A structural change in clinical trials is underway as the life sciences industry shifts toward virtualization and decentralization.

Three primary trends are driving this shift:

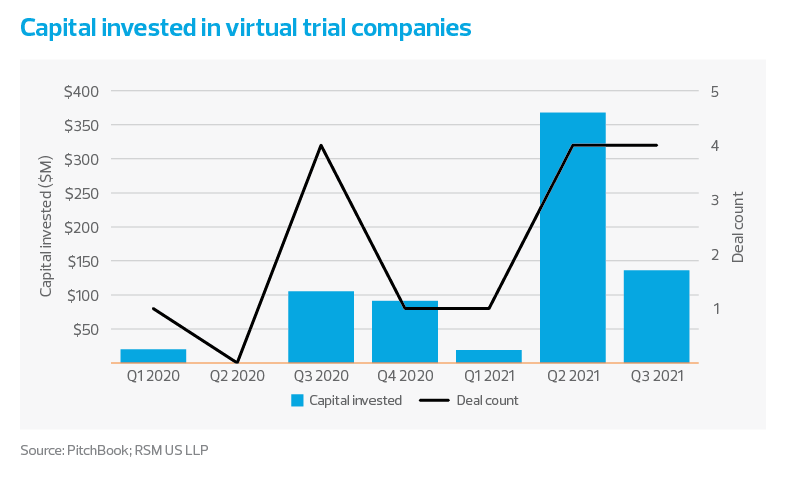

- A new group of companies has entered the contract service provider market. These newcomers are virtual trial platform companies that typically provide a software as a service (SaaS) clinical trial management system (CTMS) to contract research organizations (CROs). Over $700 million has been invested in this market in the past seven quarters, and we expect this number to grow significantly in the coming years.

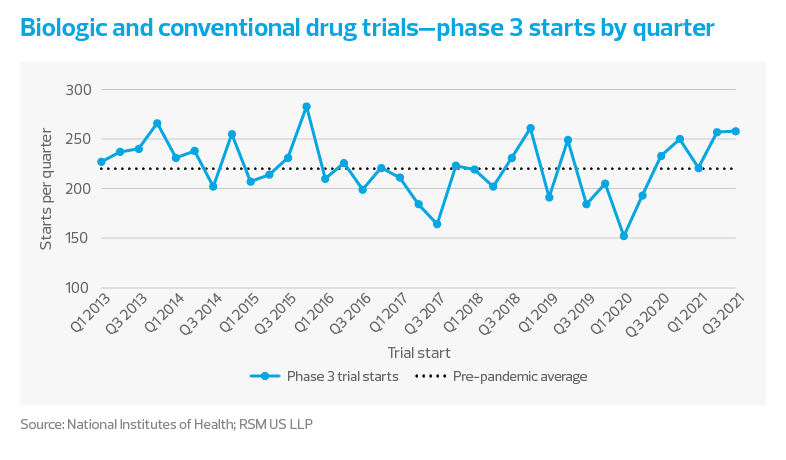

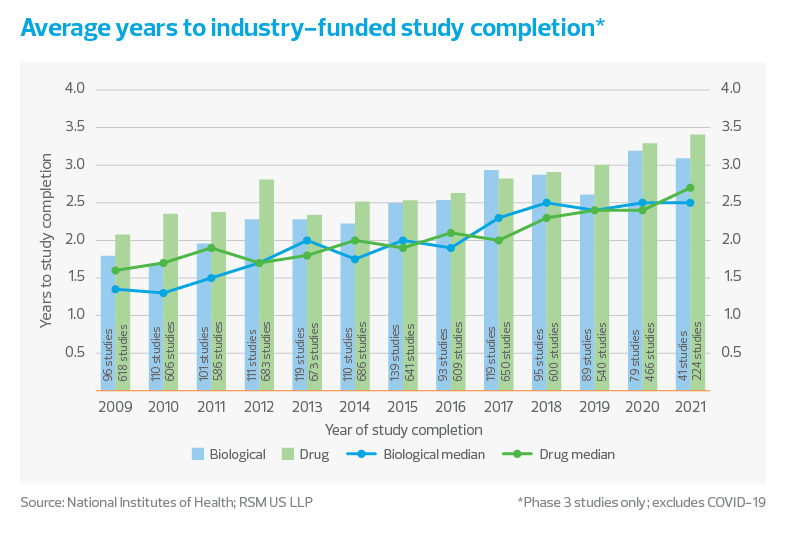

- Clinical trial starts have rebounded from the pandemic-induced lull, and currently exceed historical levels as investors continue to pump capital into the ecosystem during this life sciences renaissance. At the same time, there is a major shortage of labor and trial duration continues to increase. Many companies are looking to virtualize and digitize their trials to minimize cost, maximize efficiency and reduce the likelihood of delay.

- Contrary to the current narrative, virtualization often does not lead to cost reductions in telehealth, including when telehealth serves as a proxy for a clinical trial. Clinical research executives note that patient-centricity, not necessarily clinical trial cost, remains the key objective in execution of virtualized clinical trials.

New entrants: Virtual trial platform companies

“Decentralized” and “virtual” are ubiquitous buzzwords in current descriptions of clinical trials; however, the meaning of these terms within the industry can be confusing. Clinical trials are designed to fall within a spectrum of virtualization. On one end of the spectrum, all trial procedures are performed virtually; on the other, all trial procedures are conducted physically at a research site. Trials typically do not fall at the extreme ends of this spectrum but instead comprise a mix of virtual and on-site procedures—a design commonly referred to as hybrid.

The number of clinical trials utilizing virtualization is on the rise. In a recent ERT survey, 33 per cent of clinical professional respondents indicated they were incorporating virtual components into their trials prior to the COVID-19 pandemic, while 82 per cent indicated they are currently doing so.

With this changing landscape, several new players have entered the arena. These companies are primarily service providers to large CROs and assist with clinical trial virtualization through some sort of SaaS CTMS. In its Decentralized Clinical Trial Products PEAK Matrix® Assessment 2021, the Everest Group ranked several companies based on their vision and capability related to decentralization. The leaders—Medable, Science 37 and THREAD—fall into this bucket of SaaS CTMS providers. A few companies fall outside this bucket, such as ObvioHealth, which markets itself as a virtual research organization and aims to provide fully virtualized clinical trial administration to trial sponsors.

Partnerships between decentralized trial companies and CROs are increasing, and so is investment in virtual trial companies. According to PitchBook, there have been 14 disclosed investments into these organizations over the past seven quarters, totaling $719 million. We expect that capital will continue to flow into these organizations as partnerships expand. We also expect established CROs to look into acquiring these organizations as they grow their in-house virtual trial offerings.