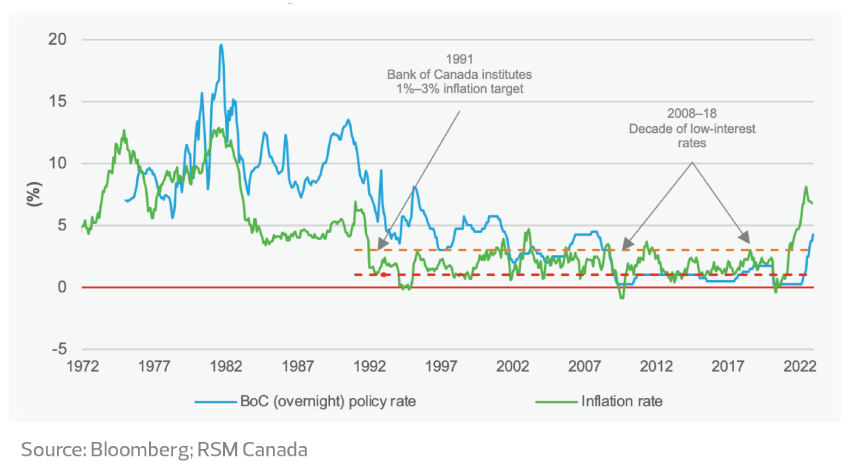

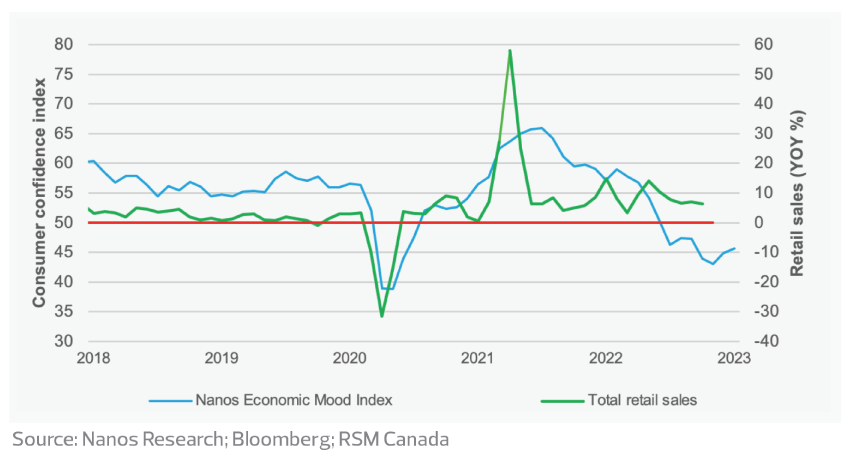

Economies respond to financial conditions which are determined by market expectations for monetary policy. With inflation still elevated and demand surging in Canada, we expect the Bank of Canada to continue raising interest rates to cool an overheating economy.

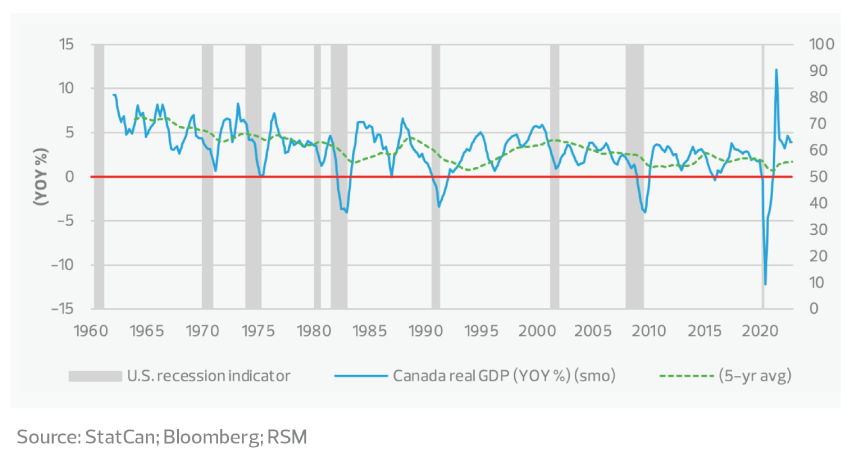

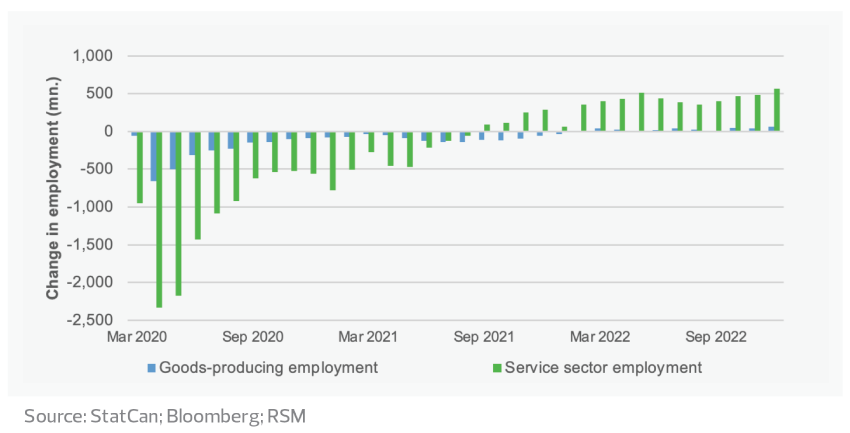

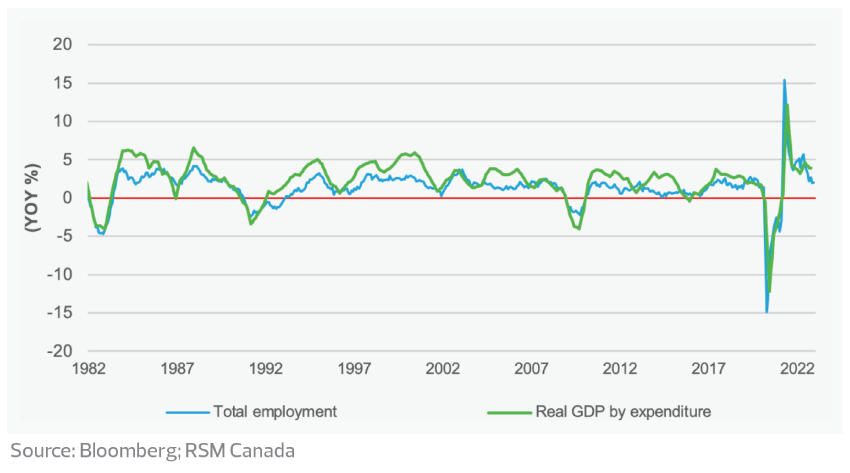

While the Canadian economy may avoid a recession next year, we expect growth will slow below 1 per cent over the next few quarters, well below its capacity.

The economy needs to slow down to rebalance demand and supply, and to relieve price pressures. After that, growth will pick up and the economy will grow solidly.

What else awaits? We offer our outlook for the coming year.