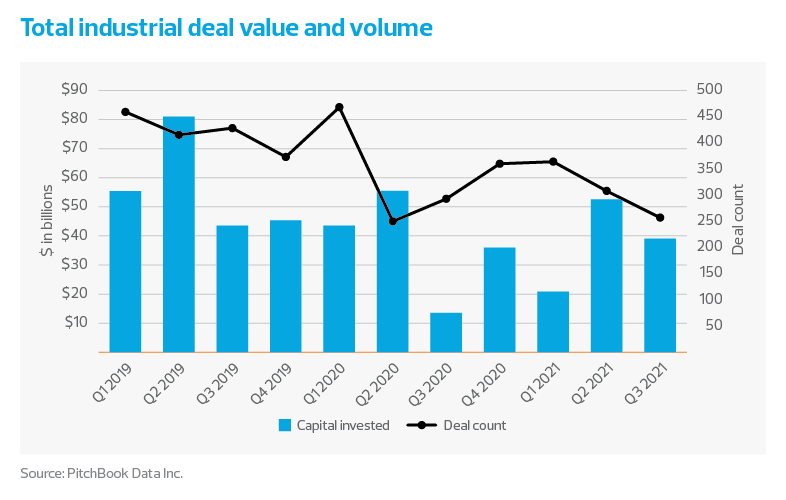

As the economy continues to show signs of recovery, we saw elevated merger and acquisition activity within industrials in the first half of 2021. This trend is expected to continue as stakeholders look to get deals across the line before year-end and in advance of potential changes in tax legislation that may produce a fourth-quarter result similar to 2020’s weak showing. We anticipate that performance around environmental, social and governance issues—already growing in prominence across most industries over the last few years—will become an increasingly important consideration in such deals, including performance related to diversity and inclusion.

A broader variety of stakeholders—including customers, employees, suppliers, communities and shareholders—is ramping up pressure on companies to show greater transparency around ESG issues and behaviors, and investors are taking note. Between 2015 and 2019 there was a surge in capital invested in ESG-linked projects, with such capital growing by 500% over that time to $17.67 billion, according to Morningstar.

Reporting and regulatory bodies are also invested in making ESG a standardized, reportable metric to provide transparency to shareholders. As such, ESG is becoming a critical consideration in the due diligence process in an effort to evaluate the attractiveness of assets in transactions going forward. Below, we take a look at the rising importance of ESG issues in the industrials space.

Environmental

For middle market industrial companies, the environmental aspect of ESG is a core focus, as industrial processes are a significant source of global emissions. Production of base metals like iron, steel and aluminum is notorious for high emission levels and energy consumption. Accordingly, the ESG focus is on areas such as sources of energy (clean or carbon-based), types of materials used within the manufacturing process (recyclable or non-recyclable), types of waste products (and the disposal process), and how business processes affect air, water and soil.

The extent to which companies are shrinking their carbon footprint through reduced emissions and reduced material consumption is increasingly becoming part of deal considerations. Proactive adoption of ESG initiatives and the impact on financial results—such as ability to reduce costs, optimize capital expenditure and secure more favorable lending terms—will be a key consideration for valuing businesses.

The number of companies familiar with ESG criteria has risen significantly, according to RSM’s third-quarter Middle Market Business Index special report on these issues. The report—which polled executives from July 8 through July 26 on ESG and climate change-related questions—found that 69% of executives were very familiar or somewhat familiar with using ESG criteria to evaluate performance as of Q3 2021, compared to only 39% in Q4 2019. Further, 84% of middle market organizations said they use the ESG criteria to evaluate their own performance, and 78% use it to evaluate the performance of other organizations. We expect this analysis of performance using ESG measures to continue to grow across industrial organizations within the middle market and influence new standards for investing.

Middle Market Insight

For middle market industrial companies, the environmental aspect of ESG is a core focus, as industrial processes are a significant source of global emissions. The extent to which companies are shrinking their carbon footprint through reduced emissions and reduced material consumption is increasingly becoming part of deal considerations.

Social—purpose and people

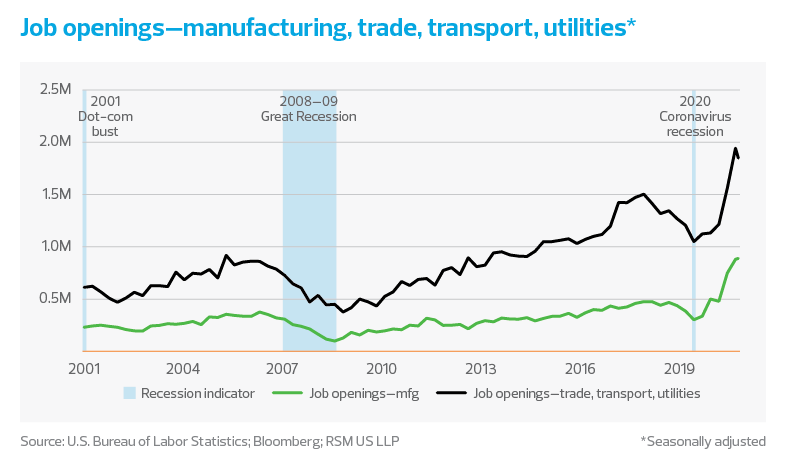

While M&A transactions focus on company performance, such deals are also largely driven by the people who make up the company culture. The “S,” or social aspect, of ESG therefore includes issues of diversity, equity, inclusion, human rights, consumer protections and animal welfare, to name a few. Businesses should strive to make an impact in these areas and have a verifiable set of values they convey in interactions with their suppliers, customers, community and employees. Companies can no longer ignore their role in these areas if they wish to maintain a positive brand and attract and retain talent, which is in the shortest supply in decades. Strength in the talent arena will be an immense advantage in the context of investment decisions and company valuations.

In the manufacturing sector, for instance, job openings increased nearly threefold from 302,000 in the beginning of the pandemic to 880,000 by August of this year. Unfilled positions in trade, transport and utilities similarly went from 1.05 million to 1.94 million over the same period, according to the Bureau of Labor Statistics. The glut of companies seeking employees dwarfs all numbers in recent memory, and is putting pressure on people in recruiting, hiring, training and retaining roles to do more to attract candidates.

While important to many employees, pay raises have not resulted in a broad return to work. Manufacturers and transport businesses are at a disadvantage in that many of their jobs cannot be done remotely, at a time when more employees are demanding remote work options. Therefore, industrial businesses may want to focus on understanding and responding to how employees feel about their social fit within an organization, whether they feel appreciated, and whether they believe the business cares about its larger social responsibility to society.

Companies may also have an opportunity right now to attract women into the workforce by providing flexible schedules, child care support, and opportunities for skills development and growth. The technology transformation in manufacturing requires more STEM skills and digital talent. Women are increasingly dominating men in college enrollment, and over the next few years two women will earn a college degree for every man if the trend continues, the executive director of the research center at the National Student Clearinghouse recently told The Wall Street Journal. Women can potentially play a greater role in addressing the digital talent gap, and companies that provide workplace policies and schedules that work for women will benefit.

Increased social unrest in recent years, coupled with people reassessing their jobs during the pandemic, has shone a spotlight on business to provide an appropriate response. Many companies have taken steps in the right direction. For example, job titles such as “head of diversity” grew by 107% between 2015 and 2020, according to global LinkedIn data. However, turnover in these roles is high—an average stay is three years, per LinkedIn—with a key issue being lack of commitment and support from management.

Employees and job seekers want their employers to be socially aware and have inclusive and diverse workforces. Company commitment to a strong culture and an employee’s belief that the company is genuinely committed to them can make a difference in their decision to join and stay, even when things get bumpy.

Both public and private companies must embrace the fact that business commitment to ESG is increasingly becoming mainstream, and that stakeholders evaluate ESG efforts as part of their engagement with a company.

Governance

Corporate governance, or the “G” in ESG, pertains to the governance factors of decision-making within a company and includes business ethics and risk management. While environmental and social matters appear on the front burner for most organizations, governance practices play a significant role in how companies respond to key ESG issues. As such, insufficient governance practices can have a negative impact on the bottom line and investment decisions, and proper governance should be considered a critical foundation in an organization’s operations.

Lastly, both public and private companies must embrace the fact that business commitment to ESG is increasingly becoming mainstream, and that stakeholders evaluate ESG efforts as part of their engagement with a company.

Looking forward

Investment decisions and company valuations in M&A deals will be influenced in no small part by ESG standards. Here are some key ESG considerations for manufacturing leadership teams:

- Alongside ongoing signs of economic recovery, deal activity within the industrials space has remained strong in 2021. This trend is expected to continue through the remainder of the year, with ESG being a key factor in evaluating the attractiveness of assets in M&A going forward.

- With this increased ESG focus, middle market industrial organizations should consider a proactive approach to ESG. This would include developing and evaluating ESG strategies and programs, which will be critical to long-term competitive success, affecting financial results and investment decisions.

Middle market industrial organizations need to begin assessing and establishing their baseline ESG metrics and performance if they haven’t already, and then put programs in place to continually show progress over time.