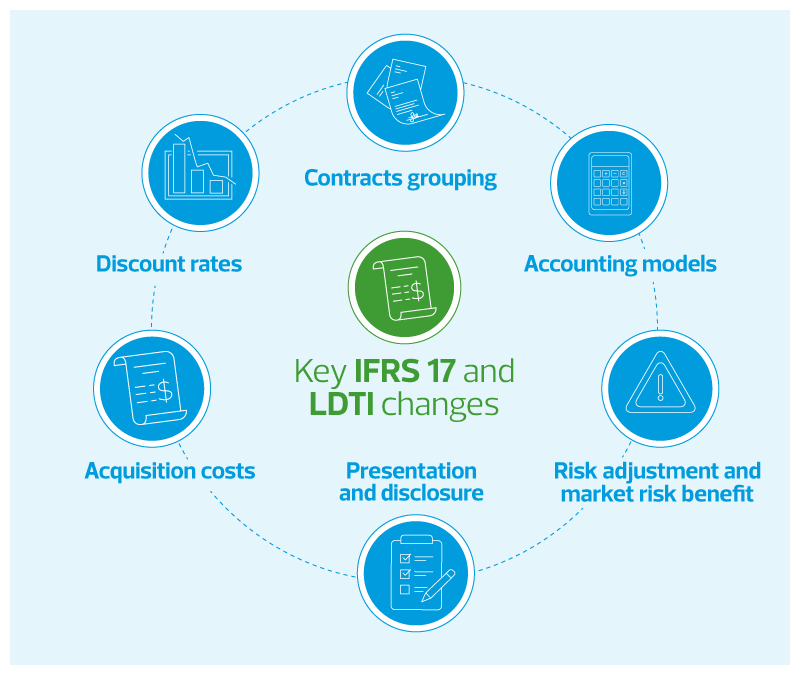

Assessing and separating insurance contracts into annual groups may present operational challenges. For example, multiple separate cohorts will require assessment on a continuing basis because IFRS 17 and LDTI both prohibit entities from including contracts issued more than one year apart in the same group. Insurers who report both in the United States and internationally may need to introduce new data elements to enable filtering and aggregation of contracts. The transition from LDTI into IFRS 17 will require that annual cohorts be identified as either onerous or profitable groups.

Operationally, insurers may need to adopt new methods to process new types of data, transfer the data into actuarial systems and measure that information. Governance processes around model change management may become a focal point.

Accounting for longer vs. shorter coverages (IFRS 17 (53))

IFRS 17 and LDTI both distinguish between long duration and shorter duration contracts. For example, IFRS 17 introduced a new general measurement model (GMM) (IFRS 17 (32-52)) is typically applied to longer duration contracts, while the alternative premium allocation approach (PAA) is allowed for contracts with one year of coverage or less.

LDTI also differentiates between long and shorter duration contracts, although its specifics of how to do so differ from IFRS 17.

Acquisition costs

IFRS 17 requires acquisition costs to be deferred under the GMM and provides an accounting policy choice of deferral or expense under the PAA. Additionally, IFRS 17 defines insurance acquisition costs for the first time, which may result in new costs for insurers.

LDTI eliminates current U.S. GAAP methods of amortizing in proportion to profit measures such as premiums (traditional life), estimated gross profits (nontraditional) or estimated gross margins (participating life). Instead, LDTI requires insurers to amortize deferred acquisition costs on a constant-level basis over the expected life of the contracts, independent of profitability or revenue considerations.

Insurers may need to update their systems and processes to transfer new types and amounts of acquisition costs into their accounting systems and actuarial measurement models. They also will need to allocate new types of acquisition costs and amortization periods into new periods, portfolios and cohorts.

Risk adjustment (IFRS 17 (32(a)(iii), 37))

IFRS 17 risk adjustment is an explicit part of insurance liability and contributes to profits under both the GMM and PAA approaches. The new risk adjustment calculation represents the compensation an entity requires for bearing the uncertainty about the amount and timing of nonfinancial risk cash flows. This calculation is complex and may require insurers to build new actuarial models and processes.

Under IFRS 17, approaches to calculating risk adjustment include the percentile method and the cost of capital method. The equivalent insurance measurement under the current U.S. GAAP is the provision for adverse deviation (PAD), which follows a different methodology compared to IFRS 17 approaches. However, under LDTI, the PAD requirement is removed in the calculation of future policy benefits.

Discount rates (IFRS 17(36))

IFRS 17 and LDTI have technical differences in their approaches to discounting, with significant implications for profitability and capital. Under IFRS 17, insurance contract claims expected to be settled in more than 12 months are required to be measured at the discounted value, similar to previous practices under IFRS. However, IFRS 17 also introduces a fundamentally different approach to calculating the discount rate used for the valuation of insurance liabilities. The standard requires application of either the top-down (IFRS 17 (B81)) or bottom-up (IFRS 17 (B80)) approach to calculate the discount rate. The discount rates are required to reflect the characteristics of underlying insurance contracts.

In contrast, LDTI requires insurers to set the discount rate using an upper-medium grade (generally interpreted as single-A or equivalent rating) fixed-income instrument yield in subsequent accounting periods, reflecting the duration characteristics of the liability and maximizing the use of observable inputs. As a result of this guidance, the calculation will incorporate single-A rates for each cash flow duration. Under LDTI, the impact of changes to discount rates will be reflected in other comprehensive income.

Cash flow assumptions

Changes in assumptions can have significant impacts on the valuation of insurance contracts and are often subject to significant scrutiny and oversight. IFRS 17 generally maintains previous IFRS approaches, in which significant assumptions are updated at each balance sheet date to arrive at best estimates of future cash flows.

LDTI aligns with IFRS 17 by introducing requirements for best estimates, requiring insurers to review and update the assumptions on at least an annual basis to reflect current experience. Under LDTI, the impact of updating cash flow assumptions (other than the impact of the change in discount rate) will be reflected in earnings.

Presentation and disclosure (IFRS 17 (78−132))

IFRS 17 and LDTI both have new disclosure requirements, which generally expand the quantity of information required compared to previous requirements. IFRS 17 condenses the presentation of insurance contracts within the financial statements and expands disclosure tables to include new elements of measurement within the GMM and PAA accounting approaches.

LDTI similarly expands disclosures to include year-to-date disaggregated roll-forward tables, providing an increased level of transparency for users of the financial statements.

Further considerations

Integration of IFRS 17 and LDTI changes will require greater interaction between actuarial and accounting systems and functions and involve significant challenges around data, modeling, processes governance and business integration. RSM can help you take advantage of the opportunities arising from changing requirements. Our experienced teams of actuaries, consultants, IT managers and other professionals can help you empower your business to deliver on its potential and embrace the possibilities.