Capital markets remain volatile, but sector performance over the last decade relative to the S&P 500 remains strong.

Key takeaways

In vitro devices continue to make up the majority of device sales, but the cardiology segment is forecast to grow at the quickest pace.

An aging population battling chronic diseases will continue to drive strong compound annual growth in the sector.

Record research and development spend is expected to continue, or companies risk being left behind.

Capital markets outlook

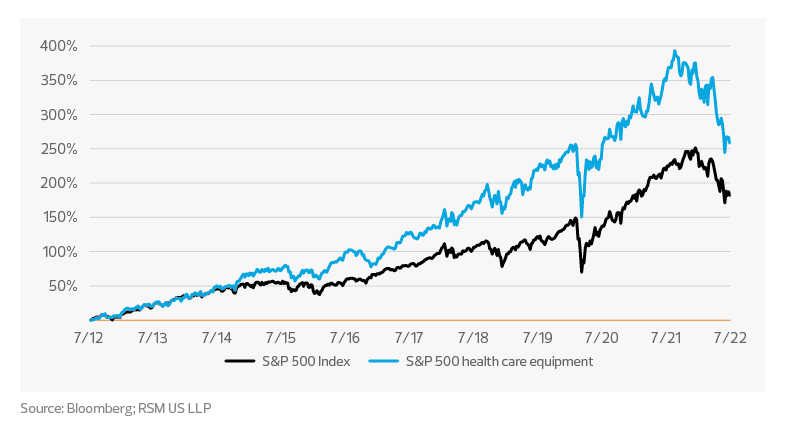

We compared the S&P 500 index overall with the S&P 500 health care equipment index, which includes all medtech, medical device and health care equipment companies that are part of the S&P 500. The following chart highlights their performance, normalized for 10 years of appreciation. Convergence of the two indexes began early this year, with values for health care equipment falling faster relative to the index overall.

However, despite the temporary underperformance, the index for health care equipment remained ahead over the 10-year period. As a percentage of value increase, the compound annual growth rate has been 13.6%, compared to the S&P 500 at 10.9%. We expect volatility will remain high and valuations will continue to retrace if the Fed maintains its tightening of fiscal and monetary policy. However, we expect performance for the medical device sector over the long term will continue to outperform the S&P 500 overall, as demand for and sales of medical devices are expected to remain at all-time highs.

Medtech market activity - percentage appreciation over 10 years*

Device sales by segment

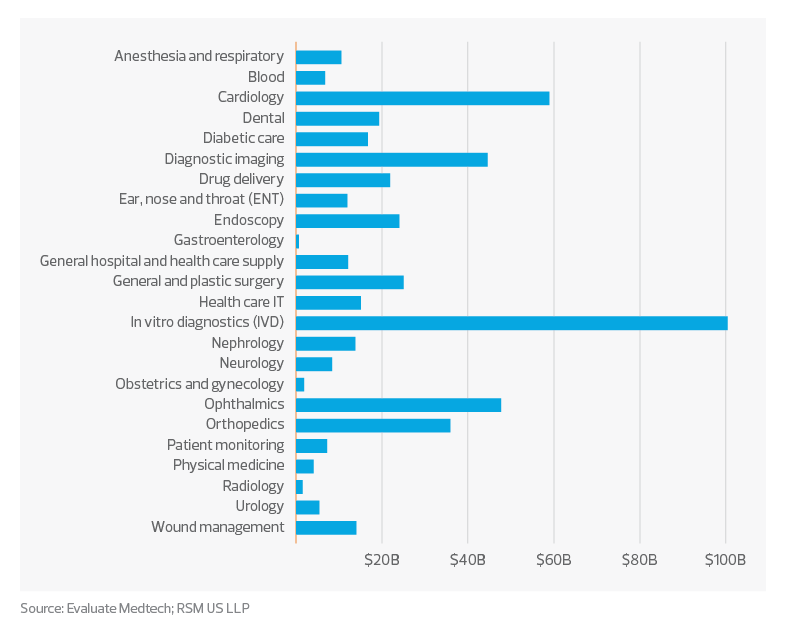

In 2021, in vitro devices—ranging from blood glucose monitors to sophisticated diagnostic tools used in clinical laboratories to cancer screening tests—made up the largest portion of worldwide medical device sales, accounting for over $100 billion. Cardiology devices, focused on the monitoring and treatment of heart disease, is the second largest segment, at nearly $60 billion. This is no surprise, as heart disease continues to be the leading cause of death in the United States, followed closely by cancer, according to the Centers for Disease Control and Prevention.

Additionally, as noted in our previous outlook, 6 out of 10 Americans now live with at least one chronic illness. Demand for medical devices to help treat, monitor and support our aging population will continue to drive growth in the sector.

Predictions for growth in the in vitro devices sector vary significantly among analysts, but we expect the CAGR will exceed 5% over the next six years. Evaluate Medtech analysts forecast that cardiology devices will be the fastest-growing segment and will eclipse $90 billion in revenue by 2028, compared to less than $60 billion in 2021. Record research and development spend is expected to be a primary growth factor across all segments.

2021 device sales by segment*

Medtech research and development: A look forward

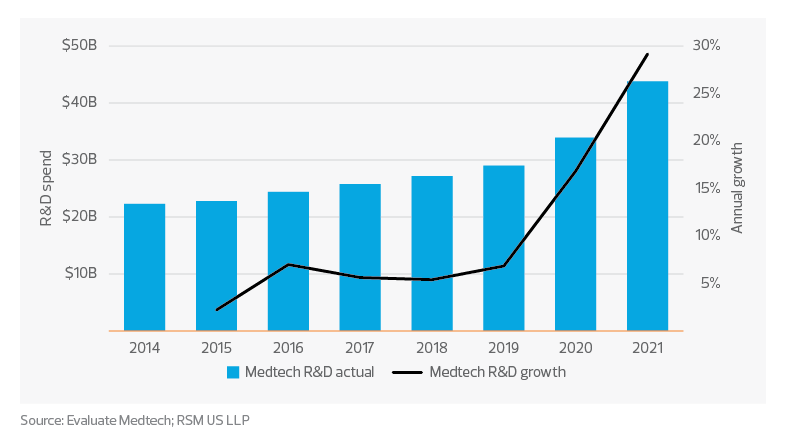

Last year, R&D reached record levels of nearly 30% growth from the year prior. In 2020, it exceeded 15% as companies quickly spent cash reserves to combat COVID-19. The long-term annual growth average for R&D in the sector typically hovers around 3% to 5%. We expect only modest growth in R&D spend this year as companies look for ways to combat rising inflation concerns.

However, even modest growth year over year represents a record level of spending. We expect the trend of record R&D spend will continue as companies jockey for technical superiority and the pace of innovation continues to accelerate. There are no viable substitutions; if medtech companies don’t maintain strong R&D spend, they risk being left behind in a highly competitive and segmented industry

Global medtech R&D spend*