Self-storage facilities have emerged as a potential solution for repurposing vacant office space.

This niche asset class may generate higher returns for commercial building owners and developers.

Income tax considerations add complexity to converting existing office space to self storage.

Death, divorce, dislocation, disaster and downsizing: These life experiences are known as the five D’s of self storage.

A potential sixth is “disenchanted,” which describes many current homeowners who long to upsize but cannot due to the housing shortage, rising interest rates and other prohibiting factors. When a starter home becomes a forever home that also functions as a hybrid office (given today’s workforce trends), it is understandable why today’s homeowners may need more storage space.

RSM analysts expect more homeowners will opt to stay put rather than try to flip their homes. Already, Canadian household debt has ballooned to 180 per cent of income. According to the Bank of Canada, over one-third of mortgage borrowers have seen their interest payments rise, and more borrowers will be affected as mortgage terms expire. Meanwhile, many households have moved into negative amortization during their mortgage term. The high costs of selling a home—including but not limited to MLS commissions (currently under scrutiny with a class action lawsuit), staging costs, legal fees and closing costs—are additional deterrents for disenchanted homeowners wanting to move.

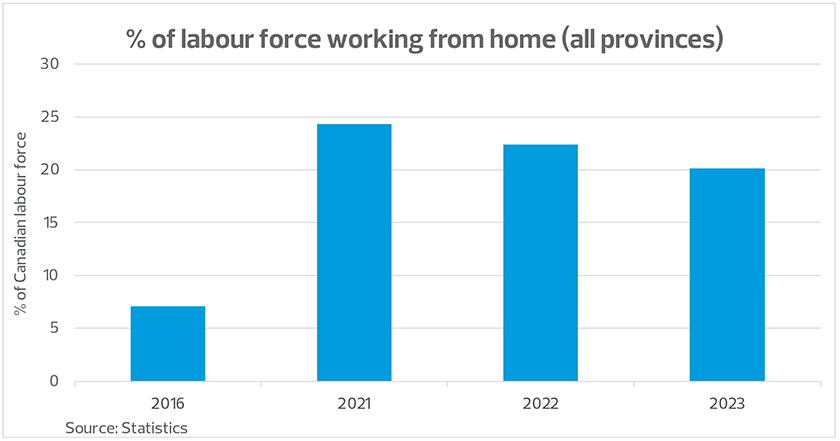

Part-time and permanent remote work options have become more prevalent at middle market companies. While some companies have implemented return-to-office mandates, RSM analysts expect remote and hybrid work trends to continue.

Source: Statistics Canada

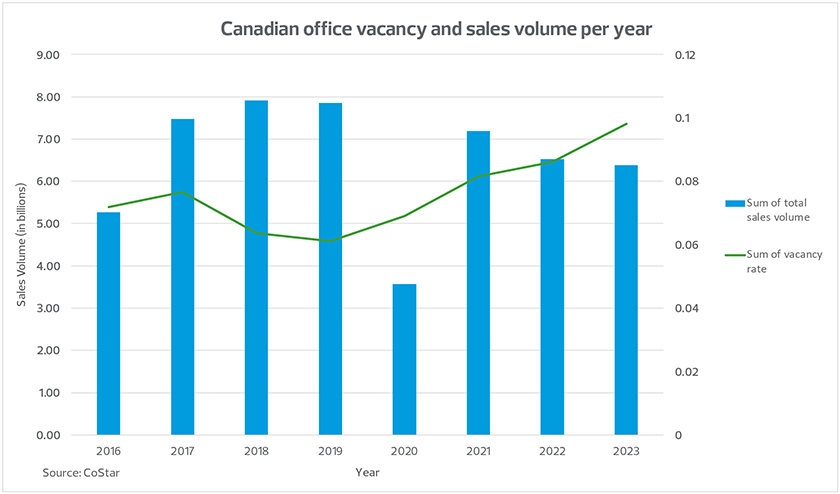

As a result, office transaction volume has declined year-over-year for the last three years, with vacancy rates trending upward. With the seismic shift in how office work is conducted, commercial landlords can expect more vacancies and declining lease rates to continue. This shift is evident from the recent WeWork bankruptcy in the U.S. (and likely will be in Canada as well), and currently, they will walk away from two of their leases.

Source: Costar

Building the future of the office

Office construction remains active in Canada’s largest office markets, with close to 20 million square feet currently in the pipeline, according to Costar. Builders should consider creating spaces that could more easily be repurposed into self storage or other asset classes, as retrofit costs can be significant.

Floor load capacity in office buildings is typically 50-60 pounds per square foot, while for self storage the average is 100-120 pounds per square foot. Most office buildings do not have an elevator shaft that can carry freight, which is a necessity for a self-storage business. Commercial developers should learn a lesson from the recent shift in core asset classes and incorporate more flexibility into future building designs to accommodate the needs of different tenants.

Converting office space to self storage

As commercial property owners rethink building uses, they should also consider which conversions will generate higher returns. The returns are generally higher for self-storage conversions compared to multifamily conversions, as self storage comes with a higher cost of capital but also a higher risk of leasing. The returns are generally lower for residential conversions if leveraging Canada Mortgage and Housing Corporation-backed financing to lower the cost of capital and increase liquidity.

Despite the demand for affordable housing, converting office space to residential dwellings may prove cost-inhibitive for developers and property owners. Alternatively, self storage is a potentially lower-cost adaptive reuse option that indirectly benefits homeowners and renters, especially when situated in or near residential developments. Developers still need to account for environmental (i.e., energy use, material sourcing, etc.) and social (i.e., affordability, access, safety, etc.) considerations when repurposing office space into self storage.

Restrictive zoning and planning bylaws and regulations have made it more challenging for owners in some communities to obtain permits and approvals to proceed with their self-storage development plans. The Vancouver City Council voted to require multiple uses for new self-storage developments and banned the property type entirely in a few parts of the city. These steps were part of a broader effort to prioritize job-creating development projects in Vancouver’s limited industrial lands.

It is worth noting that while self storage does not generate jobs directly, providing warehousing for businesses is still a value-add for Canada’s supply chain. Consideration should be given to whether self storage that provides warehousing for personal use should be rezoned as an extension of multifamily properties rather than be limited to industrial spaces.

Tax implications of converting an office to self storage

Like any adaptive reuse option, converting commercial property to self-storage space comes with income tax considerations. Specifically, under the Income Tax Act (the Act), a self-storage business may be considered a separate venture from the original operation of office space, which may matter due to how the business’s income is treated under the Act.

To determine whether a separate business is created by converting the space, one would look at the interconnection, interlacing or interdependence between the simultaneous business operations: the self-storage operations and the original operations. For example, if two separate businesses share the same processes, products, customers and inventory types, they may be considered one business for the purposes of the Act. However, compared to the original operation of office space, a self-storage venture would, in many cases, constitute a new business with the distinct goal of deriving passive income from the storage units. The analysis of whether a separate business exists is not affected by both businesses housed in one corporation.

Additional income tax considerations:

- Income earned: A self-storage business would most likely earn passive investment income unless it has five full-time employees, which would be taxed at a higher rate when earned by a Canadian-controlled private corporation (CCPC).

- Small business deduction (SBD) phase out: Income earned from the self-storage business, if contained in a CCPC, may reduce that corporation’s and the associated corporations’ eligibility for the SBD (a preferential tax rate).

- Change in use of space: In specific cases, the original space could be considered to have undergone a “change in use,” which is a taxable event according to the Act. For example, if the initial use for the space was to store inventory and subsequently produce income, it may constitute a change in use with income tax consequences.

- Treatment of construction period costs for income tax purposes: Most direct construction and renovation costs, as well as certain soft costs incurred during the construction/conversion period, may not be deducted as current period costs but will need to be capitalized to the cost of the building. However, certain exceptions to the capitalization rules would allow for the immediate deduction of certain costs, e.g., landscaping costs, general and administrative (G&A) expenses, marketing costs and outlays incurred where the building continues to generate rental income during the construction period. In addition, certain capital costs may be classified as separate class (other than building) assets with a faster capital cost allowance period. Companies should consider tax treatment of the construction period costs and maintain sufficient accounting details to ensure proper tax classification and achieve beneficial treatment where available.

Income tax considerations add complexity when converting existing office space to self storage and, therefore, should be factored into this reuse option in addition to ROI, bylaws and regulations, and other startup costs.

The takeaway

As the office market continues to decline and homeowners run short on space, an opportunity for self-storage conversion emerges for real estate owners and developers. Office developers should use a long-term lens when factoring in the needs of other asset classes, including self storage, to create more flexibility that can accommodate a shift in core asset classes.

RSM Canada associate Michael Whitwell and senior associate Jenny Wu contributed to this article.

RSM contributors

-

-

-

Simon TownsendSenior Manager

Simon TownsendSenior Manager