As public pressure builds for industries to adhere to environmental, social and governance standards, the real estate and construction industries are no exception. The European Union, for example, has passed many regulations that require proper ESG planning and disclosures for real estate businesses.

While ESG may not carry the same weight yet in the United States, this trend is not slowing down anytime soon. Unlike in Europe, the adoption of ESG standards in the U.S. may come about more as a result of public pressure than from regulation.

Millennials value social impact more than previous generations. As they start to become the key decision makers and investors, real estate organizations will need to have clear ESG policies to attract their capital.

So what are the opportunities for the real estate owners and operators?

Environmental sustainability

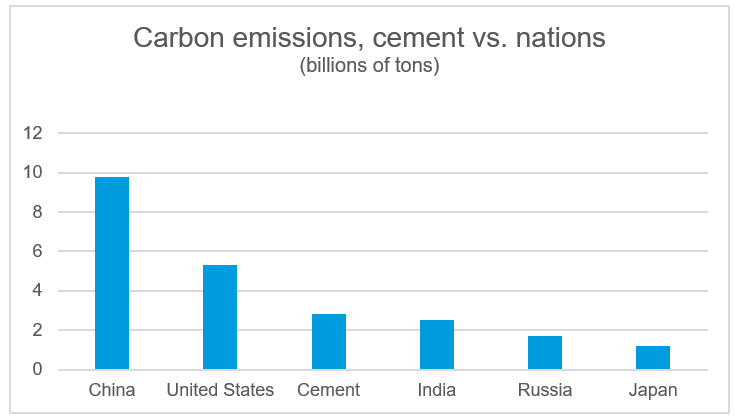

Concrete is the most widely used man-made material in the world, second only to water as the most consumed resource. It is also the source of about 8% of the world’s carbon dioxide emissions, according the BBC, which cited a report by Chatham House, a think tank. With concrete being such a vital element to the real estate industry, the responsibility to reduce carbon emissions will be a strong focus.

There are alternatives to concrete that help lower its environmental impact. Grasscrete is a method of laying concrete that allows for grass and other flora to grow. Not only does this reduce concrete usage, but it also improves stormwater absorption and drainage. There are similar hybrid materials, including HempCrete, AshCrete and Timbercrete. While these alternative materials may be an option for some projects, there are still other opportunities for concrete buildings to target lowering emissions.

Utilities consumption is another highlighted area. Saving energy not only helps the environment but also reduces operating costs. The LEED rating – which stands for Leadership in Energy and Environmental Design — is the mostly widely used green building rating system in the world. There are more than 35,400 LEED-certified projects representing more than 6.4 billion gross square feet of space. Certification as well as other consumption reduction initiatives must be considered during initial planning and development phases in order to be efficiently executed from a cost perspective.

Social responsibility

Social initiatives, while harder to quantify, are key for financial metrics and crucial for employee and tenant retention. Internally, workforce programs are vital to both attract and retain employees. Health and wellness programs contribute heavily to an employee’s overall engagement to the business. Real estate developers also have a responsibility to consider the overall community during construction. Collaborative spaces, like rooftop terraces or parks, connect tenants to the property and reduce likelihood of turnover.

Responsible governance

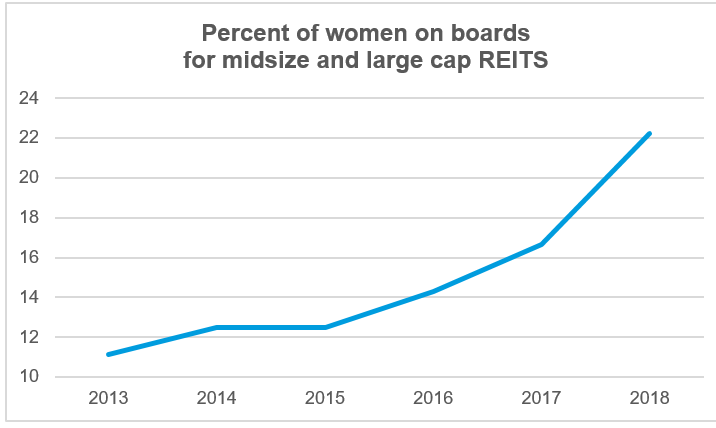

Corporate governance is the system of rules, practices and processes by which a firm is directed and controls. It involves balancing the interests of a company’s shareholders, executives, customers, supply chain and overall community. Culture, diversity and inclusion are essential to the success of an organization in providing varying perspectives and backgrounds to corporate decisions.

Many of the largest real estate companies are already showing the importance of this; 97 of the top 100 REITs have at least one female board member and the number of total female REIT board members has grown almost 50% in just two years.

How do you measure progress?

Once initiatives have been decided, the next step is to settle on how to measure and communicate the progress of these programs. Currently, there are no universal benchmark or reporting systems, but some tools are being commonly used in the real estate sector. There are a variety of disclosure frameworks available as guidance for key performance indicators and benchmarking. Some organizations may even use multiple frameworks as guidance.

- Global Real Estate Sustainability Benchmark had the highest participation rate by number of companies in the top 100 public REITs. Directly targeting real estate portfolios, GRESB benchmarks are based on metered and actual data that relies on third-party validation.

- Carbon Disclosure Project is a not-for-profit charity that runs a global environmental disclosure system, marking scores on both cities and organizations for their ESG standards. More than 800 cities and 8,400 companies worldwide report through the Carbon Disclosure Project.

- Global Reporting Initiative is an international independent standards organization that helps businesses and governments understand and communicate their impact on ESG factors. The initiative was a pioneer in sustainability standards and has been around for more than 20 years.

ESG considerations will become all the more vital in the coming years for all types of real estate companies. Some will be motivated solely by the desire for social change and see a responsibility to help the environment. Others will at least see the financial benefit through reduced operating costs and lower turnover.

Without proper action and communication of these efforts, real estate owners and operators may be left behind trying to fill vacant space and unable to compete in finding capital.