Landed-cost planning can strengthen margins and competitiveness.

Key takeaways

Tariffs often are overlooked but significantly affect the price of bringing products to market.

Tariff classifications and trade agreements are common topics of strategic planning.

Many companies that have tapped international markets to drive growth over the past decade face significant downward pressure on margins and competitiveness due to ongoing global supply chain disruptions and rising tariffs driven by trade disputes.

In response, operations, finance, and tax leaders are increasingly tasked with assessing the effects and developing strategies to reduce risks and costs. Some have found success at the intersection of supply chain and international trade by focusing on landed-cost planning. They have turned to various strategies and tactics to help reduce cross-border expenses, improve competitiveness and grow margin.

On the whole, indirect taxes, such as customs tariffs, value-added taxes, and excise taxes, can significantly affect a company’s ability to compete in global markets against other enterprises, both foreign and domestic.

Commonly—and seemingly more intensely over the past few years—tariffs can be used by governments as an instrument of domestic market protection to drive changes in trading partner behaviors or as a means to fill treasury coffers. As an above-the-line expense often buried in the costs of goods sold, tariffs often can be overlooked but may have a profound impact on the price paid to bring products to market. Occasionally, they may even be the difference between profit- or loss-making global business ventures.

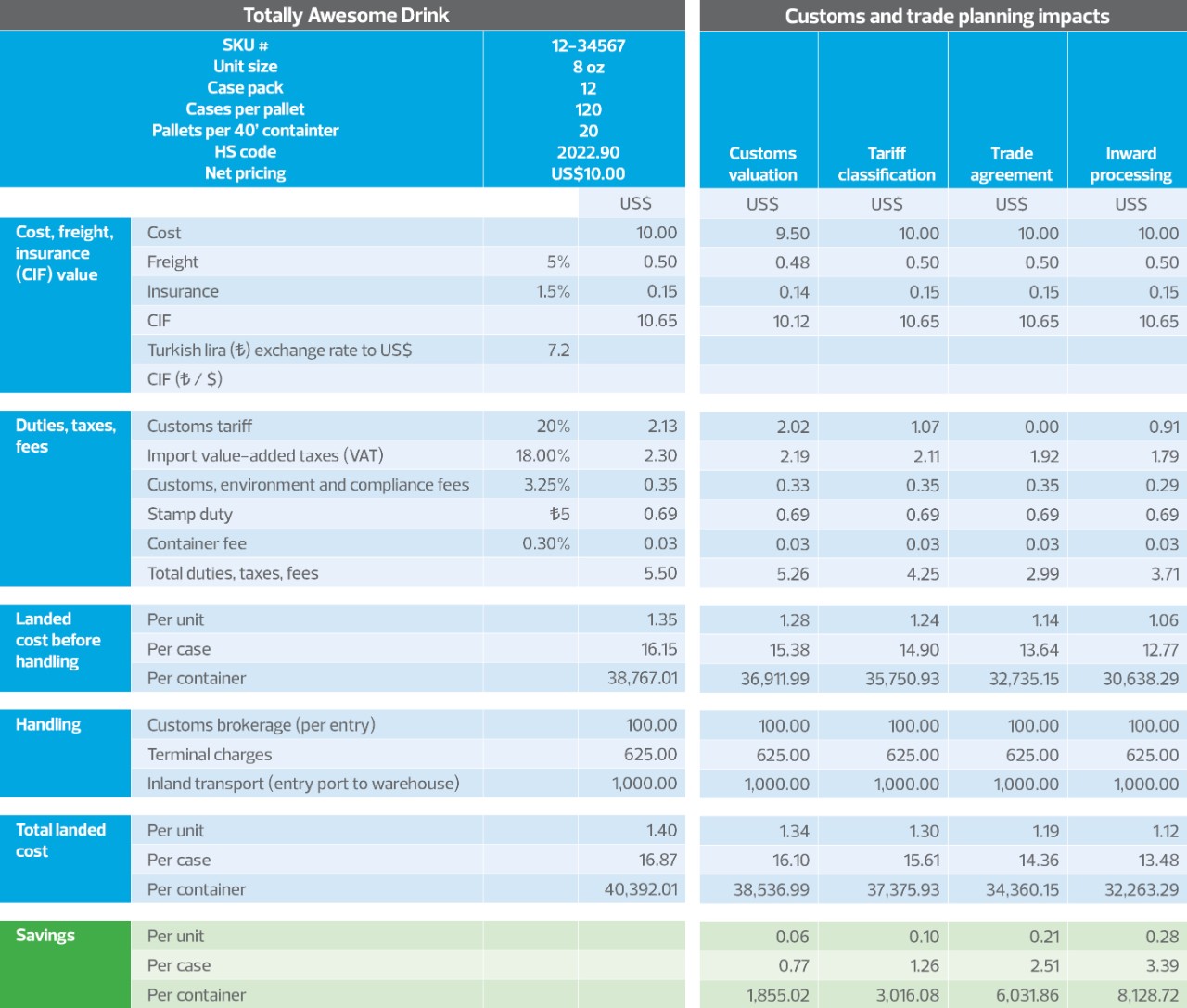

To help underscore the potential effects of tariff planning in cross-border supply chain operations, we present a sample landed-cost analysis of a product alongside several customs and trade strategies that can significantly lower the expense to get that item to market.

Whether through lowering the declared price of that product, changing the tariff classification (and thus the applicable duty rate), qualifying for a trade agreement, or utilizing a special customs program, the net result from such proactive planning is a more competitively priced product that can result in greater margins and market-share gains.

Indirect taxes—including tariffs—are often overlooked but can significantly affect the landed cost of goods. As shown in the chart, substantial savings can be achieved with careful analysis and planning, potentially leading to improved profit and competitiveness.