The Inflation Reduction Act will likely have the biggest impact on large pharma companies and less on the middle market.

Key takeaways

IPO and M&A activity, along with drug licensing deals, remains quiet for now.

Those with capital—including venture capital and private equity funds—along with established companies able to make drug licensing and M&A deals, are waiting for valuations to come down.

With the recent news that U.S. gross domestic product declined in the two most recent quarters, the overall U.S. economy faces a real risk of recession. In this context, it is important to understand the current state of the biopharma sector. The capital markets for biopharma assets are currently challenging, whether seen through the lens of valuations, access to the initial public offering market or difficulty in raising new capital.

To gain greater understanding, we can use tools, similar to those used to determine if the economy overall is in a recession. There are four key metrics: employment levels, wages, sales and prices. A decline in these metrics for several months indicates a recession for the sector. Below we examine each metric.

- Employment at biopharma companies has grown steadily after an initial dip early in the pandemic, from 336,600 workers in January 2022 to 342,300 in May (according to the U.S. Bureau of Labor Statistics). This growth has been steady from month to month, with no signs of slowing or decline, even in the face of recent headlines around biotechs and pharma companies restructuring or reducing head count—indicating the overall demand for labor in the market is outpacing any impact from these events.

- Wages for employees of biopharma companies rose steadily from the beginning of the pandemic through March 2022. In May (according to the U.S. Bureau of Labor Statistics) they declined modestly, but only to the level last seen in December 2021. More data will be needed to know if this is the start of a trend.

- Sales in the biopharma sector can be examined by looking at prescription drug spend in the United States and worldwide sales forecasts. Based on data from Evaluate Pharma, there are no signs of slowing in spending, with worldwide sales for 2022 forecast to grow 7% over 2021, to $1.14 trillion. The recently passed Inflation Reduction Act of 2022 will reduce U.S. drug spending by $288 billion over 10 years, which is a relatively small decrease when compared to the trillion-plus dollars spent each year worldwide.

- Prices for prescription drugs have remained flat so far this year, in contrast with the inflation in the broader economy.

So, much like for the economy overall, the data is mixed—but there is undoubtedly significant stress in the biopharma sector right now. To better understand that stress, we need look no further than the IRA, IPOs, mergers and acquisitions, and licensing deals.

Impact of the Inflation Reduction Act

With the IRA signed into law this August, several provisions could affect biopharma companies, including a corporate minimum tax, out-of-pocket caps on prescriptions and allowing Medicare to negotiate drug prices for the first time. However, these changes will have the biggest impact on large pharma companies and a much smaller impact on the middle market.

Drug price negotiations

Allowing Medicare to negotiate drug prices has been included in numerous drug pricing reform proposals over the years. The IRA finally moves this concept into law but in a very limited way. It allows Medicare to negotiate drug prices under Part D starting in 2026 and Part B in 2028. The provision has numerous limitations, including a maximum number of drugs that can be negotiated and restricting negotiations to drugs that have been on the market for seven years (or 11 years for biologics), with exceptions for drugs for rare diseases. The direct impact on middle market biopharma companies will be limited, but the new law establishes a precedent that the pharma industry has been fighting for years.

Corporate minimum tax

The new corporate minimum tax will affect companies with reported revenues greater than $1 billion. Currently, 29 biopharma companies reach this threshold (with another 18 nearing it with revenues greater than $750 million but less than $1 billion). Of these 29, seven already have an effective tax rate higher than the minimum. As a result, this provision will have an impact on just over 20 large, public pharma companies and a minimal impact on the majority of biotechs.

Out-of-pocket spending caps

The IRA includes out-of-pocket caps on copays for insulin in Medicare Part D, provides additional coverage for vaccines, and caps other out-of-pocket costs in Medicare Part D. These increased benefits will not directly affect drugmakers.

Limits on drug price increases

The bill includes a provision aimed at limiting price increases for drugs provided under Medicare parts B and D to match inflation. Drugmakers will be required to provide a rebate to Medicare when the prices of the drugs they sell to beneficiaries increases faster than the consumer price index.

IPO market remains frozen

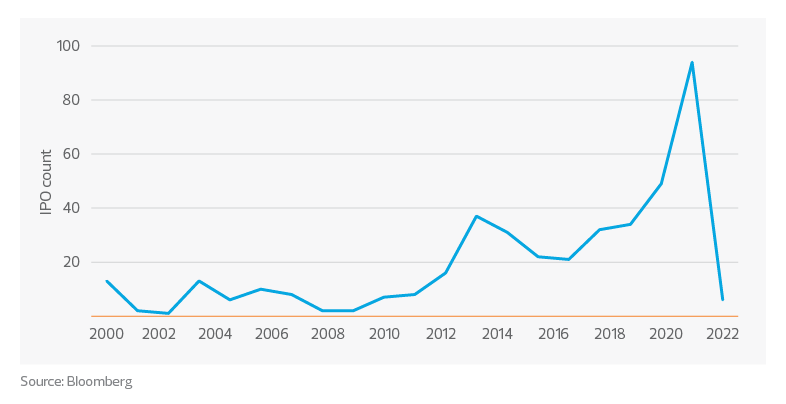

Life sciences IPOs January 2000 through July 2022*

So far in 2022, there have been a total of six IPOs of life sciences companies on U.S.-based exchanges and none between May 1 and the end of July. This is a stark departure from the record volume of offerings in 2020 and 2021. The total volume of IPOs in 2020 and 2021 was greater than the volume of IPOs in the four years prior. The last time there was a substantial drop in IPOs was from 90 in 2014 to 62 in 2015. It was not until 2020 that the volume of IPOs exceeded the record set in 2014. The last time there were this few IPOs between January and July was in 2003.

M&A activity has not picked up

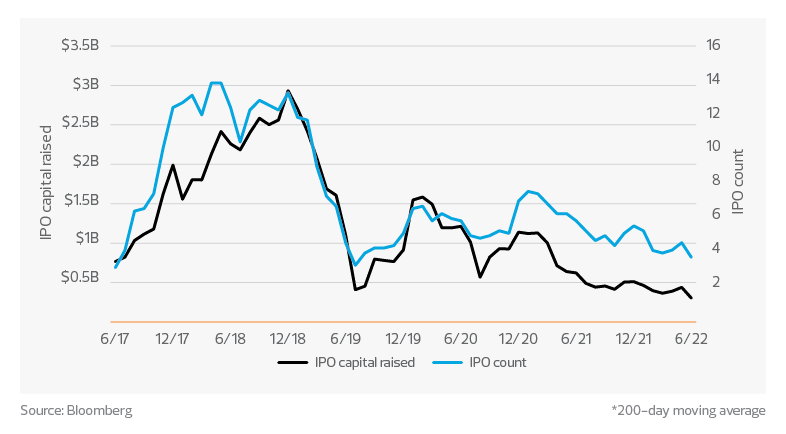

Life sciences IPO activity - U.S. exchanges*

M&A activity, unlike IPOs, has been relatively constrained during the pandemic, with a major slowdown in 2020 followed by 2021 picking back up to an average year. Year to date in 2022, the volume of completed M&A transactions and the capital raised are both down significantly. In the first seven months, 117 M&A transactions were completed compared to 221 through the same period last year. We are unlikely this year to match the 375 total deals closed in 2021.

It is also important to note that the average value of M&A deals in 2022 is much lower than in prior years. Year to date, M&A deal values have totaled $26 billion compared to $102 billion in 2021—with an average deal size of $225 million this year compared to $464 million last year. This paints a picture of an M&A environment where fewer deals are happening and, for those that do close, the size is typically smaller. However, the 30 largest biopharma companies are currently holding $87 billion in cash, so at some point this impasse will break and deals will start happening again.

Drug licensing deals also down sharply

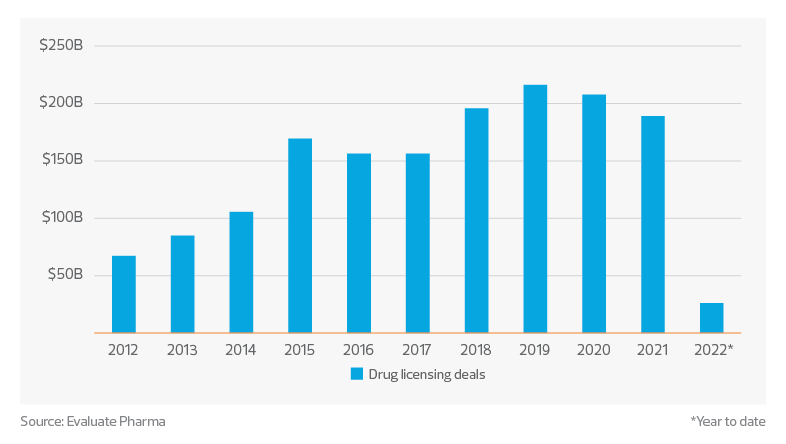

Drug licensing deals ($ millions)

Finally, we see that drug licensing deals are also down significantly in 2022, with only $26 billion of drug licensing deals completed through July. Of these, the top therapeutic areas were oncology ($11 billion) and central nervous system treatments ($6.4 billion). By far the largest deal so far this year has been the $3 billion strategic collaboration between Century Therapeutics and Bristol Meyers Squibb.

Record years create a headwind for new investment

This all points to a very quiet market for deal-making so far in 2022, whether looking at public markets, private markets or licensing deals. There seem to be two related major drivers of this environment: overall economic uncertainty and rising interest rates. Both are pushing down the value of risky assets like biopharma stocks and new drug candidates.

In contrast, biopharma companies in 2020 and 2021 were able to raise substantial capital at generous valuations. Now, as those same companies burn through that capital, they are reluctant to take potentially lower valuations to execute deals in the current economic environment. Those with capital—including venture capital and private equity funds—along with established companies able to make drug licensing and M&A deals, are waiting for valuations to come down to reflect the current risk environment. Which, for the time being, leaves all players on the sidelines.