Manufacturing production and sales slow in response to tightening economic conditions.

Key takeaways

Cost pressures persist, while showing signs of moderation with easing supply chains.

Manufacturers should use data-driven forecasting to adapt to evolving demand.

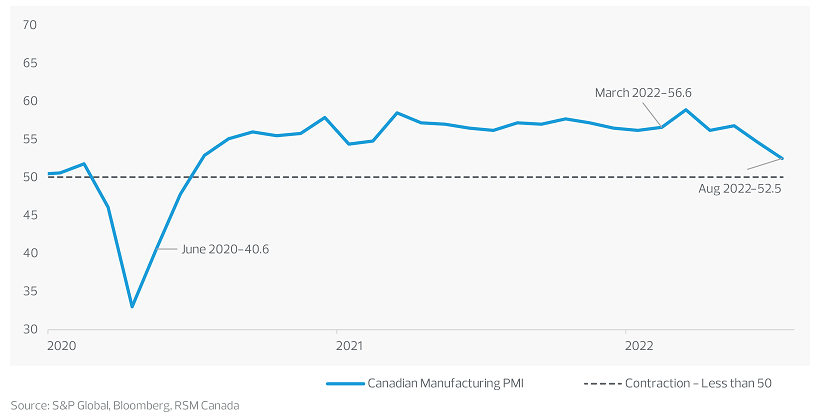

The performance of Canada’s manufacturing sector has softened in response to inflationary pressures, rising interest rates and expectations of coming economic headwinds globally and domestically. Canadian manufacturers’ confidence dipped over summer, according to S&P Global’s purchasing managers’ index survey, reflecting concerns over slowing demand, material and workforce shortages, sustained inflationary pressures and the inability to fully pass cost hikes along to customers.

While pricing and margin pressures persist, there are some signs of moderation as supply chain disruptions ease and commodity prices soften.

By the numbers

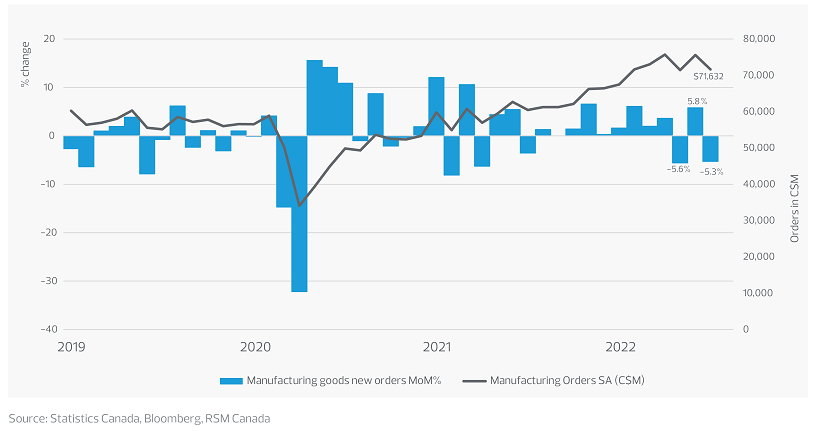

Manufacturing goods orders dipped 5.3 per cent month-over-month in July, according to data from Statistics Canada. In June there was a 5.8 per cent increase in orders following a 5.6 per cent decrease in May.

Manufacturing orders: Month over month seasonally adjusted

Headline PMI continued to contract after its peak in March this year, falling to 48.7 in August from 52.5 a month earlier—the lowest reading since June 2020, signaling overall deterioration in manufacturers’ sentiment. The forward-looking new orders index also weakened for the second consecutive month, falling to 44.4 in August from 48.8 in July.

Canada manufacturing PMI

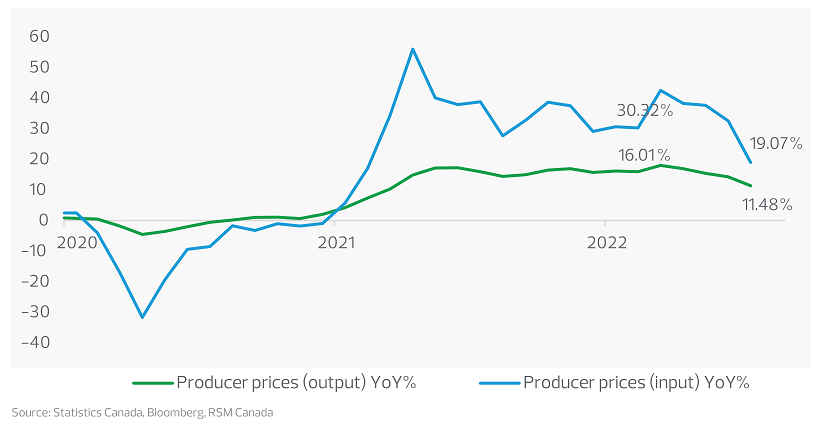

Overall, industrial input costs have outpaced product prices for most of 2022: raw materials prices were up an average of 31 per cent through the first eight months of this year when compared to the previous year—that figure was just 15 per cent for output product prices. While the situation varies by sector, these figures signal that not all manufacturers have been able to pass on increased production costs and have taken a hit on margins.

Industrial producer price indices

There is, however, a positive trend of moderation in both input and output pricing, resulting from normalizing supply chains and slight easing in commodity prices.

According to the RSM Canada Supply Chain Index, supply chain pressures have eased back into a positive territory since July this year. Peaks in inventory levels in August were consistent with the annual trends in preparation for Q4 demand, but also indicated that gradually improving supply is catching up with the waning demand.

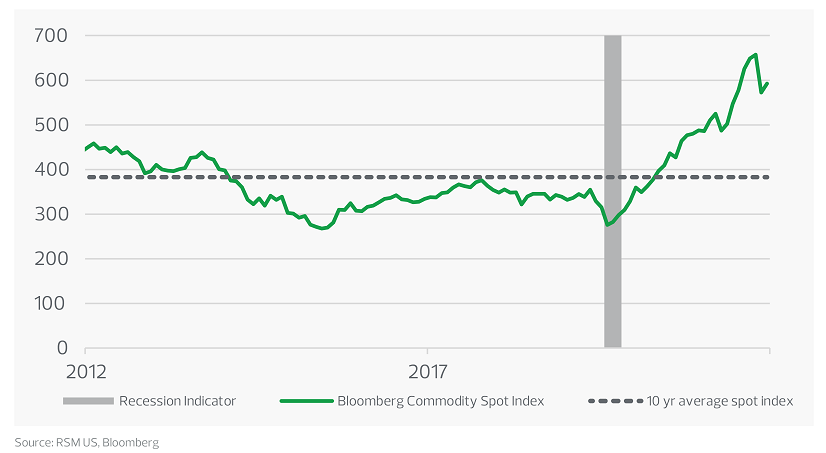

As for commodity prices, the broad-based Bloomberg commodity spot index is showing a downward trend from its all-time high in May of this year, signaling a slight easing on both pricing and margin pressure in the coming months. Still, commodity prices remain above the 10-year historical average and have room to fall before normalizing.

Commodity prices falling but remain above historical averages

Manufacturing employment remained steady throughout the first eight months of the year; the sector’s unemployment rate went up in August to 3.8 per cent after staying at 3 per cent since May, according to Statistics Canada. Total labour force participation dropped slightly over the summer to 64.8 per cent compared to 65.4 per cent at the beginning of the year. Still, the current participation level remains below 65.6% in February 2020 before the pandemic. We expect that the manufacturing labour market will continue to be tight due to 83,000 unfilled jobs, which is nearly twice the level of such jobs a year and half ago.

The top challenge for the manufacturing industry in a slowing economy is forecasting demand

Accurately forecasting mid- to long-term future demand will prove to be a challenge. On one hand, manufacturing orders after holding steady and growing over the past 12 months started to show signs of contraction. On the other hand, the Bank of Canada is seeking to dampen demand without tipping the country into a recession. The Bank of Canada will not stop raising rates until it sees signs inflation is trending towards its target rate of 2 per cent from its 7 per cent rate today. Manufacturers will need to plan for a pullback in orders, but still ensure sufficient inventory levels in view of the continuing supply chain disruptions.

Other manufacturing challenges include labour

Another challenge for manufacturing companies is the continuing labour shortage. For many manufacturers, labour attraction and retention are issues in terms of both factory floor workers and white-collar engineers who operate or oversee complex processes and equipment. As economic headwinds mount, companies will need to develop a workforce plan that will allow them to operate efficiently but avoid the loss of highly sought-after talent. Locking in the appropriate talent with the necessary skillset is imperative to not only current production capacity but to navigating an ever-evolving digital environment.

How the sector is mitigating these challenges

Manufacturers who continue to look to data-driven decision making will be best positioned to quickly adapt to evolving market demand. Data-driven decision making will unlock opportunities to gain efficiency in the supply chain vertical and ensure appropriate workforce resources to meet production needs. Leveraging technology to support the workforce will continue to be a priority to streamline processes and provide talent support.