Oil and gas prices have played a big role in Canada's recent surge in inflation. While the headline inflation number stands at 5.7 per cent, inflation excluding energy is noticeably lower at 4.4 per cent and excluding only gasoline is at 4.7 per cent.

The high oil prices have come about in large part because of geopolitical conditions, namely Russia's war against Ukraine, which add to global economic uncertainty. These factors have had a profound impact on Canada's economy, whether it's lower-income households feeling the pinch, businesses contending with shrinking profit margins, or slowing economic growth.

But these factors aren't the only reason for higher prices at the pump. In 2019, the federal government adopted a carbon tax, which will accelerate year by year until 2030. Today it stands at $50 per ton, on its way to $170 per ton in 2030.

It's designed to be a market solution to a global problem, and has the potential to help Canadian consumers and businesses transition from the boom-and-bust of fluctuating oil and gas prices toward a more sustainable economy based on renewable energy.

High oil prices in Canada

The origins of the current energy shock go back before the war in Ukraine. Low production of oil in 2020 contributed to shortages of supplies last year just as the economy reopened and demand surged. Then Russia's invasion of Ukraine caused the largest supply shock to the global oil markets since the 1970s, sending oil prices skyrocketing and with possible further increases ahead.

If a ban on Russian oil occurs in Western Europe -

a distinct possibility - oil prices are bound to reach

new heights.

But the federal carbon tax remains in the background.

The tax increased by 25 per cent on April 1 from $40 to $50 per ton, which works out to about 11 cents per litre at the pump. It is scheduled to increase annually by $15 per year starting next year until it reaches the $170 per ton level in 2030. That rate translates to 38 cents per litre at the pump. And that doesn't include the taxes adopted by some provinces, which have either their own carbon tax or other cap-and-trade programs similar to those of the federal government.

In the end, consumers will pay more per litre of gas, regardless of what happens with the global oil supply.

Impact on the economy

It all shows up in higher prices for a variety of goods and services. Not only do consumers pay more at the pump, but businesses also pay more to transport their goods. This, in turn, translates into higher food costs. At the same time, the price of natural gas, which is a major source of home heating fuel in Canada, also soared this past winter.

This increase hurts all consumers, especially those on fixed incomes and those in lower-income brackets because they spend a larger percentage of their income on fuel and food.

When households have to spend a larger portion of their income on fuel and food, they must cut discretionary spending, which lowers consumer demand and can thwart economic growth.

Consumers' responses

This is where the carbon tax comes in. It is designed to make carbon emissions expensive, which encourages consumers to use less fossil fuel and switch to non-carbon-intensive alternatives. As economists like to say, the solution for high prices is high prices.

To an extent, the current supply shock is helping to make this happen, and consumers are making the switch in the face of high prices. For example, the demand for electric vehicles is outstripping supply and is rising faster than demand for gas vehicles, as the math increasingly favours EV ownership.

But for the most part, oil consumption has not decreased. Instead of turning toward renewables, many consumers continue to pay more for gasoline and for natural gas because they lack readily accessible alternatives.

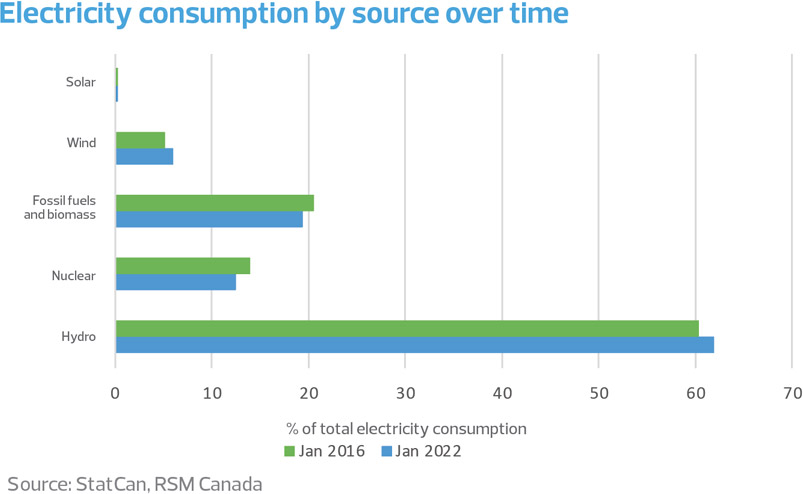

In fact, the share of renewables in Canada's total electricity production and consumption increased only marginally between 2016 and 2022, even though the cost of renewables fell and fossil fuels increased.