Having clear processes in place will be central to managing liquidity and interest rate risks.

Key takeaways

Banks must understand when and how significant deposit outflows will drive liquidity decisions.

What was already shaping up as a difficult exam season will only become more intense.

The failures in recent days of Silicon Valley Bank and Signature Bank of New York represent the second- and third-largest bank failures in U.S. history, respectively.

These failures were preceded by the parent of cryptocurrency-focused Silvergate Bank announcing last week that the bank would wind down operations and voluntarily liquidate. In a vacuum, the circumstances that drove each of these banks to close may seem unique, but for the most part they are emblematic of the issues facing banking institutions in the current macroeconomic environment.

Specifically, the confluence of macroeconomic factors that led to these collapses—a dramatically rising interest rate environment, liquidity constraints, diminished capital levels driven by bond portfolio unrealized losses, and customer concentrations—is unlikely to change despite the tremors shaking the banking landscape. (Roughly $620 billion in unrealized losses were sitting on the balance sheets of the nation’s banks at the end of 2022, according to the Federal Deposit Insurance Corp.)

Given all of this, financial institutions need to understand what led to the collapse of these banks in order to enhance their organizations’ risk management activities and meet increased regulatory expectations while also maintaining customer confidence.

Background

Shock waves hit the banking ecosystem in early March as these three high-profile organizations folded, largely driven by the impact of ongoing interest rate hikes from the Federal Reserve—which helped fuel liquidity constraints—combined with the fact that these banks had significant customer concentration in the tech and innovation economy as well as the cryptocurrency space.

Cryptocurrencies in 2022 saw significant volatility and the collapse of several high-profile crypto-related organizations or exchanges. Further, 2022 saw capital markets geared toward the innovator economy—private equity and venture capital funds, including their portfolio companies—soften, while at the same time their cash burn increased due to the costs of labor, materials and rising debt service requirements.

While the customer concentration issue at these banks was one of the unique factors at play—SVB focused heavily on technology startups and the venture capital firms that support them—they weren’t the only issues. Financial institutions need to understand the other dynamics affecting their customers and influencing their behaviors, and have clear processes in place to manage liquidity and interest rate risks.

Interest rates and liquidity

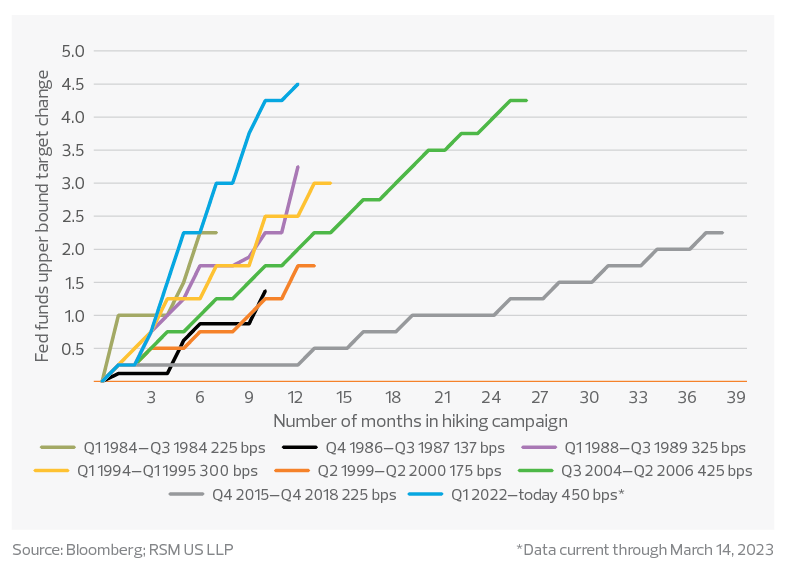

On the heels of the COVID-19 global health pandemic, inflation soared to a multigenerational high, causing the Fed to respond with its most intensive monetary policy response in over 40 years. Not since the Volcker era of the 1980s has the banking system seen such a dramatic increase in interest rates in such a short period.

Fed rate hike campaigns

The 450-basis-point increase in the Fed funds rate since February 2022 has had numerous impacts on the banking industry. First, and most notably, the shock to the interest rate environment has driven historic unrealized losses in the bond portfolio. And second, the interest rate environment has created more challenging financial conditions for cash-intensive industries, such as technology, life sciences and real estate.

The interest rate hike campaign in 2022 extinguished an abnormally long period of banks operating in a low- to no-interest rate environment. While the rapidly rising rates boded well for interest income, they also caused unrealized losses on securities to balloon, resulting in a major risk to capital levels and constricting liquidity.

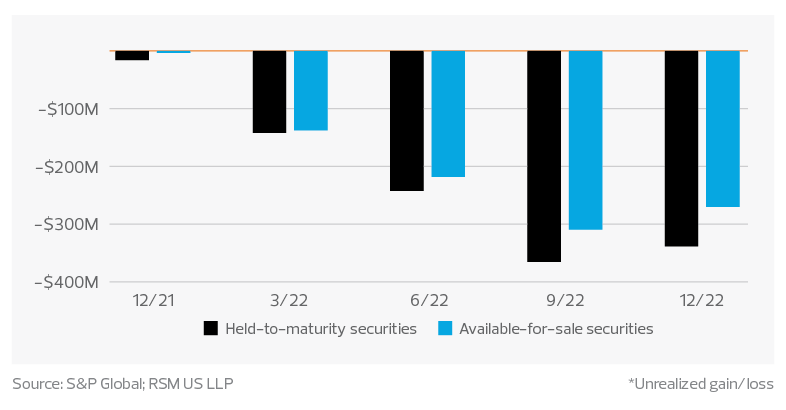

The net unrealized losses for the available-for-sale bond portfolio reflected on bank and bank holding company balance sheets were reported at $326 billion as of Q4 2022. Although this is a slight improvement from Q3 2022, the year-over-year change in unrealized losses checks in at a staggering 949%.

Available-for-sale securities have traditionally been a more popular classification than held-to-maturity securities, due to their more flexible nature. In 2020 and 2021, HTM securities represented on average 30% of the total investment portfolio, leaving 70% represented by AFS securities. In 2022, the disparity between the security types diminished, with HTM representing 45% of the total portfolio and AFS representing 55%.

U.S. bank investment portfolio

Unrealized gains/losses

The fair-value mark-to-market adjustments for HTM securities became more extreme throughout 2022, and although they aren’t recorded in the financial statements, they are disclosed in the footnotes. Similar to unrealized losses on AFS securities, the related HTM unrealized losses have skyrocketed, sitting at $337 billion for insured depository institutions as of Q4 2022. The impact of this fluctuation in unrealized positions on the investment portfolio has continuously built up over the past year, creating an interest risk bubble that, when pressed with the needle of liquidity needs, could burst.

Institutions that truly evaluate scenario interdependencies and maximum stress situations may not be hit as hard by current events. Those that don’t appropriately analyze balance sheet stress and allow significant mismatching of their assets and liabilities increase the risk of a liquidity event that could ultimately lead to insolvency, as evidenced by the recent high-profile failures.

The moment an institution is in a liquidity event—whether due to growth, current obligations or, worse, a bank run—it may consider selling a portion of its investment portfolio to address immediate liquidity needs, which is not ideal from an earnings standpoint and, ultimately, capital perspective.

Deposit outflows

Both consumers and businesses continue to use the cash reserves amassed during the pandemic, resulting in continuous deposit outflows, which further stimulated the need for liquid assets or the ability to borrow. Yet through the most recently reported date for 2022, the decrease in deposits across the industry has been limited, with only a 2% decrease year over year. But the pace of outflow is certain to increase in 2023.

Banks will need to take a closer look at their deposit portfolios to understand when and how significant deposit outflows will drive liquidity decisions. The failures of SVB and Signature have made clear that having liquidity tied up in longer-duration investments, or investments locked in until maturity, can lead to significant financial losses and liquidity constraints. In the current environment, movements from large-deposit customers or customers that operate in a specific industry (such as technology or life sciences) carry risk of outflow compared to an insured consumer depositor. Reliance on deposit customers with lower balances and fully insured accounts is typically a more stable option, considering recent events.

Looking forward

It’s important to remember that the shift in the macroeconomic environment in 2022 as the Fed’s monetary policy went from extreme accommodation to record tightening did not happen without warning. It was scripted. The fall of digital asset prices and related volatility also did not happen overnight or without any publicity. These events dominated headlines. They also drove behaviors of people and businesses in nearly every ecosystem served by the banking community.

The banking industry may very well avoid additional failures. But the mantra of “people don’t forget” rings truer than ever, not just with bank customers but, more importantly, with bank regulators. Sound balance sheet management strategies, rigorous stress-testing under extreme interest rate scenarios, and prudent risk management practices at a few select institutions appear to have not been sufficient to foresee events that cast deep shadows over an otherwise healthy industry.

So, what lessons can financial institutions take away from the past week? What was already shaping up as a difficult exam season will only become more intense. For leadership teams at financial institutions, planning will be key between now and exam day. This will include revisiting asset-liability management programs and policies, assessing liquidity policies and requirements, stress-testing under multiple extreme scenarios, analyzing how high interest rates affect customer constituencies and reviewing strategic plans.

All of these actions will be critical to ensure a passing exam grade and prevent numerous matters from arising that will require attention from the examiners.