Middle market consumer goods companies face shifts in strategy from growth to profitability.

Key takeaways

Inventory planning will surpass supply chain disruption concerns.

A long-term decoupling from China will require companies to identify new supply chain strategies.

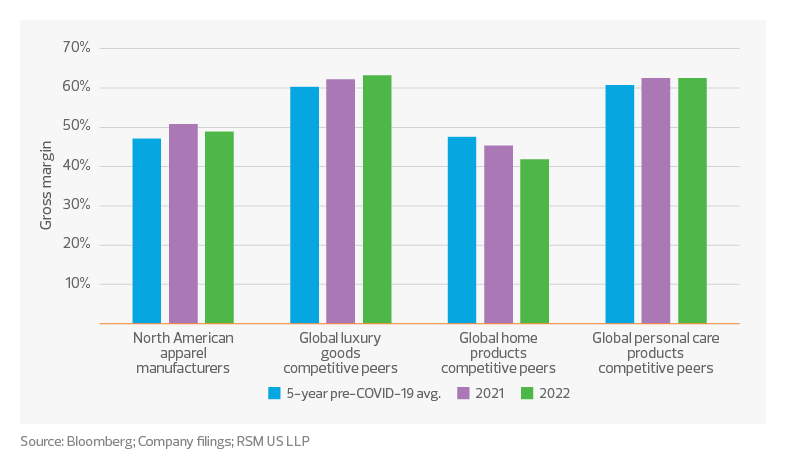

Since early in the pandemic, many consumer goods companies benefited from elevated consumer demand for products. As a result, some companies successfully passed along input cost increases (i.e., freight, labor and raw materials) to the consumer resulting in stronger margins for businesses across consumer goods categories, particularly in 2021.

In 2023, businesses are reexamining operational strategies and shifting focus from a grow-at-all-costs model to one that maximizes profitability as many have seen their margins contract in 2021 and 2022. This shift is especially prevalent as consumers have become more strategic about spending and look for value in their purchases. The change is driven by many factors, including deflationary price pressure, production costs, a tight labor market that keeps labor costs high and increasing borrowing costs.

As savings levels have declined, especially for those in the lowest quartile of earners, and consumer debt continues to rise, companies can no longer anticipate broad acceptance of ongoing price increases. A pessimistic view of the economic environment is most evident in consumer surveys, such as the University of Michigan’s survey of consumer sentiment, which experienced a sharp decline in February and March.

Consumer goods gross margin

As consumer demand decreases, companies with challenging inventory positions will be pressured to reduce their excess inventory through additional promotional events, which will, in turn, further compress margins. The result will likely disproportionally affect companies that focus on consumers in the bottom two quartiles of earners. They are most exposed to continued inflationary pressures.

Production costs and overhead expenses are not decreasing quickly enough to offset waning sales revenue. This pricing pressure will directly affect margin and bottom-line profitability until price stability is established in the market.

The longer lead time for middle market companies to improve supply chains and reduce labor and production costs will cause them to focus on maintaining profitability. Companies will look for solutions to control costs, automate processes to reduce the need for workers, remove low-margin products, and will get rid of underperforming product lines.

TAX TREND: Workforce

Developing a compensation philosophy centered on total rewards instead of just cash salary may help consumer goods companies balance costs with offerings that match workers’ preferences. Retirement programs, equity compensation, education opportunities or assistance and subsidized transportation benefits are just a few of many common offerings with tax implications.

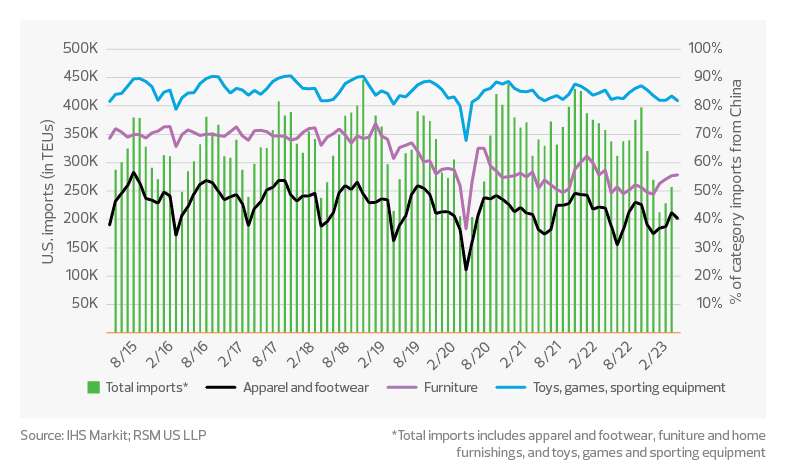

Decoupling from China

Throughout the pandemic, supply chain challenges were one of the core areas of stress for business executives. Now that the supply chain is operating close to pre-COVID-19 levels and there is a possibility of a pending recession, it is time for companies to evaluate operational structures and determine if changes should be made. Supply chains should be a primary area for review this year.

For many consumer products companies, supply chains depend on third-party manufacturing in Asia, most notably China. As the chart shows, imported products, including consumer goods (i.e., apparel and footwear, furniture, toys, games and sporting equipment), are primarily manufactured in China. In fact, outside of the initial pandemic shock in March 2020, imports of consumer goods from China, measured by twenty-foot equipment units (TEUs), have maintained the same trendline since 2015.

Consumer products imports

As part of the companies’ supply chain review, manufacturing hubs should be a primary discussion point. Many manufacturers have already begun constructing their own factories in Mexico and Singapore, anticipating some production shifts in the coming years. As businesses rethink inventory strategies and consider smaller production batches and more just-in-time inventory—shifting away from manufacturing large quantities, and the ship-and-store practices of today—maintaining production hubs closer to distribution centers will be critical.

This transition marks a sizeable shift away from how businesses manufactured and acquired products over the last 30 to 40 years. However, the supply chain scars of the pandemic and ongoing inventory challenges continue to weigh on middle market executives in the consumer space. The ability to diversify manufacturing from a single source, or country, will help executives better manage future supply chain shocks.

Ongoing supply chain challenges from the pandemic, as well as increasing costs, should drive middle market executives to reevaluate manufacturing relationships and consider near shoring and other alternatives.

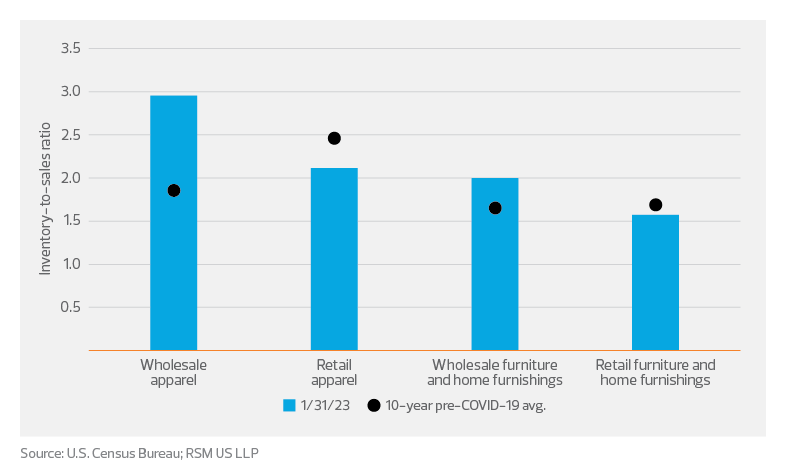

Inventory challenges remain, especially for wholesalers

Since the pullback in goods spending by consumers many consumer products companies have been on the defensive regarding inventory management strategies. As referenced by many public filers since the summer of 2022, as consumer spending on goods fell, inventory levels rose; the resulting impact on inventory and margin became a primary focus of businesses for the remainder of 2022 and continues into 2023.

Inventory-to-sales ratio

While many companies used aggressive inventory strategies over the winter holidays, including product discounts to right-size inventory levels, challenges remain. As shown above, retailers of apparel and furniture and home furnishings largely succeeded in inventory management strategies, with inventory-to-sales ratios below the 10-year pre-COVID-19 average. For wholesalers, including many middle market companies, inventory-to-sales ratios remain too high. As of January 2023, inventory to sales ratios for apparel wholesalers were 59% higher than the 10-year pre-COVID-19 average, while those of furniture and home furnishings wholesalers were 21% higher.

TAX TREND: Inventory

Elevated inventory levels and decreased demand for goods amount to an opportunity for consumer goods companies to review their inventory accounting methods—which affect net earnings and the associated tax obligations. Companies should confirm their methods align with how their inventory is purchased, how they incur direct and indirect costs, and how quickly inventory is turning over.

Given retailers' aggressive inventory management, wholesalers will be unlikely to offload excess inventory to retail partners. Businesses in this space will need to find new distribution channels, including selling direct-to-consumer and offering deeper discounts, resulting in extended margin compression, forcing companies to reduce operating and administrative costs. Further, even as consumers within the top income quintiles continue to spend, businesses will unlikely be able to rely on this consumer base to offload all excess inventory.

TAX TREND: Supply chain

As supply chains evolve, the transfer pricing implications can be outsized, leading to tax planning opportunities and risk management needs. The increasing permanence of supply chain challenges may necessitate companies updating their transfer pricing more frequently than in previous business cycles. A company that understands the transfer pricing life cycle can tackle its numerous complexities—including data management, analyses, documentation and implementation—to ensure compliance and tax efficiency.

A key lesson for businesses will be to make targeted investments in technology to manage inventory better and forecast future consumer consumption to avoid the pitfalls of today.

Middle market companies, most notably wholesalers, continue to sit on excess inventory levels as consumers continue their broad pullback in spending. Investments in the proper inventory management and sales forecasting tools will be critical to limit future exposure and improve profitability.

Originally published by RSM US.