Medtech demand continues to rise, but device-makers face difficulty meeting it due to high supply costs and manufacturing challenges related to disruption in the global supply chain.

Medtech industry outlook key takeaways

Research and development spend nearly doubled in 2021 and remains strong as companies jockey for market dominance in an increasingly competitive sector.

If the trend toward fewer, smaller acquisitions continues, it could have a ripple effect on the sector.

Medtech companies jockey for market dominance in a competitive sector.

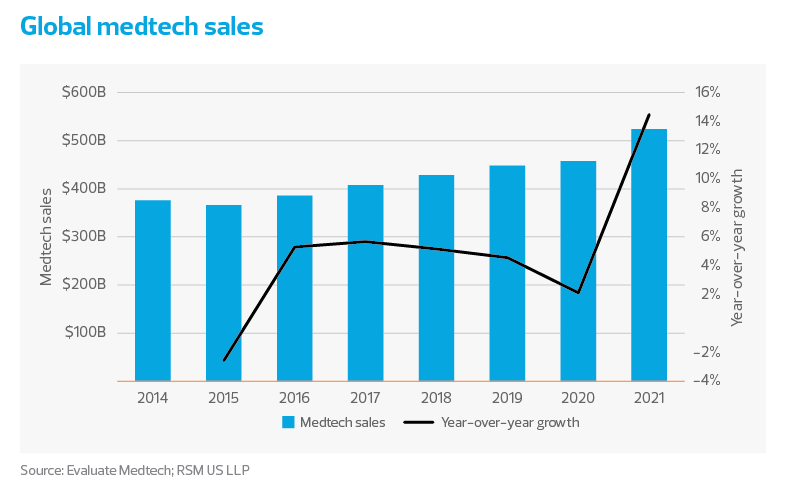

Global medtech sales: A look forward

Worldwide sales grew a record 14% last year and exceeded $500 billion for the first time. A portion of that growth is attributed to device sales related to COVID-19 testing. The remainder is attributed to growth across nearly all other device types as demand to support an aging population and a surge of people battling chronic illnesses, including heart disease, arthritis, cancer and diabetes, continue to grow. According to a recent Centers for Disease Control and Prevention report, 6 out of 10 Americans now live with at least one chronic illness. Wearable monitoring devices, drug delivery systems and other medtech devices are critical for helping this population with the treatment and management of their illnesses. The rapid pace of technological advances will continue to improve the effectiveness of these devices and will drive demand for them even higher.

Unfortunately, device-makers will experience difficulty keeping up with demand as they deal with rising supply costs and manufacturing challenges related to disruptions in the global supply chain. Additionally, as we noted in our Jan. 17 article 5 things to know in life sciences, regulatory approval for new devices will remain delayed through 2022 as the Food and Drug Administration continues to work through a backlog of submissions.

Despite the headwinds, though, data from Evaluate Medtech forecasts overall sales growth of 4% in 2022 and a compound annual growth rate of 6% thereafter.

Medtech research and development spending reaches new highs

Research and development spend globally nearly doubled in 2021 to over $50 billion, driven by competitive challenges brought on by the emergence of new digital and remote monitoring technologies. Data from Evaluate Medtech estimates that research and development spend will drop year over year slightly for 2022, but will remain at a record high of nearly $35 billion, with an expected CAGR of 5% thereafter. We expect this trend will continue as companies look for efficient ways to spend their record levels of cash and jockey for market dominance.

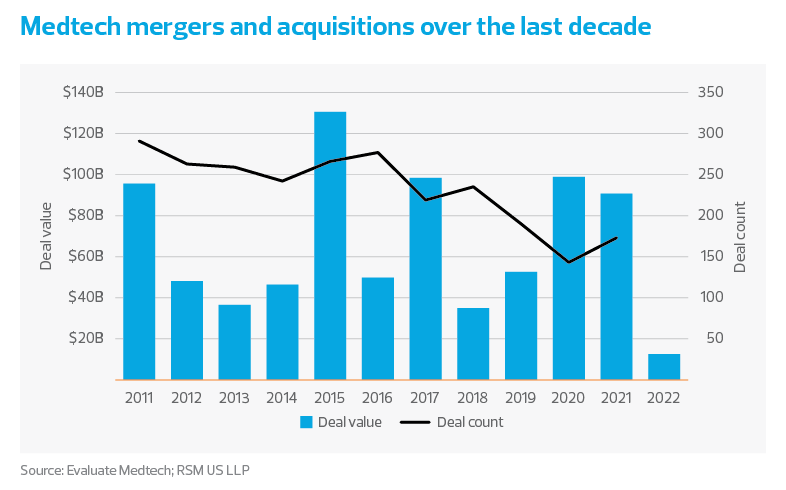

M&A activity drives deal size

In the first quarter of 2022, the pace of M&A activity receded slightly after two years of near-record deal volume. Companies seeking to achieve scale during a difficult time drove M&A activity to new highs in 2020 and 2021. During that same period, strong performance in the public capital markets also drove company valuations to record highs. As a result, and due to a number of large acquisitions, average deal size trended higher during those two years.

Conversely, appetite for smaller acquisitions, of less than $100 million, continues to wane. Robust investment from private equity and venture capital has continued to support medtech. However, these investment firms depend on liquidity events such as a public offering or acquisition to support their investment thesis. If the trend toward smaller acquisitions continues, it could have a spillover impact on the M&A space and a rippling effect on the medtech sector.

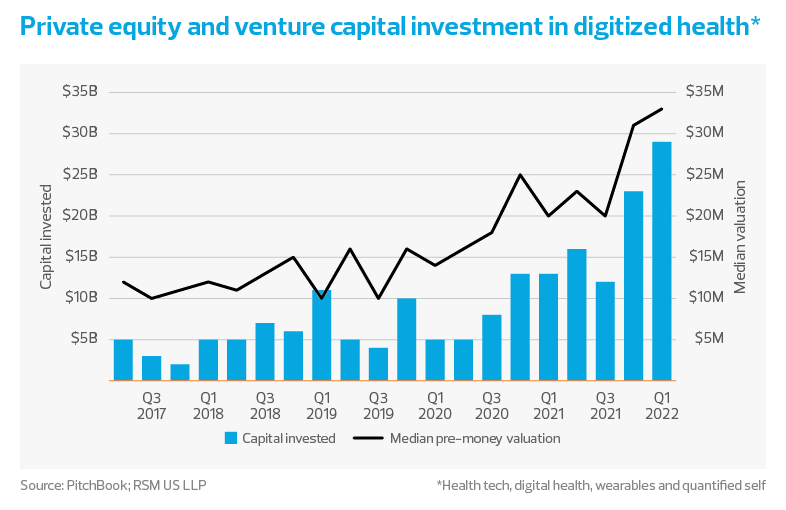

Private investment into digitized health continues

The private capital sector continues to invest heavily in the emerging sector of digitized health. In the first quarter, investment across private equity and venture capital reached record highs of nearly $30 billion, with average pre-money valuations above $30 million. We expect this trend will continue, as private investors look to capitalize on first-mover advantage.

Emerging technologies have allowed startups to develop, validate and manufacture wearable devices that are cheaper than previously achievable. Fueling that growth is the upward trend of direct-to-consumer products, including wearable fitness trackers that allow people to monitor multiple biomarkers. Direct-to-consumer devices give companies the benefit of commercializing their products faster, allowing investors to earn a quicker return on their investment. As FDA approvals for these devices grow, so will investment into the space. We expect 2022 will be another record year as new product development continues to accelerate.