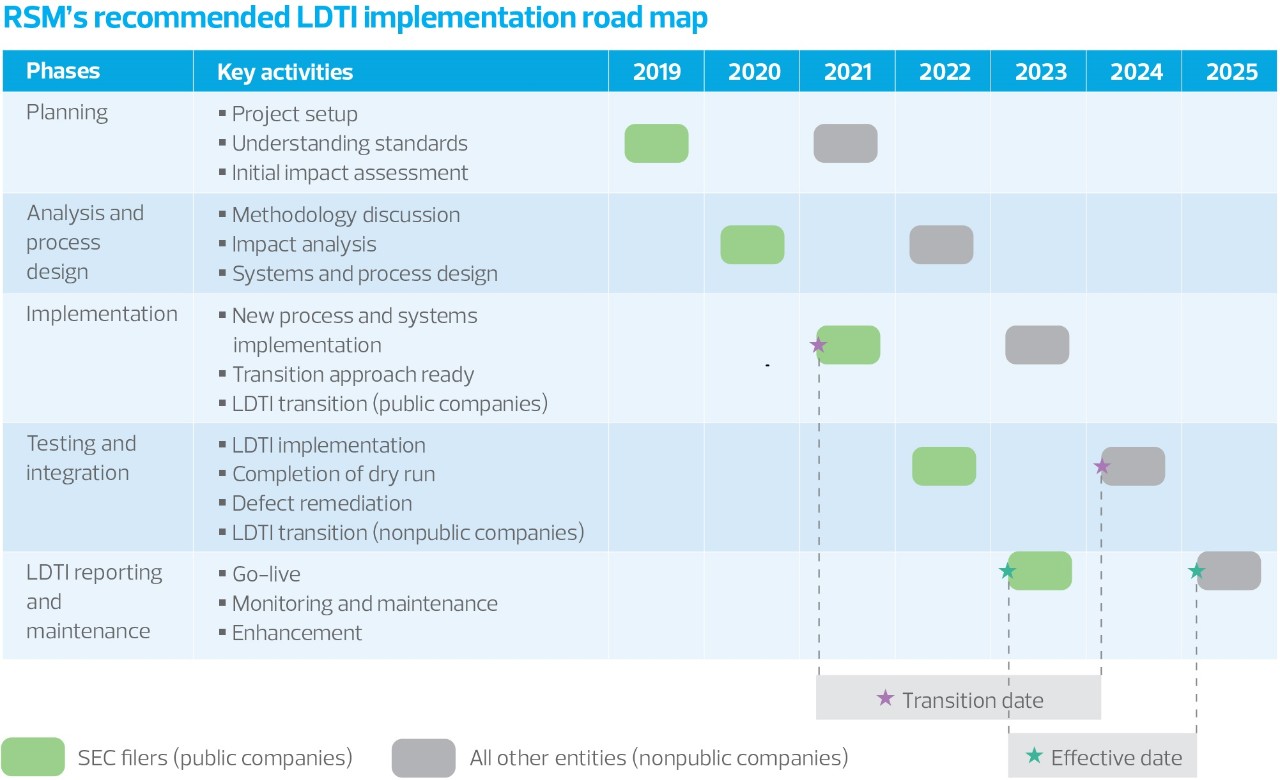

A new paradigm for insurance accounting will require significant changes in the valuation and disclosure of long-term contracts, effective Jan. 1, 2023, for Securities and Exchange Commission (SEC) filers, with an option to early adopt; and Jan. 1, 2025, for other entities. Insurers that report under U.S. generally accepted accounting principles (GAAP) need to plan long-duration targeted improvements (LDTI) ahead of time to understand the strategic implications and prepare for implementation factors that could affect end-to-end business operations such as actuarial and financial reporting.

LDTI adoption will require greater interaction between actuarial and accounting systems

A. LDTI overview

In 2018 the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-12, requiring “targeted improvements to the accounting for long-duration contracts”—or LDTI, as it is known in the insurance industry. The objective of these improvements is to simplify and enhance the financial reporting of long-duration contracts, providing more useful information about the amount, timing and uncertainty of cash flows. The scope of ASU 2018-12 requirements for consideration of cash flows includes the liability for unpaid claims on traditional life and limited pay contracts.

The updated standard will materially change the way many insurers report their financials and potentially expose material weaknesses in businesses’ operating models. Earnings could become more volatile, and balance sheets and income statements could change significantly. On the other hand, performance comparison among insurers will become more standardized and transparent, giving key stakeholders a more realistic perspective on risk.

Adoption of LDTI will require greater interaction between actuarial and accounting systems and functions, and involve significant challenges around granular data collection, actuarial modeling, process governance and business integration. LDTI implementation is a great opportunity for insurers to modernize data and analytics capabilities to develop a single source of truth, and to adopt an enhanced or new modeling platform to increase the efficiency of financial reporting processes. Key areas of change between the current GAAP and the GAAP under LDTI include the unit of account, discount rates, assumption unlocking, market risk benefit, deferred acquisition costs and disclosures.

A-1. Scope

The ASU focuses on long-duration contracts written, ceded or assumed by insurers and reinsurers. Accounting Standards Codification (ASC) 944-20-15-2 defines long-duration contracts as insurance contracts expected to remain in force for an extended period. To qualify as long-duration, a contract generally should not be subject to unilateral changes in its provisions and requires the performance of various functions and services (including insurance protection) for an extended period.

Examples of long-duration contracts include universal life-type products, limited pay contracts, certain participating life insurance contracts, term and whole life insurance, payout annuity contracts, and certain fixed and variable annuity guarantee products. Although other insurance products could be thought of as long-duration, such as title insurance or financial guarantee contracts, those are not within the scope of LDTI.

B. Liability for future policy benefits for traditional long-duration and limited pay contracts

B-1. Net premium ratio

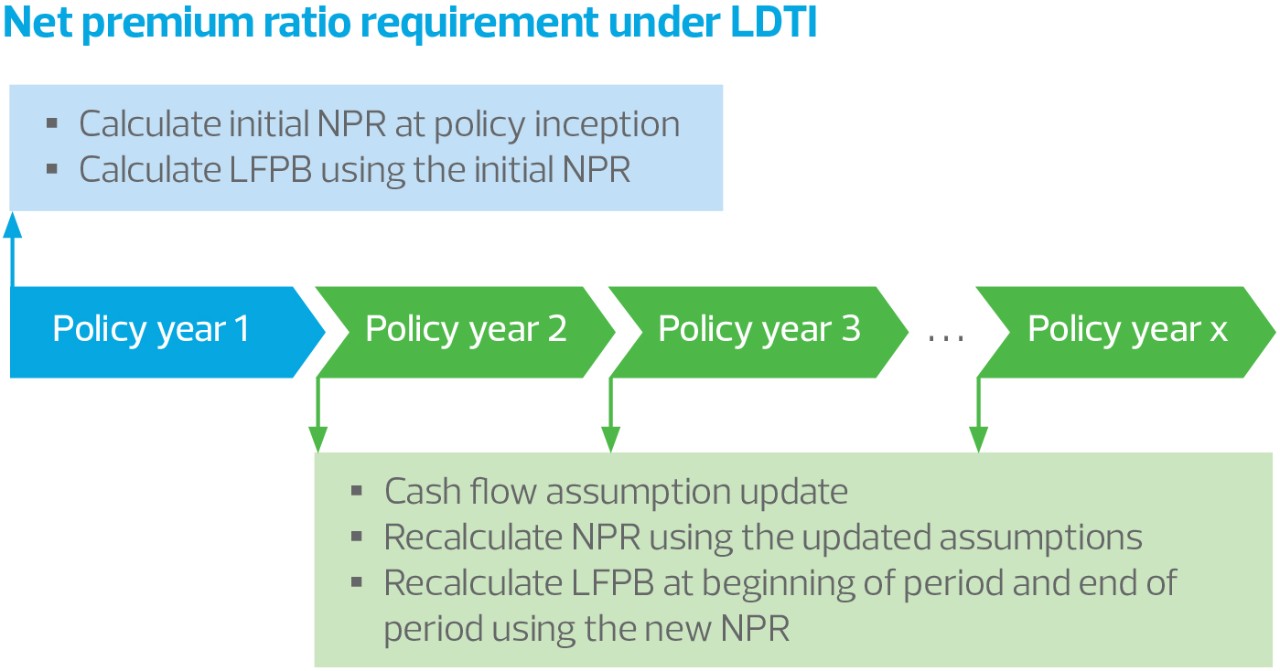

Under LDTI, the FASB continues to allow use of the net premium ratio (NPR) method at the inception of the policy; however, LDTI introduces changes requiring insurers to recalculate the NPR at least annually over the lifetime of an insurance contract. The following flowchart summarizes the NPR measurement requirement, based on an annual update of cash flow assumptions.

Unit of account, discount rates and updating of assumptions are other key considerations when calculating the NPR under LDTI, discussed below.

B-1.1. Unit of account

LDTI requires insurers to identify the unit of account, also known as the cohort or the level of aggregation, for which the liability for future policy benefits (LFPB) is measured. As with the current GAAP, insurers must group contracts into quarterly or annual cohorts—but under the LDTI, contracts issued in different years cannot be grouped together, reducing complexity. Additionally, LDTI does not have specific grouping requirements for insurance contracts that are onerous, non-onerous or share similar risks.

These changes simplify the financial reporting process, and imply that most insurers’ current approach to determining the unit of account may continue under LDTI. If contracts issued in different years are grouped into the same cohort under the current GAAP, an insurer must redesign the grouping methodology to adhere to the LDTI requirement and reassess the end-to-end business impacts, including disclosures and calculations performed at the group level.

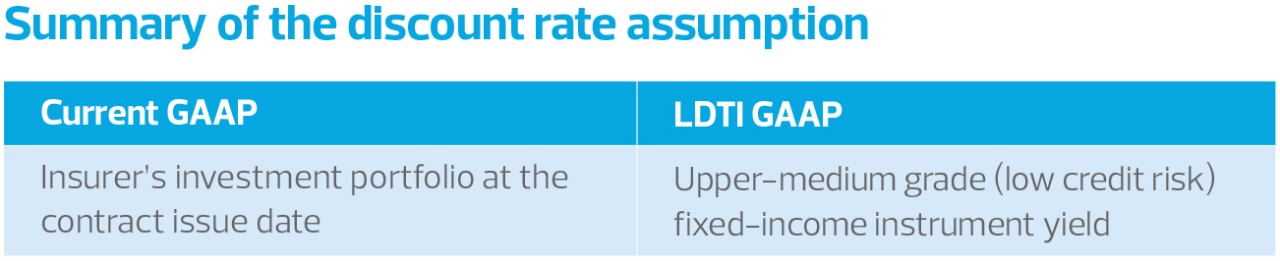

B-1.2. Discount rates

In the current rising interest rate environment, LDTI insurance liabilities are expected to fluctuate more than the liabilities under the current GAAP, which is based on an insurer’s investment portfolio on the contract issue date. The impact of the LDTI discount rate on the LFPB is captured through accumulated other comprehensive income (OCI) on the balance sheet upon transition; changes to subsequent calculations due to changes in the discount rate are recognized in OCI in subsequent periods, while not impacting an insurer’s LDTI profit and loss (P&L). Therefore, it is important for insurers to develop an efficient, repeatable process with a comprehensive controls framework to use the appropriate LDTI discount rates and evaluate financial results for reasonableness periodically.

The anticipated higher insurance liabilities with the LDTI discount rate will offset unrealized investment gains in OCI. The reduction in OCI will decrease the retained earnings when realized in the future.

Additionally, the LDTI discount rate will drive asset-liability mismatching because it creates a disconnect between investment yield on assets held and insurance liabilities. Insurers will need to stress-test balance sheets and income statements and assess the impact of potential mismatching. Insurers should revisit their hedging strategy to mitigate the market risk exposures that do not exist under the current GAAP, which uses insurers’ investment portfolio rate.

B-1.3. Updating of assumptions

Current GAAP for traditional long-duration insurance contracts allows insurers to determine the assumptions used to measure the LFPB at policy inception and update them only if a premium deficiency is recognized. The historical mode results in recognition of income over the life of the policy based on a level percentage of net premiums, with differences between the cash flows expected at contract inception and actual cash flows reflected in income over time. The assumptions for measuring the LFPB include mortality, morbidity, expense, lapse and investment return (ASC 944-40-30-11 through 944-40-30-15). However, using these “locked-in” assumptions may provide inaccurate information regarding contractual cash flows, financial position and risk exposure.

In contrast, LDTI requires that the cash flow assumptions used in measuring LFPB be current—which means insurers must review and update cash flow assumptions on an annual basis, or more frequently if indicated (ASC 944-40-35-5). Frequent updates of assumptions may affect the LFPB, and introduce additional volatility in net income (profit and loss). However, LDTI eliminates the need for premium deficiency or loss recognition testing, as the assumptions are revisited at least annually, in the same period each year.

C. Market risk benefit

A market risk benefit (MRB) is a contract that provides protection to a contract holder’s account balance and exposes the insurer to other-than-nominal capital market risks, such as interest rate and investment losses. The MRB can be either an insurance liability or an asset in the financial statement. MRBs are most often found in variable annuity guarantee products, which are typically offered through separate account products, but sometimes general account products as well.

The current GAAP standard provides insurers with two measurement methods for valuating benefit features, depending on the benefit’s characteristics: bifurcate it as an embedded derivative and recognize it at fair value under ASC 815; or recognize it as an insurance liability using a benefit ratio model under the FASB’s statement of position 03-1, in which liabilities are gradually established over time. Similar to the ASC 815 model, the LDTI standard requires insurers to measure MRBs at a fair value. This change allows for greater consistency across different insurers due to the simplified, more consistent model.

Implementation of the fair value approach may introduce a variety of challenges to insurers, including the need to run numerous risk-neutral scenarios to reach the desired convergence threshold. As this may increase runtime and computing costs, actuaries should consider variance reduction techniques to gain efficiency.

Additionally, changes in fair value related to MRBs must be recognized in net income; however, the portion of changes resulting from a change in the instrument-specific credit risk of MRBs in a liability position should be recognized in OCI (ASC 944-40-35-8A).

D. Deferred acquisition costs

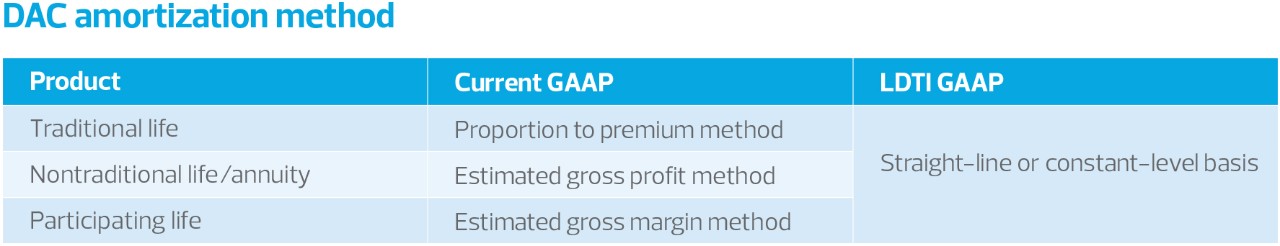

Deferred acquisition costs (DAC) is an accounting method that allows insurers to defer costs directly related to the successful acquisition of new contracts over the expected life of the contracts. DAC is considered an asset on the balance sheet and, under the current GAAP, is amortized over the expected life of the long-duration insurance contracts based on the emergence of revenue or gross profits.

The LDTI standard introduces a simplified method of amortizing DAC for long-duration contracts. LDTI eliminates current amortization methods such as proportion to premium (traditional life), estimated gross profit (nontraditional) or estimated gross margin (participating life). Instead, LDTI requires insurers to amortize DAC on a straight-line basis for individual contracts or a constant-level basis for grouped contracts over the expected term of the contracts (ASC 944-30-35-3A). Additionally, no interest will accrue to the DAC unamortized balance (ASC 944-30-35-3C), and DAC is no longer subject to impairment testing under the new guidance.

Whereas the LDTI requirements introduce greater volatility to the measurement of future policy benefits due to the updating of cash flow assumptions on at least an annual basis, the updated DAC requirements result in less volatility in the amortization of DAC into the income statement.

E. Presentation and disclosures

LDTI requires insurers to provide their primary financial statement in a condensed format as well as enhanced disclosures for easier evaluation and understanding of their financial position.

Many new disclosures are required, including a year-to-date disaggregated tabular roll-forward balance of DAC (ASC 944-30-50-2B); liability for future policy benefits (ASC 944-40-50-6); a policyholder account balance (ASC 944-40-50-7A); MRBs (ASC 944-40-50-7B); and separate account liabilities (ASC 944-80-50-2).

Additionally, insurers will need to disclose qualitative and quantitative information regarding significant assumptions used to measure the account balances.

The additional requirements are relevant for both annual and interim reporting periods. Insurers will need to perform a gap analysis to understand the required level of data granularity and additional output data elements for LDTI reporting.

F. Transition

An insurer’s transition approach will directly affect the emergence of its earnings. LDTI allows two retrospective approaches: full or modified. Insurers are required to elect their approach based on the availability of historical data since policy inception dates and on the capabilities of the current business and actuarial processes.

One exception to the choice of approaches is the opening balance of MRBs, which must be calculated at fair value using the full retrospective approach. This will introduce significant data challenges, because insurers are required to collect granular historical data at contract inception to measure the MRB at the transition date. The guidance allows hindsight when setting assumptions for the MRB calculation; however, insurers should make a reasonable effort to maximize the use of observable data first.

G. What does this mean for your business?

Adoption of LDTI will require greater interaction between actuarial and accounting systems and functions, and involve significant challenges around data, modeling, process governance and business integration.

RSM can help you take advantage of the opportunities arising from these changing requirements by assisting you in assessing data models, identifying opportunities to modernize, implementing transition processes and much more. Our experienced teams of actuaries, consultants, information technology specialists and other professionals can help you empower your business to embrace the possibilities and deliver on your potential.

RSM contributors

-

-

Jake SeokManager

Jake SeokManager