Developing new products/services ranks as the most important growth factor for 2022.

Key takeaways

Companies are doubling down on their ability to utilize data to inform strategy.

Companies’ ability to improve the customer experience depends on leveraging new technologies.

Survey reveals how corporate boards view the tax digital imperative

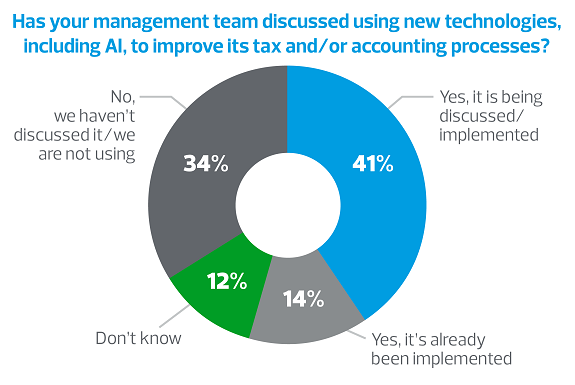

RSM US LLP and Corporate Board Member surveyed over 200 executives about the importance of digital innovation and strategies related to the tax function. The results are analyzed in the Transformation Imperative report and in “The Risks and Opportunities Of [Not] Automating The Tax Function” article, which offer a detailed look at the challenges and opportunities of embracing digital tax solutions.

According to the survey, few respondents have actually implemented new technologies to improve their tax or accounting processes, although many have discussed doing so. Neglecting digital strategies can be a significant missed opportunity.

“We continue to see companies’ finance and tax departments working in silos, exacerbated by the virtual working environment brought on by COVID-19. Breaking down these silos is a critical starting point of an organization’s transformation journey.”

Elizabeth Sponsel, Partner, RSM US LLP

The report and article discuss how companies that are serious about the power of digital innovation are looking to harness the power of artificial intelligence, machine learning, neural networks and natural language processing technologies in their upstream core business processes. Using these technologies, companies can intelligently automate their processes from the start, avoiding downstream Band-Aids, rework and, ultimately, lost time and money for their tax departments.

To find out more about how companies are implementing digital solutions for their tax systems, and to learn about other vital aspects of the digital imperative, download the full report.