While many insurers continue to face rising operational costs, outdated legacy technology systems and increased competition in the market, blockchain is a potential game changer that could revolutionize how they operate. In a risk-averse industry, blockchain can create an environment of trust by providing a network with controlled access and a method to share valuable data in a secure, tamper-proof way.

Blockchain is a decentralized digital database or ledger that records transactions and tracks assets across numerous computers, or nodes, which continuously and collectively agree to the current state of the ledger. Blockchain nodes can encompass several computers or electronic devices that maintain the chain of records that keeps the network functioning, ensuring no single entity can own or manipulate the information. When new blocks are formed, the data in the current block is linked to the previously added block. This forms a chain of data with enhanced accuracy and traceability, and prevents manipulation of the prior data.

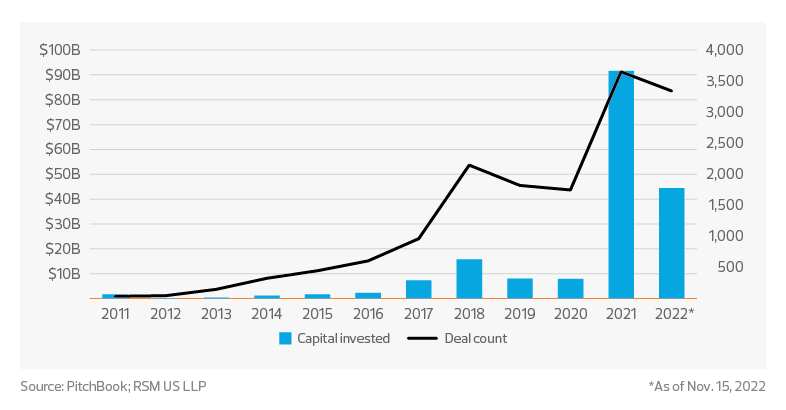

Twelve years ago, when blockchain was introduced to the global market, the emerging technology was mainly associated with cryptocurrency. In 2021, capital investments in blockchain grew from $7.9 billion to an astounding $91.6 billion, according to PitchBook data. Since March 2022, while capital investments in the space have decreased significantly, deal counts have maintained the pace of the prior year. This trend may reflect current economic challenges and inflationary pressures. While capital may be strained, blockchain may still provide significant business value for companies looking to expand their networks and economies of scale.

While capital may be strained, blockchain may still provide significant business value for companies looking to expand their networks and economies of scale.