New manufacturing plant construction in North America surges to $190 billion, driven by investments in energy transition and EV supply chains.

Key takeaways

Global transition to electric vehicles creates economic opportunities across the value chain, with governments prioritizing EV supply chains.

Government policies and substantial investments fuel the EV sector, presenting growth opportunities for middle market businesses and provinces like Ontario.

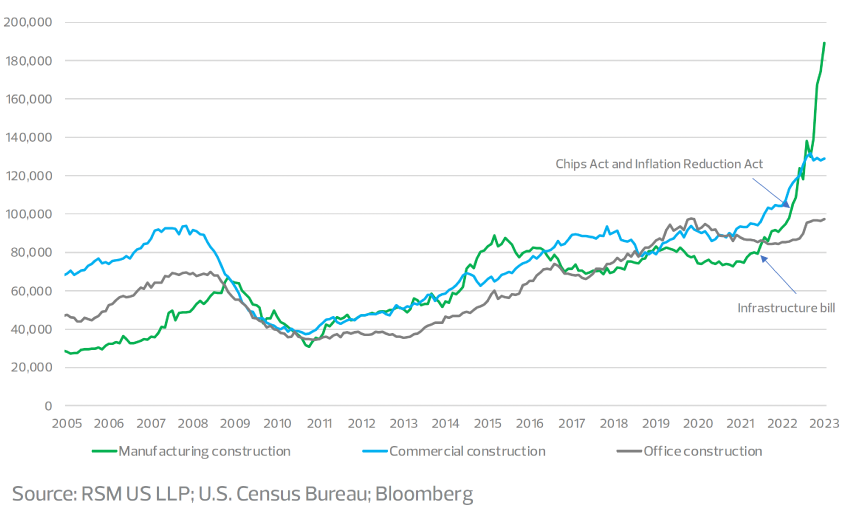

Despite recent slowdowns in manufacturing and construction, construction spending on new manufacturing plants has surged, doubling over the past year to reach US$190 billion by April 2023, according to Bloomberg data.

This upward trend reflects a renaissance in the manufacturing landscape in North America as new factories sprout across the country and the initial success of the onshoring objectives of U.S. industrial policies. Significant growth is coming from the rising investments in energy transition technologies, semiconductor manufacturing and the build-out of electric vehicle supply chains.

Real construction spending, inflation adjusted, US $ million

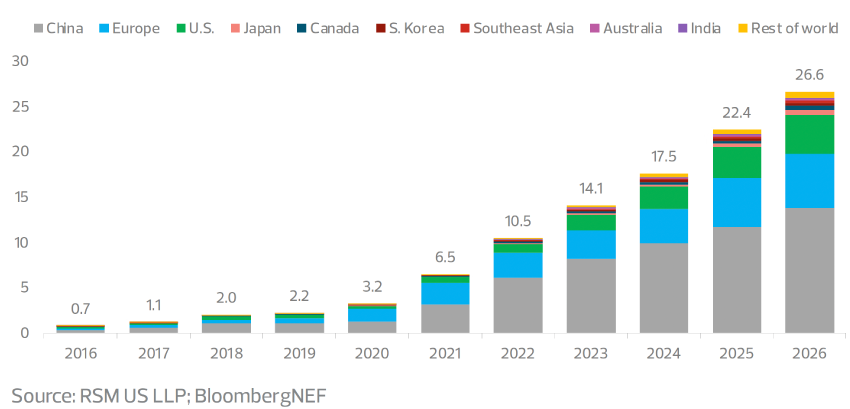

The automotive sector's historic transition involves electrification in all segments of transportation, from passenger vehicles to public transportation and commercial fleets. EV sales worldwide are set to surge, rising from 10.5 million in 2022 to an anticipated 27 million by 2026, according to BloombergNEF.

Worldwide passenger EV sales

MILLION UNITS

This transition is unlocking vast economic opportunities across the entire value chain. In response to these prospects, as well as lessons learned from COVID-19 supply disruptions, many countries are putting EV supply chains at the forefront of their industrial policies. This has initiated a race to attract investments and expedite the build-out of the EV supply, which involves securing critical minerals; onshoring EV production, battery development and production; and advancing charging infrastructure. The momentum is set to accelerate across North America as the mass adoption of EVs progresses and additional public funding becomes available through the Inflation Reduction Act (IRA) and other similar incentives.

Policy support

To fuel investments from the private sector, the Canadian and American governments have introduced a number of policy tools, including tax credits and incentives at the consumer and manufacturer levels, as well as subsidies, grants and other government funding and loan programs.

Canada

Canada is actively shaping its economic landscape to cater to the evolving EV industry. Governments at both the federal and provincial levels offer billions of dollars in incentives and support programs to attract investments from key automotive and battery manufacturers. These initiatives include investment tax credits for capital spending, subsidies and grants through various innovation funds and programs, government financing and targeted support negotiated directly with original equipment manufacturers (OEMs), battery manufacturers and suppliers. The 2023 federal budget amplified these measures, introducing a 30 per cent refundable investment tax credit for capital investments in eligible property used in clean technology manufacturing and critical mineral extraction and processing.

Provinces (Ontario and Quebec, in particular) are also fully committed to building out the EV supply chains, luring OEMs and automotive suppliers with lower operating costs, a secure supply of minerals and materials, a developed industrial supply chain, province-funded infrastructure upgrades, effective environmental legislation, easy access to U.S. markets and a highly skilled workforce.

Canada's critical minerals mining and processing has also emerged as a priority sector, benefiting from the full spectrum of mineral deposits needed for energy transition technologies, proximity to the U.S. market and the ability to meet sourcing requirements under the IRA. In the 2022 global lithium-ion battery supply chain ranking by BloombergNEF, Canada rose from fifth to second place, surpassing the United States and closely trailing China: a testament to Canada's rich mineral resources, a well-developed mining sector and industrial infrastructure and strong positioning on the environmental, sustainability and governance front.

United States

The IRA is arguably the most significant development for the North American auto industry in recent history, setting aside over US$370 billion to combat climate change, with a substantial portion earmarked for EV manufacturing and infrastructure. The IRA strategically ties consumer EV incentives to North American sourcing, incentivizing manufacturers to localize EV and battery production in North America and diversify critical minerals supply chains within U.S.-friendly countries.

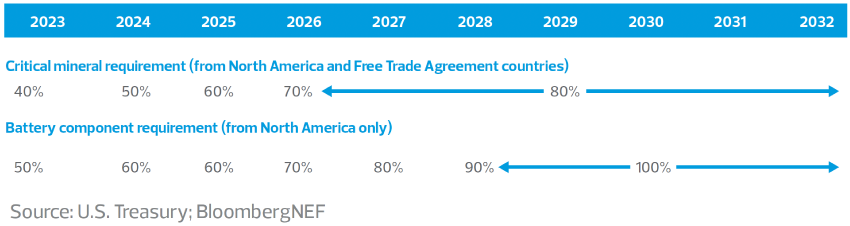

In March, the U.S. Treasury Department released guidance on the eligibility for the US$7,500 clean vehicle credit, for which consumers must meet income threshold criteria. From the automakers' perspective, to be partially or fully eligible for the credit, vehicles must undergo final assembly in North America and meet stringent sourcing requirements for critical mineral and battery components.

Sourcing requirements for US$7,500 EV credits

Heavy tax savings for both consumers and automakers will undoubtedly drive demand in the EV market. Under the tax code section 45X credit — which incentivizes manufacturers' domestic expansion efforts — eligible manufacturers can receive up to 10 per cent of project cost reimbursements to produce renewable energy components like EV batteries domestically.

Apart from offering credit and incentives, the U.S. government is pouring billions of dollars in low-cost government loans into funding manufacturers' expensive EV projects. Just last month, the U.S. Energy Department announced an unprecedented US$9.2 billion loan to BlueOval SK, a joint venture between the Ford Motor Company and South Korean battery producer SK On to fund the construction of three battery manufacturing facilities in Kentucky and Tennessee. That follows a US$2.5 billion loan granted to another joint venture project to finance the construction of new lithium-ion battery manufacturing facilities in Ohio, Tennessee and Michigan.

Investments on the rise

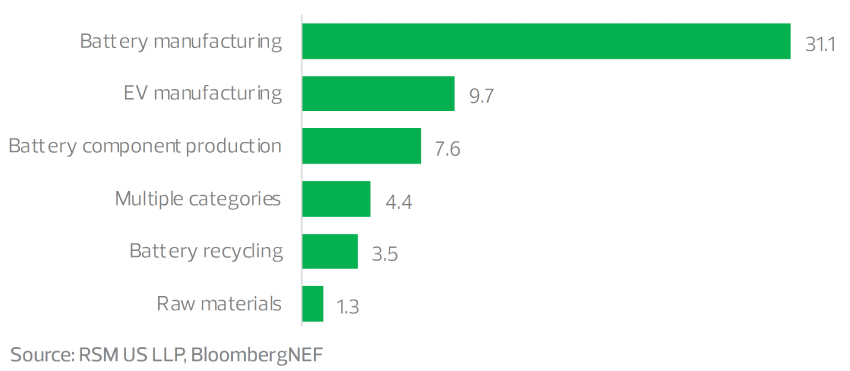

Anticipated EV growth and unprecedented government support have already yielded historic investments into the sector. At the end of 2022, Reuters estimated that by 2030, top automakers worldwide will have pumped US$1.2 trillion into the EV sector, which includes batteries and raw material sourcing and processing. And since the IRA passed in August 2022, BloombergNEF estimates new investments of US$57.6 billion in North American EV and battery production as of the end of March 2023, a figure that is continually increasing.

North America EV and battery investments announced post-IRA

US$5.76 BILLION INVESTMENTS AS OF MARCH END

In Canada, Ontario is emerging as a powerhouse for the EV supply chain; the province aims to grow its automotive sector to produce at least 400,000 hybrid and electric vehicles by 2030. According to the government of Ontario, from October 2020 to June 2023, the province attracted a staggering US$25 billion from car manufacturers and battery producers. This includes announced investments by Ford (US$1.8 billion), Umicore (US$1.5 billion), General Motors (US$3 billion), Stellantis (US$3.9 billion) and Volkswagen (US$7 billion).

Opportunities for growth

To capitalize on this transition, companies should assess current resource capacity to meet the requirements of the respective tax credits. Companies will need to assess their existing supply chain infrastructure to ensure adequate capacity and availability of resources and assess timelines to ensure component requirements are met in accordance with the transition pace. Collecting and assessing the data needed to meet the incentives requirements could make for a large hurdle in capitalizing on these opportunities.

Manufacturers that want to take advantage of the incentives and be a first-choice provider for EV consumers eager for tax savings should work with a third party to obtain and analyze data at a level precise enough to capture relevant criteria. That might include data on construction contract labor and battery composition data needed to ensure manufacturing facilities and EVs manufactured therein meet jurisdictional tax credit requirements.

The EV investment frenzy has significant implications for the broader economy and middle market businesses, including immense growth opportunities. The associated manufacturing growth will lead to broad economic benefits, fostering job creation and a circular economy with a widespread positive socioeconomic impact in communities. It will create spillover demand for new products and services across sectors, while also enhancing research and innovation. For middle market businesses, this translates into new market opportunities, particularly in the technology, manufacturing and energy sectors but also in the logistics and service sectors. Given these prospects, it's no surprise that nations are rushing to secure their position in the global EV supply chain.

RSM contributors

More from this edition of The Real Economy, Canada

Want more economic insights?

Subscribe to our quarterly newsletter