Don’t fall into the trap of rapidly implementing automation without assessing processes.

Process intelligence can help insurers decide whether to automate or outsource various functions.

Streamlining claims processing, policy administration, and underwriting can reduce costs.

As the insurance industry faces a range of challenges—including increasing competition, economic uncertainty and a tough labor market—companies must look for ways to become more agile and adapt to new ways of working.

Agile organizations can quickly and efficiently adjust to market changes, technology advancements, and shifting customer demands without sacrificing quality outcomes or customer satisfaction. Increasingly, agility also requires embracing remote or hybrid work environments to meet employee demand for greater workplace flexibility.

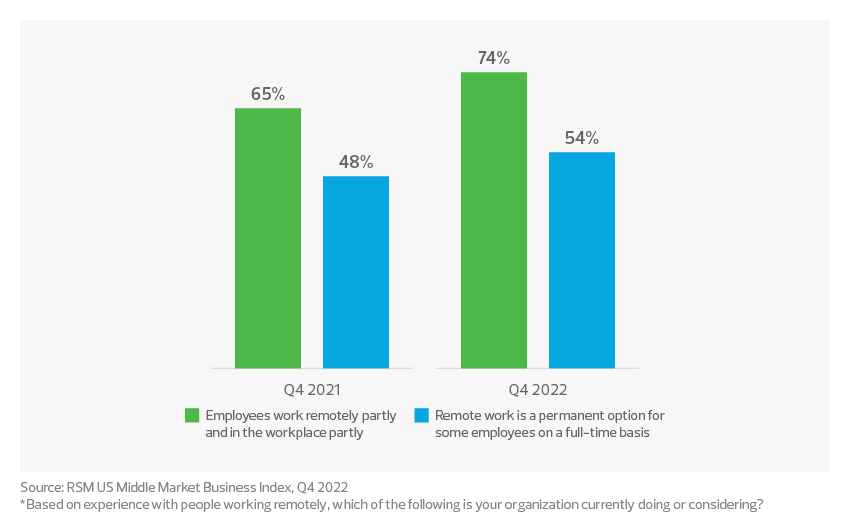

According to a recent workforce special report based on the Q4 2022 RSM US Middle Market Business Index survey, 74% of executives surveyed allow for hybrid work and 54% provided an option to work full-time off-site. In response to these new ways of working, companies are investing in automation to increase efficiency and employee productivity.

But automation is also where organizations should use caution; many companies have fallen into the trap of rapidly implementing automation without first conducting a holistic assessment of their existing processes. A proper assessment requires a data-driven approach that involves analyzing event logs to identify, monitor and improve processes. If skipping this assessment, companies end up automating—and often accelerating—bad processes, rather than taking the opportunity to improve them.

Process intelligence can help organizations avoid this pitfall. At a basic level, this involves a company harnessing data from its own systems of record to identify transaction pathways and uncover more granular insights into how processes are executed.

For insurers, process intelligence can be especially useful in helping them decide whether to automate or outsource specific functions to gain efficiencies and respond to market demands more quickly. In one recent example, RSM used process-mining technology to help a client identify claims process gaps and improve claims segmentation, allowing the company to handle claims faster.

Acquiring process intelligence can be broken down into three stages:

Process mining: Through data extraction, a company first collects event logs that show all event steps, including details such as the date and time each step of an event took place and who performed it. Process-mining technology can help by automating extraction and sorting tasks previously performed manually.

Process analysis: The company analyzes the extracted data to identify bottlenecks, gaps and other process inefficiencies, as well as potential fraud and compliance issues. A company can then develop ways to reduce waste, increase operational efficiency, and better manage risks. Improved efficiency can lead to cost savings through reduced labor and material costs, decreased errors and rework, and better resource utilization.

Full visualization of processes enables a company to work on reengineering what is broken before making substantial investments in technology and/or outsourcing solutions.

Protecting the improvements: Monitoring improvements for adoption and process conformity requires disciplined focus and continuity. Some organizations establish a process center of excellence to measure performance outcomes empowered by data-driven insights and reporting.

The insurance industry continues to face a range of challenges that require quick and efficient responses. Like organizations in other industries, many insurers and brokerages are considering investing in automation to streamline processes, reduce errors, and improve efficiency, with the goal of increasing operational strength. Streamlining tasks such as claims processing, policy administration, and underwriting can reduce costs and improve the employee and customer experience.

Knowing which processes to automate can be a challenge. However, with the help of process-mining technology, companies can acquire process intelligence to guide them in identifying and fixing broken processes; deciding whether to automate, outsource or eliminate processes; and monitoring and protecting process improvements.