can integrate AI-driven tools effectively, gaining efficiency while maintaining the human oversight necessary for long-term financial stability. AI is a transformative tool but one that works best as a complement to, rather than a replacement for, human cash management insights.

RSM contributors

-

Arkadiusz ZarzeckiSupervisor

Arkadiusz ZarzeckiSupervisor