The energy crisis affects everything from strategy development to supply chain and ESG plans.

Key takeaways

Manufacturers need to leverage technology to improve efficiency of operations.

Forward-looking strategies around investments and customer and supplier relationships will be key.

Middle market leaders need to understand the impacts of the energy crisis

Economic conditions across the board show commodity prices have eased from their peak but remain elevated, and interest rates and geopolitical tensions are not expected to ease for the remainder of 2022 and first half of 2023. These conditions, coupled with the expectation that demand for both oil and gas will rise for the next several years, indicate that higher energy prices are here to stay.

This energy landscape affects manufacturers across the globe on multiple fronts. From strategy development to protecting margins amid inflation to supply chain and ESG considerations, it will be important for middle market leaders to understand the near-term and long-term impacts of the energy crisis.

How volatility affects industrial ecosystems

Since the start of the Russia-Ukraine war in February 2022, the energy market has been tight mostly due to supply uncertainty. Reasons for significant supply apprehension around both oil and gas include sanctions on Russian exports, supply chain interruptions, increases in U.S. oil and gas production regulation and OPEC+’s decision in early October to cut oil production by 2 million barrels per day. This decision, intended to preempt the decline in demand caused by a looming recession, only furthered global supply shock speculation.

Middle market insight

While middle market manufacturers should prepare for the downturn, the current landscape also presents an opportunity to rethink their strategy and further modernize their business for the long term.

Volatile energy prices affect manufacturers’ entire value chains, from materials costs to energy consumption to power production lines and transportation costs throughout the supply and distribution life cycle. The composition of manufacturing costs has been shifting with the adoption of advanced technologies and the emerging transition toward renewables, but natural gas and petroleum remain a significant component of the total production cost for most industrial companies.

Access to and cost of natural gas and petroleum are also key factors in assessing cost-competitiveness of global economies. Since the expansion of shale gas production in the United States in the early 2000s, the United States and Canada have benefited from lower natural gas prices compared to the rest of the world. But the energy crisis, prompted by the war in Ukraine and sanctions on Russian oil and gas supply, has exacerbated the price gap; at the end of October, natural gas was around six times more expensive in Europe than in North America, drastically affecting companies’ gross margins.

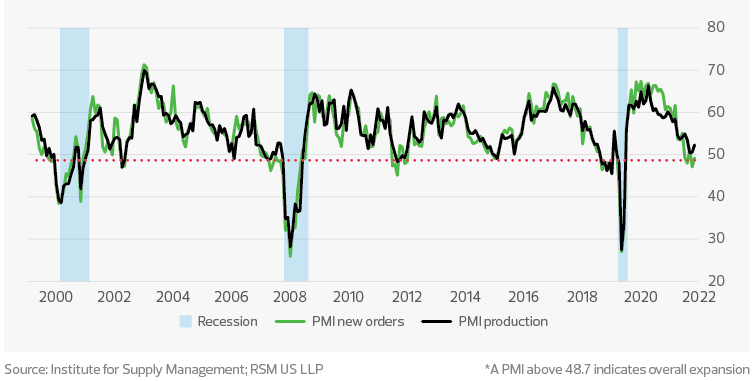

With no prospects of a near-term conflict resolution between Russia and Ukraine and restricted capacity for replacing Russian oil and gas, high energy prices will persist. Along with rising interest rates and a global economic slowdown, the impacts are already showing up in the manufacturing industry. In October, the RSM US Manufacturing Outlook Index showed a slowdown in U.S. manufacturing activity for the sixth consecutive month, and the Institute for Supply Management’s gauge for U.S. factory activity dropped to 50.2, the lowest reading since May 2020. The largest contributor to the drop in the sentiment was a downshift in new orders as consumers start rationing their discretionary spendings on merchandise while businesses start to pause capital investments.

ISM U.S. manufacturing purchasing managers indices on new orders and production—seasonally adjusted

The situation is even more challenging in Europe, where energy-intensive manufacturers have been forced to curtail or temporarily suspend production, facing skyrocketing input costs on one side and demand destruction on the other. The petrochemical and fertilizer sectors, where gas may account for up to 80% of production costs, are among those most affected. Certain chemical productions in Europe now have more than half of capacity suspended or running at reduced rates, according to Independent Commodity Intelligence Services.

Seeking out opportunity

While middle market manufacturers should prepare for the downturn, the current landscape also presents an opportunity to rethink their strategy and further modernize their business for the long term. Manufacturers will need to continue to strengthen the resilience of supply chains, evaluate product mixes and cost structures, and leverage technology to improve efficiency and productivity of operations. In addition, organizations will need to double down on their efforts to attract and retain key talent, as the current tight labor market is here to stay even as the economy slows.

Whether the gap in energy prices will trigger a structural shift in the global manufacturing footprint depends on how long prices remain elevated and the specific sector in question. Global supply chains have been developing for years based on a complex array of comparative advantages of global economies, including but not limited to proximity to and cost of energy.

The United States compared to other countries has relatively stable natural gas prices and significant government support for certain sectors, potentially making it a more attractive location for global manufacturers. Sectors representing national security interest and backed up by developing national industrial policy in particular will see future investment.

Semiconductors, critical minerals and green energy equipment are among such sectors. Just in the past few months legislators signed into law multiple bills aimed at supporting domestic manufacturing in these sectors. The CHIPS and Science Act provides $52 billion in subsidies to support development and manufacturing chips in the United States; amendments to the Export Administration Regulations expand export controls on advanced AI chips and semiconductor manufacturing equipment destined for China; and the Inflation Reduction Act earmarks up to $369 billion of new funding for the clean energy economy.

These funds will increase renewable use over the next decade through investments in electric vehicle charging, public transit, electrical grid improvements, and tax credits and incentives for renewable and efficiency projects. Such investments provide significant opportunities for domestic middle market manufacturers.

Business leaders will need to understand the ins and outs of legislation and how their organizations can benefit. A forward-looking strategy around investments and customer and supplier relationships will be imperative for companies to position themselves to weather the current economic challenges while taking advantage of recent policy developments.

The impact on the energy transition

Some believe that the energy shortage will accelerate the transition to net-zero emissions, while others hold the view that elevated prices may drive the use of more fossil fuels. We believe meeting the current needs of society while staying on the path to a net-zero future will require a delicate balance. History tells us to expect volatility in times of significant change, and the energy transition is no different. Volatility does not mean we abandon ship; it just requires focus on the pace of the transition.

Middle Market Insight

U.S. middle market businesses should consider ways to reduce exposure to future market shocks such as hedging contracts, diversifying energy sources, and investing in technology to drive efficiencies across the organization.

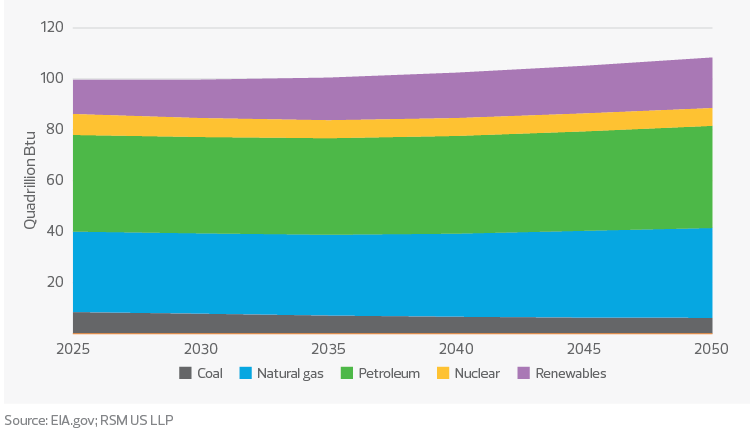

Looking to the future, forecasts from the U.S. Energy Information Administration show 75% of the U.S. energy mix will consist of fossil fuels through 2050, marking a 4% reduction from 2021 levels. Coal and nuclear power will become a smaller share of future energy consumption, and renewables will be the fastest-growing energy sector at 18%.

Renewables are not forecast to replace highly cash-generative fossil fuels based on current policies, though incentives announced this year will have some impact. Improvements in the energy transition outlook will only come from government incentives and disincentives. Government intervention reduced U.S. coal consumption, for instance, by 50% over a 15-year period.

Total U.S. energy consumption forecast, 2025-50

In our view, the “energy transition” is truly more of an “energy addition.” In other words, the mix of fuel sources is set to shift and progressively include more renewables over the next 25 years, alongside fossil fuels. To move the net-zero needle, middle market companies must invest in the decarbonization of base assets as well as in renewable energy sources.

Pricing for carbon-based energy will remain exposed to global market volatilities but will be less volatile in the United States than in other countries. U.S. middle market businesses should consider ways to reduce exposure to future market shocks such as hedging contracts, diversifying energy sources, and investing in technology to drive efficiencies across the organization.

This article was originally published on RSM US.