There are hard lessons to be learned from globalization and the response of policymakers to economic shocks and health crises. As much as those responses are well-intentioned, distortions in supply and demand could now threaten the economic recovery and have produced asset price bubbles that will need to be addressed as these crises unwind.

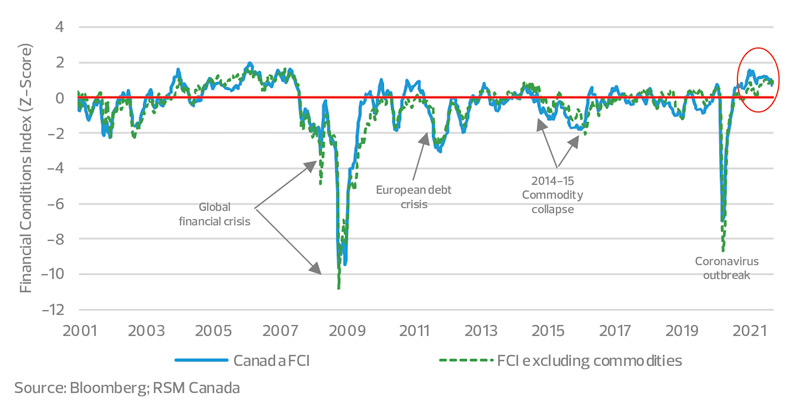

Moreover, the combination of the property sector crisis in China, the showdown over raising the debt ceiling in the United States, and disruptions to the global supply chain are all contributing to volatility in global financial conditions and creating the environment for a slower pace of growth in Canada and around the world.

Unintended consequence No. 1

The first misstep was the lack of a consistent public health approach. This lack of disciplined policy underscored by the quick reopening of local economies and the U.S. withdrawing from the World Health Organization has given the coronavirus the time and means to mutate and spread.

Now the recovery of the Canadian and U.S. economies is running into headwinds, first and foremost because the pandemic never really ended in all parts of the world. In addition, as we now exist in an interdependent world, with production in one place and consumption in another, the resurgence of the coronavirus outside the developed world is once more creating a supply crisis throughout developed economies.

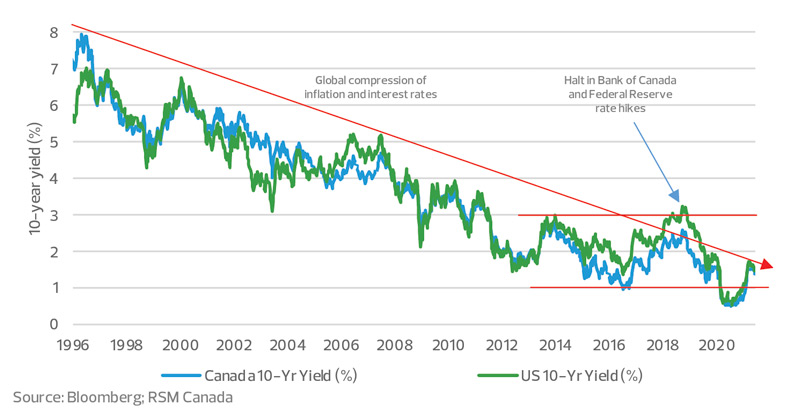

In its latest assessment, the Bank of Canada finds Canada's recovery to be choppy, with an abundance of uncertainty due to the fourth wave of COVID-19 infections and deaths. Though jobs have rebounded, the bank considers the recovery of the labour market to be uneven. (Statistics Canada attributes much of the latest increase in service-sector employment to the easing of public health restrictions in many jurisdictions.)

Growth in the second quarter was weaker than expected, the bank said, as supply chain bottlenecks constrained manufacturing and exports. As such, consumption, business investment and government spending continued to fuel the recovery.

Economists polled by Bloomberg have taken notice of the bottlenecks, halving their forecast for Canada's third quarter 2021 growth from a giddy annualized rate of 9 per cent down to 4.5 per cent. We suspect that with consumers unwilling or unable to purchase higher-priced goods, the negative impact on GDP will continue as long as the supply constraints exist.

And because that will affect the profits of corporations, the stock market has become the canary in the coal mine. The U.S. S&P 500 equity market index lost nearly 4.8 per cent of its value during September, and the Toronto stock exchange lost 2.5 per cent.