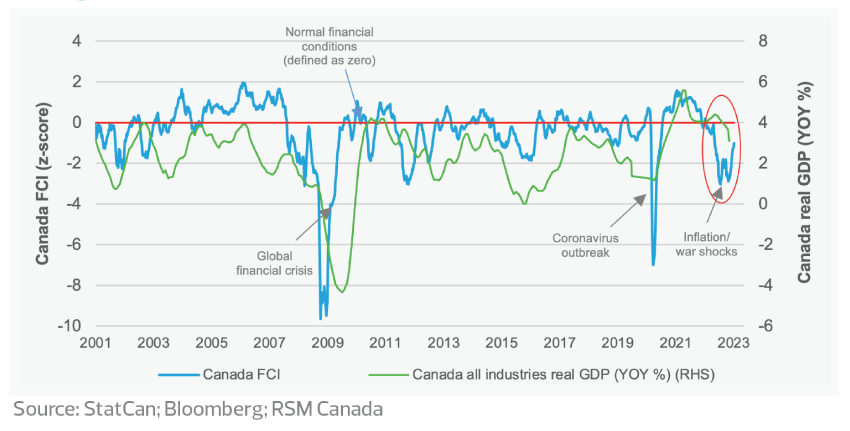

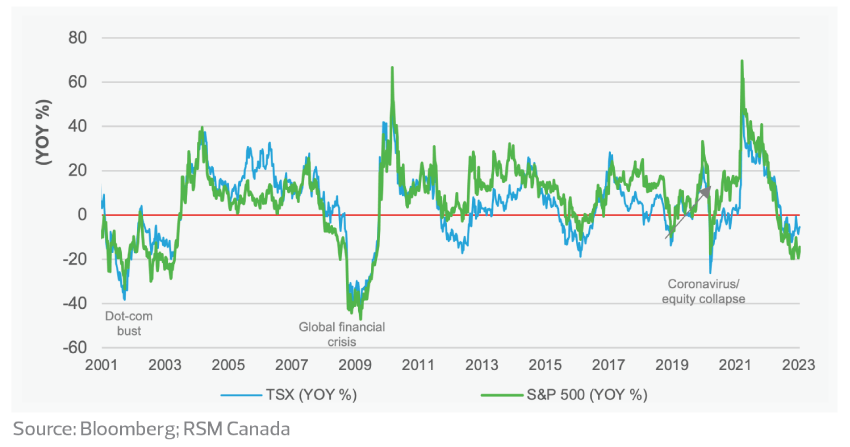

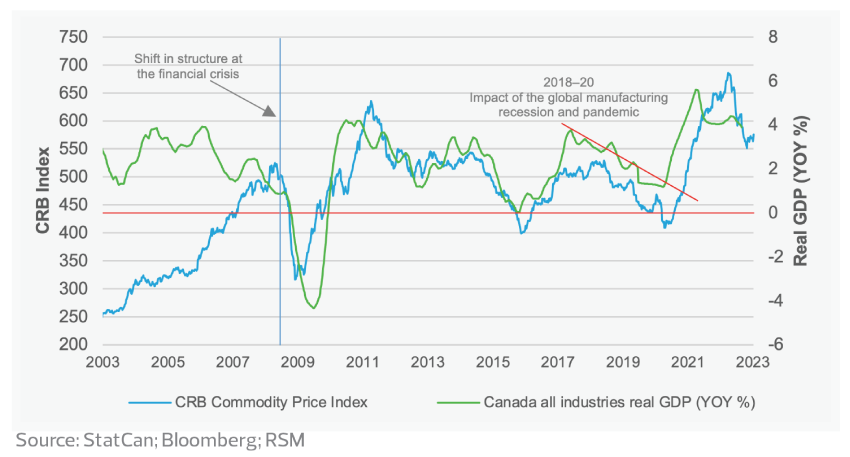

Tightening financial conditions are hurting the Canadian economy to the point where the rising risk of a recession and a housing contraction much larger than anticipated cannot be discounted.

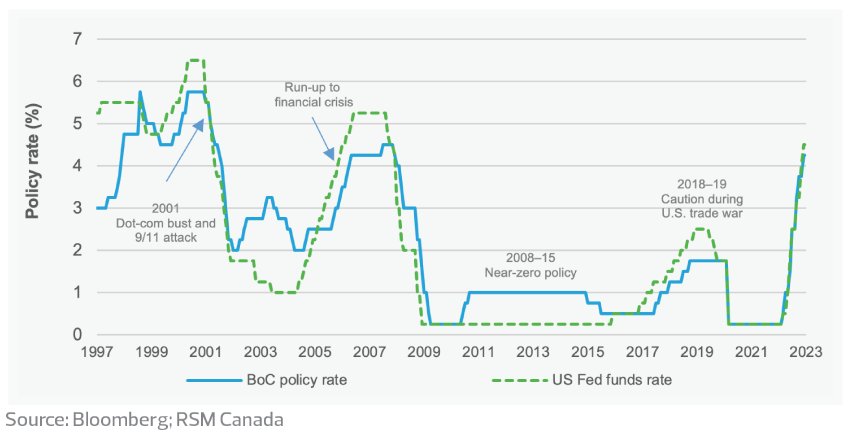

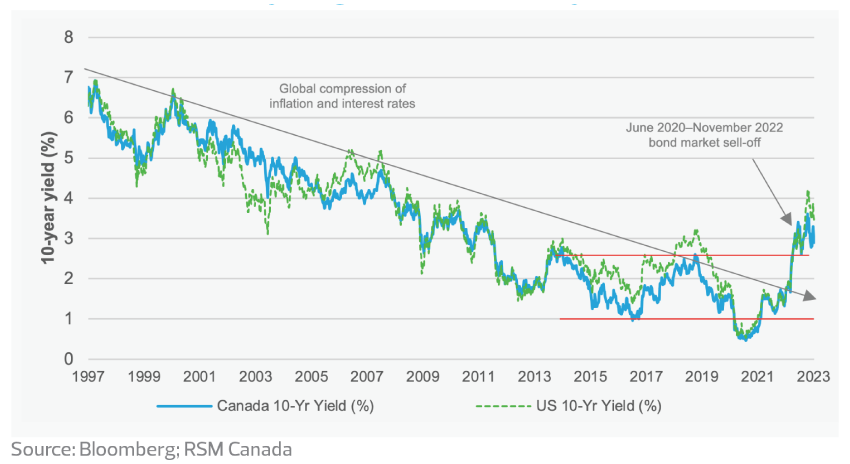

Although we expect the Bank of Canada to raise its policy rate to a peak of 4.75 per cent by the middle of the year, after that the central bank will most likely use a lift-and-hold policy that will keep financial conditions tight.