Without significantly improving productivity, law firms risk a sharp decline in profits in 2022.

Key takeaways

Demand for services—and, by extension, profitability—is in jeopardy as the U.S. economy contracts.

Firms that can afford to invest in technology stand to gain long-term competitive advantages.

The professional services industry has experienced a luxury that many others throughout the pandemic have not—stability. However, now that the U.S. economy contracted in each of the first two quarters of 2022, the warning signs are clear: Without making significant progress on improving productivity, firms in all sectors risk a sharp decline in profits in 2022 amid the increase of direct expenses and inflation.

By the numbers

Looking specifically at the law firms sector, firms usually take a hit in three key areas during an economic downturn: demand, rate growth, and productivity.

In Q2 2022, law firms saw a 0.5% decline in demand from the previous year. That drop followed a 2.7% increase in Q1.

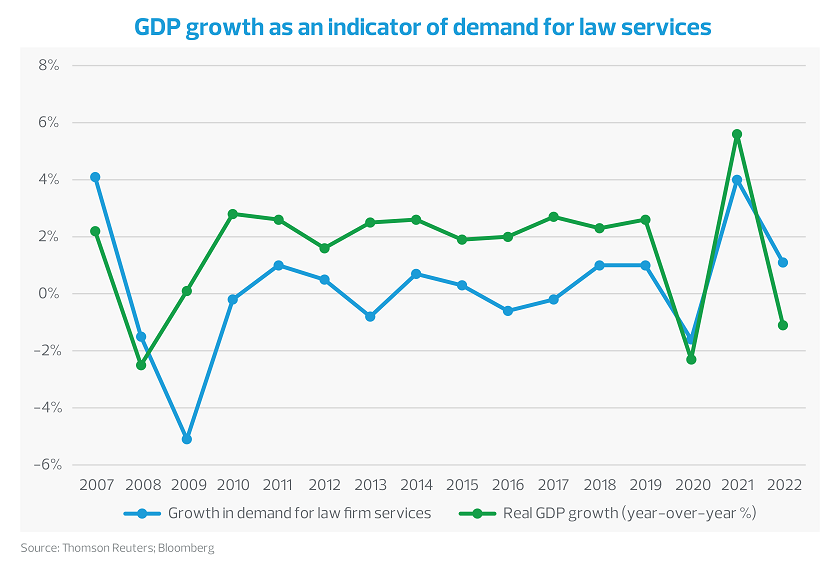

Historically, there is a close correlation between GDP growth and growth in demand for law firm services. As you can see in the chart below, GDP and law services each dropped sharply in 2008 as part of the Great Recession. However, law services demand continued to fall during 2009, even after a recovery in GDP.

Law demand eventually returned at the same scale, but not until a year later. This same pattern repeated in 2012 and 2015: simultaneous decline, then a delayed recovery of law services demand approximately one year after a rebound in GDP.

As GDP recovers after an economic decline, mergers and acquisitions activity tends to follow in step. In turn, demand for law services supporting M&A and real estate tend to be among the highest growth areas—as seen in data showing demand growth by segment. This tends to happen in a cadence, however, which helps explain the delay in recovery in law services.

The top challenge for the law firms sector in a slowing economy is productivity

Productivity is key to protecting profit margins in a tight labour market and with elevated direct expenses.

In times of economic decline, attorney productivity historically has fallen. For example, in Q1 2009, attorney productivity decreased year-over-year by 11.5%, according to the Hildebrandt International Peer Monitor Index. So far in 2022, law firms’ productivity dropped 1.1% in Q1 and 3.5% in Q2, according to Thomson Reuters’ Law Firm Financial Index.

Law firms commonly measure productivity by billable hours and utilization of billable employees. Metrics for both have trended positively over the last 15 years. However, in the past five years, utilization growth has stagnated around 71%, according to the 2022 Professional Services Maturity Benchmark report by SPI Research. This suggests firms might have hit the ceiling for the number of billable hours a professional services employee can work in a year. To relieve this squeeze on profitability, firms must enable their employees to do more during those hours.

Billing rates represent an additional challenge to the sector

Billing rate growth is critical as persistent inflation eats into profit margins. Of course, rate growth as a path to profitability becomes less viable as demand for services recedes.

For example, following an 8% drop in demand for legal services in Q1 2009, firms raised their billing rates by only 3%—less than half of the average year-over-year increase of 7%, according to the Hildebrandt International Peer Monitor Index.

So far in 2022, billing rates have grown by 5% and 4.7% year-over-year in Q1 and Q2, respectively, according to Thomson Reuters.

Professional services firms are mitigating these challenges by investing in technology

Effective use of technology enables firms to minimize administrative tasks and to work smarter. Automation, integrated workflows and approvals, knowledge-sharing technologies, and virtual communication tools have allowed professional services professionals to multitask with several projects and clients at once.

The average law firm in Q2 of 2022 increased its year-over-year spending on technology by 10.5%, the fastest pace in eight years, according to Thomson Reuters. That surge followed an 8% annual increase in Q1. The acceleration reflects a subsector with its eyes on long-term success in the face of more immediate threats to profitability. However, it remains a question how steadfastly firms can continue to afford to focus on that big picture.

Among professional services firms that are proceeding with investments in digital solutions, we are seeing a key trend toward single solutions that can do more under a simplified workflow with minimal integration complexities. Firms are turning to these single solutions to standardize and simplify IT architecture instead of just adding new technology to an existing suite of applications.

Other top considerations to offset the impact of headwinds facing the professional services industry

- Off-site delivery of professional services

Professional service professionals have proven during the pandemic they can remain productive while off-site and are now set up with the technology to maintain that capability.

- Employee retention

As demand cools, so will the need to hire more staff. Firms should prioritize retaining current staff over trying to hire.

- Productivity through technology

Investing in technology that helps automate repetitive and manual tasks and streamline workflows and approvals needs to be prioritized to drive productivity gains.

- Client value

Ensuring clients understand the value they are receiving for fees is critical to client retention.

Opportunity

There is one area of law services that has grown in past economic downturns: bankruptcy law. In Q1 2009, demand for bankruptcy attorneys increased 15% year-over-year, according to FindLaw.

It is also important to note that some legal matters do not simply go away during a recession, and law services are a necessity in many situations. During a recession, clients are more cost-conscious, though, and some will find themselves shopping the middle market firms for services that are more rate-friendly than big law firms.

Hampered by rising inflation, geopolitical uncertainty, and supply chain disruptions tied to the COVID-19 pandemic, the U.S. economy contracted in the first and second quarters of 2022.

RSM economists peg the chance of a full-blown recession over the next 12 months at about 45%; an economic slowdown of any measure creates significant challenges for middle market companies. We have taken a look at the impact of economic headwinds on several industries.