Attention around the metaverse is on the rise within the ecosystem of financial institutions.

Financial institutions industry outlook key takeaways

Banks need to understand what the metaverse will mean to their primary customers in coming decades.

Understanding what the metaverse is and what its users want is necessary for future growth.

There is much excitement around the metaverse and its implications for a more futuristic world. The reality, however, is that because of the ongoing digital revolution, that futuristic world is already here. For a financial institution to stay ahead of the game and have a competitive advantage in the market, leadership teams need to start thinking about the metaverse, considering its implications for the institution and developing a response.

Because the metaverse is ambiguous and nascent, defining it is a challenge. Even experts in the area, such as technology specialists, system engineers and platform creators, discuss the unpredictable ways the metaverse may develop and shift over time. It is precisely because of the new and as yet unknown capabilities of the metaverse that institutions need to take the time to understand how it affects the financial ecosystem.

In the most simplified explanation, the metaverse is an immersive, interactive point of convergence where aspects of the digital world—in the form of augmented reality, virtual reality and the Internet of Things—intersect with aspects of our physical world. The metaverse creates what is now commonly referred to as extended reality, or XR. It’s a place where individuals can easily connect, collaborate and experience a near physical interaction across a great physical distance.

The evolving digital future

While digital interactions between banks, their borrowers and customers were increasing well before the COVID-19 pandemic, the frequency of these digital interactions increased even more once the health crisis hit. That was even more reason for banking’s digital evolution to continue at full speed.

But looking to the next 10, 20 or 30 years, banks need to understand what the metaverse will mean to their primary customers. What type of interaction will they look for in a banking relationship? What type of banking products will they need? How will they want to invest, whether in digital or other assets?

Demographic trends provide some insight into what may come; millennials have become the largest generation of adults and will continue—along with Gen Z—to dominate the workforce for many years. As we know, these generations find more value in convenience and virtual banking options compared to services offered in a physical branch. If that trend persists, there may even be a point in time when they aren’t solely on the internet anymore. You’ll find them in the metaverse.

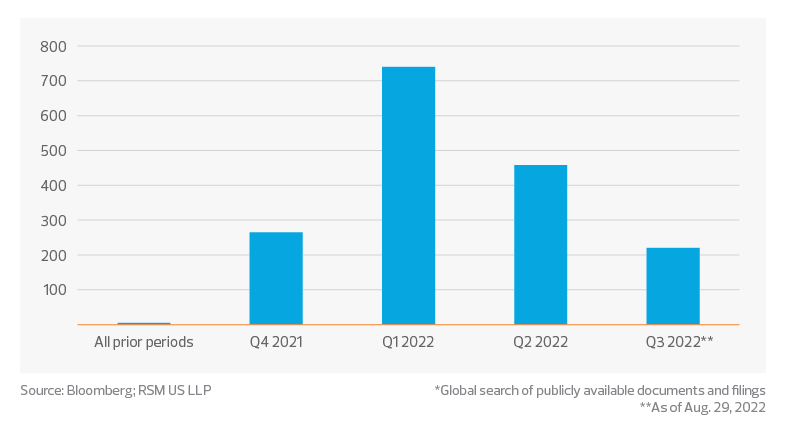

And it’s not just consumers and the tech industry talking about the metaverse, Bloomberg data shows. The chart below captures the number of times “metaverse” was mentioned in the filings and documents of public banks around the globe. This data indicates that attention around the metaverse is on the rise and an emerging topic within the financial institution ecosystem. In banks’ public filings, there was virtually no discussion of the metaverse before the third quarter of 2021—but a jump in related dialogue in the fourth quarter of 2021 and again in the first quarter of this year. This fluctuation explicitly conveys the degree of interest, momentum and opportunity that correlates with the metaverse.

Mentions of metaverse in banking: Global search of publicly available documents and filings

In Bank of America’s 2022 Small Business Owner Report, 20% of small-business customers surveyed reported that the metaverse will have an important impact on their business over the next decade.

Even with more focus on the metaverse, though, its potential impact is difficult to fathom. Financial institutions have a unique opportunity right now to enter this boundless new world and truly shape the future of financial services. The metaverse is an entirely different realm, a blank slate, a place where all financial services and related transactions will be entirely new. In essence, every type of transaction that an individual makes in today’s physical world will need to be duplicated in the metaverse. But it goes so much further than that.

The value of creation in the metaverse is vast; Goldman Sachs earlier this year estimated it could represent an $8 trillion opportunity. In addition to the sheer number of financial transactions that will occur within the metaverse, there are many other beneficial reasons for financial institutions to delve into extended reality.

First, it’s no secret that many financial institutions have been feeling the pain of the skilled labor shortage. Banks in particular have found it challenging to hire individuals from younger generations, which is concerning because members of those generations are going to one day become part of the C-suite at every institution. Being active in the metaverse may be a crucial step in overcoming that hiring challenge. A presence in the metaverse not only would be a recruitment tool, but also could boost employee retention by offering new, immersive methods for training and education.

The metaverse also offers up a favorable opportunity for financial institutions looking to develop or further strengthen their customer relationships. For so long, the trend in banking has been to digitize anything and everything, to the point that individuals can access a full suite of financial services without leaving the house. Becoming active in the metaverse pushes us further down that technological evolution path, but also has the potential to bring back the human connection that has been missing from many of these services for years. It gives companies the chance to reconnect with their clientele and provide the ultimate customer service.

How to adapt

We are at the very beginning of exploring the opportunities the metaverse may provide. And while the path forward may be long, financial institutions need to start assessing what those opportunities look like for them. For many institutions, this effort will start with learning some basics about the metaverse. These simple questions can help form a baseline:

- Who is using it?

- How are they using it?

- Why are they using it?

- How do they want to use it?

Having a fundamental understanding of what the metaverse is and what its users want is necessary for future growth. Only when you have that knowledge can you inform your company’s strategy with respect to the metaverse. In many ways, this realm of extended reality contains the building blocks for our new world.