As Russia's invasion of Ukraine continues to take a mounting human and economic toll, it also has the potential to threaten the food supply for millions of people who depend on agricultural commodities from those two countries.

Russian and Ukrainian grain exports have been severely curtailed, leaving many countries scrambling to find other sources.

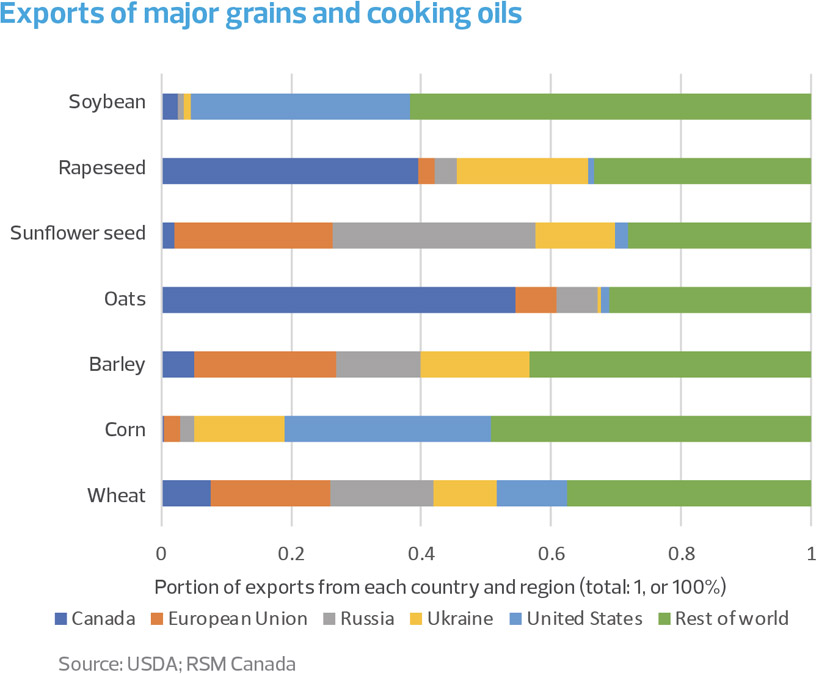

And that's no small task. Together, the two countries account for a quarter of global exports of wheat, a fifth of corn, just under 10 per cent of oats and 30 per cent of barley. They are also among the top exporters of cooking oils.

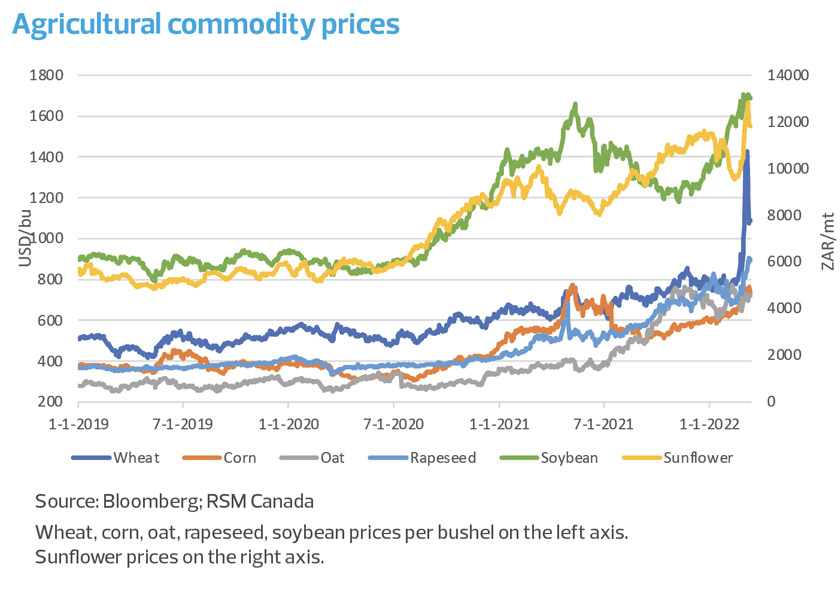

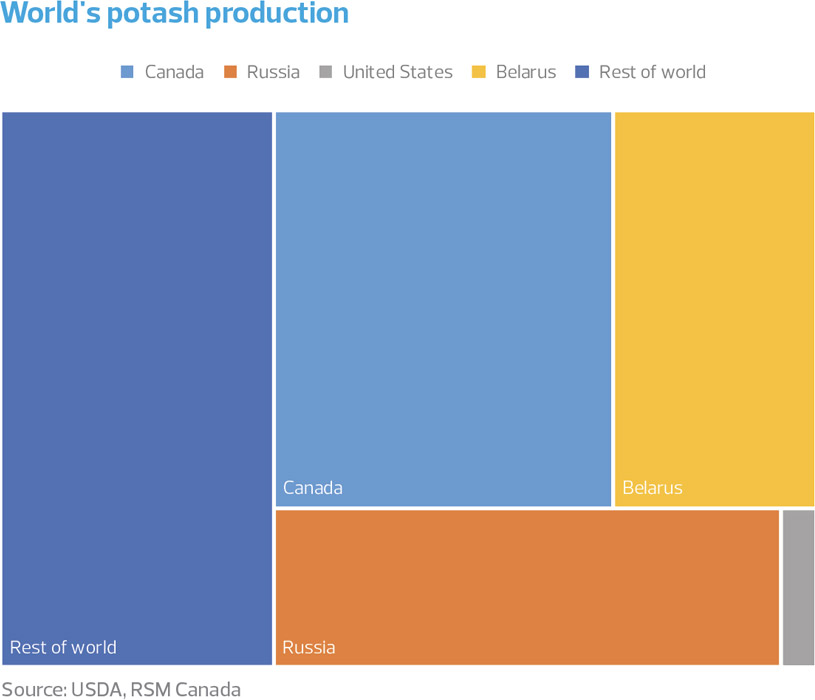

The longer the war drags on and exports are interrupted, the more the food security of nations dependent on those products becomes threatened. Already, prices of everything from grains to fertilizer to livestock have surged. Food shortages have the potential to cause social unrest across the Middle East and North African countries.

There is a silver lining, though: Canada, as well as the United States, produces many of the same agricultural products that are suddenly in short supply, and could be in a position to replace some of the lost exports on the global market.

The breadbasket of Europe

Getting there, though, will be difficult. Ukraine plays a crucial role in food production in Europe as well as globally. Nicknamed the breadbasket of Europe, it has been a leading exporter of grains and agricultural commodities.

But that status is now threatened. As farmers face increasing obstacles to maintaining their production, they also face disruptions to the supply chain like port closures and damaged transportation infrastructure. The Russian army is destroying fields and farm equipment in Ukraine to provoke a global food crisis. That will only make it more difficult to keep the exports flowing not only this year but in 2023.

Russia, too, is an important exporter of agricultural commodities, but sweeping economic sanctions threaten to cut off those supplies. And it's not just the sanctions that are putting pressure on Russian exports. Russia itself, which faces surging food prices for its residents, is temporarily banning wheat exports to other countries in the region to keep domestic food prices low.