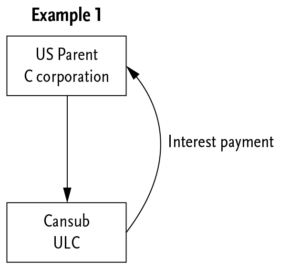

However, several arguments may be advanced to alleviate concerns that an overly broad reading of this first HMA legislative package applies to structures with a hybrid entity. First, the D/NI mismatch in example 1 arises primarily because of the difference between the countries in their tax treatment of Cansub (that is, regarded/disregarded), not because of a difference in the tax treatment of the financial instrument as such. Second, under the interpretation rule in proposed subsection 18.4(2), the Canadian rules are to be interpreted in accordance with the OECD’s action 2 report. In that report, in the overview section of chapter 1 (on which Canada’s first package of legislation is partly based), it is stated that “[a] payment cannot be attributed to the terms of the instrument where the mismatch is solely attributable to the status of the taxpayer or the circumstances in which the instrument is held.” Third, the explanatory notes provided by Finance for the proposed legislation include several examples—including examples of (1) structures with notional interest expenses on non-interest-bearing loans, (2) forward subscription agreements paired with loans, and (3) sale and repurchase agreements —and the OECD’s action 2 report provides 37 examples, and none of these examples, with respect to hybrid financial instruments, detail a mismatch arising solely because the entity is classified differently in two countries.

Second package of the proposed legislation

The second package of the proposed legislation has not been released. It is expected to include other recommendations of the BEPS action 2 report. Chapter three of the report (“Disregarded Hybrid Payments Rule”) targets a deductible payment, made by a hybrid entity, that is disregarded under the laws of the payee jurisdiction and is therefore not treated as income under the laws of the payee jurisdiction. The purpose of this rule is to prevent a taxpayer from exploiting differences between jurisdictions in the tax treatment of the payer entity. The primary recommendation in chapter 3 of the report is that the payer jurisdiction should restrict the amount of the deduction, and the defensive rule requires that the payee jurisdiction include an equivalent amount in ordinary income.

Furthermore, chapter three provides that no mismatch will arise to the extent that the payer’s deduction is set off against dual-inclusion income. “Dual-inclusion income” is generally defined in the BEPS action 2 report as an income item that is included in income under the laws of both the payer and payee jurisdictions. In addition, double taxation relief, such as a foreign tax credit granted by the payee jurisdiction, “should not prevent an item from being treated as dual inclusion income where the effect of such relief is simply to avoid subjecting the income to an additional layer of taxation in either jurisdiction” (at paragraph 126). Significantly, implementation techniques may vary by country; however, the BEPS action 2 report recommends (at paragraph 126) that when a determination is being made as to whether to treat as dual-inclusion income an item of income that benefits from double taxation relief, an approach should be taken that balances rules that “minimise compliance costs, preserve the intended effect of such double taxation relief and prevent taxpayers [from undermining] the integrity of the rules.”

If Finance were to implement, in the legislation’s second package, the recommendations in chapter 3 of the action 2 report, the arrangement described in example 1 (above) might be affected, and the deduction for interest expense might be disallowed in Canada to the extent that Cansub is in a net loss position. A deeming rule could be introduced to deem the interest payment to be a dividend paid to US Parent (a rule similar to proposed subsection 214(18) in the first package). The deemed dividend might be subject to a withholding tax of 25% because of the anti-hybrid provision in article IV(7)(b) of the treaty.

Remedial steps

If the second package of the proposed legislation indeed has an impact on the ULC structure, a remedy might be to convert the ULC to a regarded entity for US tax purposes.

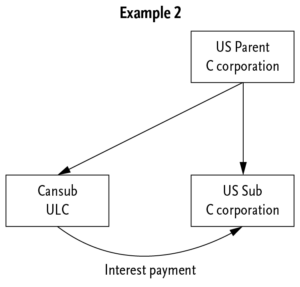

Example two

In example two, which is a variation on example one, the loan is made by a US subsidiary of US Parent (“US Sub”), and US Sub is a C corportion. The interest payments are deductible both by Cansub in Canada and by the US Parent in the United States. US Sub will have an income inclusion in the United States from the interest income. In this example, we have assumed that the indebtedness originates from US Sub. In particular, the US Parent did not loan the funds to US Sub in order to further the loan to Cansub.