Tax as a service has applications for consumer-facing tax platforms and corporate tax functions.

Key takeaways

Adjusting to fintech’s disruption in the tax space doesn’t have to be reactionary.

Companies should seek out innovative technology platforms to prepare for what is to come.

Fintech has been disrupting all areas of financial services, and the tax space may be the next to feel a significant impact with the emergence of tax as a service, or TaaS.

TaaS embeds in digital finance apps and uses simulations based on machine learning and artificial intelligence to provide cheaper, faster and more transparent tax services. Specialized finance investment in artificial intelligence and machine learning nearly doubled from 2021 to 2022, from $576 million to $1.11 billion, according to PitchBook data, further highlighting consumer demand for a more personalized financial planning experience. Decentralized and autonomous finance are in the early days of raising capital, but growth trends signal long-term transformation ahead.

Specialized finance investment in artificial intelligence and machine learning nearly doubled from 2021 to 2022, from $576 million to $1.11 billion, according to PitchBook data, further highlighting consumer demand for a more personalized financial planning experience.

While very similar to software as a service, which aims to distribute multiple applications to various users of a cloud provider, the primary goal of TaaS is to distribute a tax platform over the internet. TaaS has applications both for consumer-facing tax platforms and for the corporate tax function.

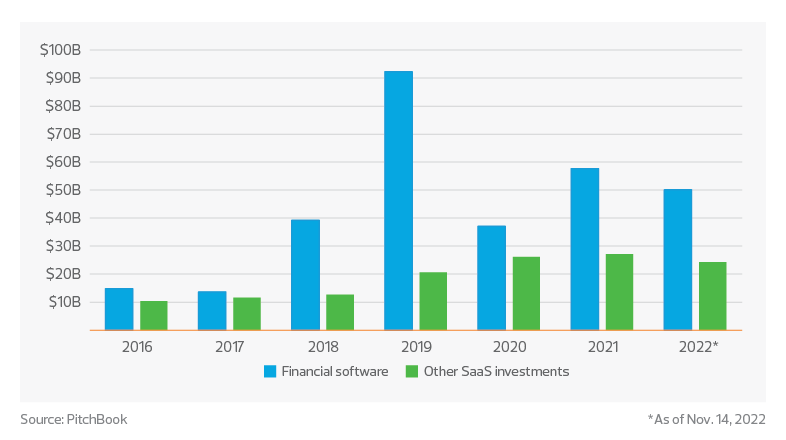

Software and SaaS have seen rapid growth over the last few years. Some may attribute that to the growing investment in financial software. In fact, investment in financial software in the SaaS space continued to outpace all other SaaS investments on a year-over-year basis from 2016 to 2022. Of the other SaaS investments, software offerings for business/productivity ($17.5 billion in 2022), specialized finance ($867.45 million in 2022), and other financial services ($3.55 billion in 2022) are not far behind.

SaaS investment over time

Today, several fintechs of various sizes offer tax planning and advisory services. SmartAsset, for example, developed a financial advisory platform that offers financial modeling. Its tools enable users to make smart financial decisions regarding homebuying, retirement and taxes. MainStreet, a financial platform designed for users to identify, file and claim government incentives, tax credits, deductions, and stimulus programs, has raised $106 million to date. Another promising fintech is Collective, a developer of tax management software that aims to help businesses minimize taxes through careful compliance with tax laws while forming their business and tracking income and expenses.

Policy implications

The rise of TaaS and tax software’s use of sensitive data does, of course, come with crucial privacy considerations.

Legislators have for several years been reexamining consumer privacy laws. The U.S. House Committee on Financial Services formed the Task Force on Financial Technology and Task Force on Artificial Intelligence in 2019. Since then, several hearings have examined the consumer risks and biases associated with recent advancements in technology.

Banks and fintechs often have back-office partnerships where the bank facilitates payment and loan origination, allowing fintechs to operate without a bank charter. In recent months these partnerships have come under scrutiny; the Consumer Financial Protection Bureau has broadened its enforcement and has cited a dormant provision under the Dodd-Frank Act to examine nonbank companies. In several recent U.S. House Committee on Financial Services hearings, the agency zeroed in on the use of consumer data, exploitation of spending patterns, and the application of lending laws by fintech companies. In November, the CFPB outlined options aimed at improving consumers’ access and control of their financial data.

We expect this broader use of consumer financial record data will expedite innovation. The use of open banking and banking as a service will likely be at the forefront of such innovation, especially for products and services in the tax space.

We expect this broader use of consumer financial record data will expedite innovation. The use of open banking and banking as a service will likely be at the forefront of such innovation, especially for products and services in the tax space.

Other innovations companies are working on include automated payroll tax collection platforms, online invoices and cash registers, value-added tax fraud detection using blockchain networks, and cloud-based invoice automation.

To prepare, tax leaders offering consumer-facing tax platforms should:

- Consider current compliance responsibilities and assess the potential for automation

- Identify use cases perhaps related to regulatory compliance and assess the availability of analysis tools

- Keep a close eye on industry trends to identify segments with high deal activity

Leaders looking to apply these innovations to their corporate function should:

- Leverage embedded tax to streamline tax reporting, filing and payment processes

- Consider ways to differentiate and co-develop products with existing fintechs

- Develop the ability to tailor solution sets for specific client use cases

- Identify key macro trends that are fueling the adoption of tax tech (cross-border transactions, the gig economy, remote work, emergence of crypto).

- Invest in emerging technologies that will facilitate data collection and analytics capabilities.

Adjusting to fintech’s disruption in the tax space doesn’t have to be reactionary. Companies should seek out innovative technology platforms that can help them view the tax function in a new light and prepare for what is to come.