At its June policy meeting, the Bank of Canada reiterated its intention to maintain an accommodative monetary policy as uncertainty over the pandemic abates and the economy recovers.

As it has since the pandemic, the bank is keeping its policy rate at near zero to maintain liquidity in the commercial markets while continuing its purchases of long-term securities to pressure interest rates lower and facilitate long-term investment.

As it said in its June policy statement, the bank noted the increased prospects for growth, but also cited the need for a consistent policy in the face of uneven growth among the global economies and the threat of a resurgent virus.

The bank also noted the threat of further shutdowns and an employment rate that remains well below its pre-pandemic level, “with low-wage workers, youth and women continuing to bear the brunt of job losses.”

MIDDLE MARKET INSIGHT: We expect the Bank of Canada will keep its policy rate at the zero bound over the summer, if not into next year.

Because of the slack remaining in the economy, we expect the bank will keep its policy rate at the zero bound over the summer, if not into next year. We also think the bank will wait until the fall before considering altering its asset purchases and will need more time to assess developments in the labour market.

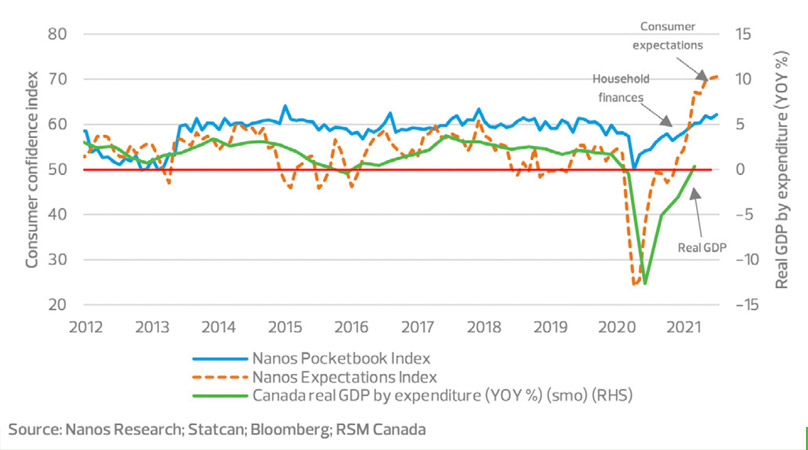

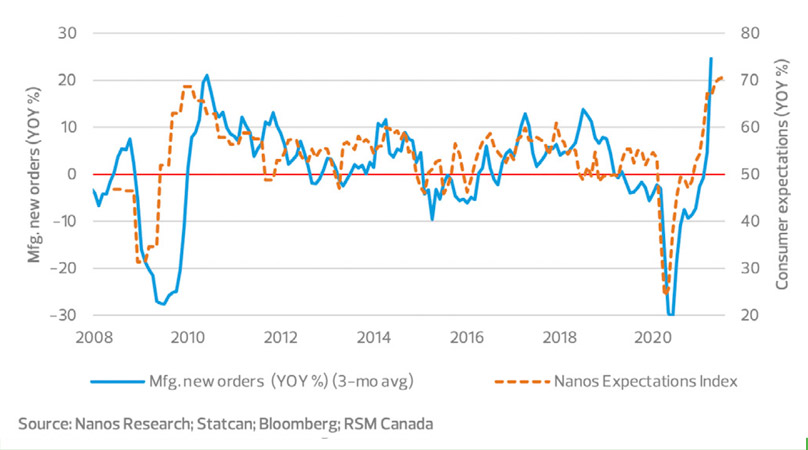

Nevertheless, the bank also noted rising confidence and resilient demand. Vaccinations continue to make it easier for Canadians to live normally again. Though the second-quarter economic data is uneven, the prospect of a safer environment has lifted consumer confidence and retail spending.

Nearly two-thirds of Canadians have received one dose of a vaccine, with roughly 43 per cent now fully vaccinated. The drop in newly reported cases to about 500 per day as of the second week of July and deaths to 10 per day is attributed to the efficacy of the vaccines.

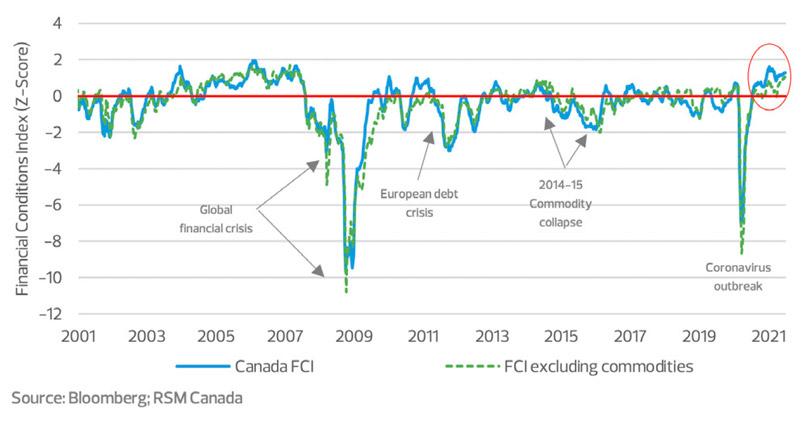

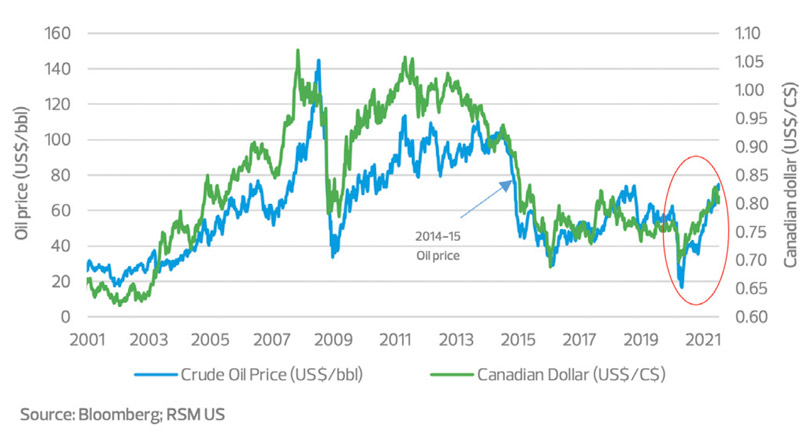

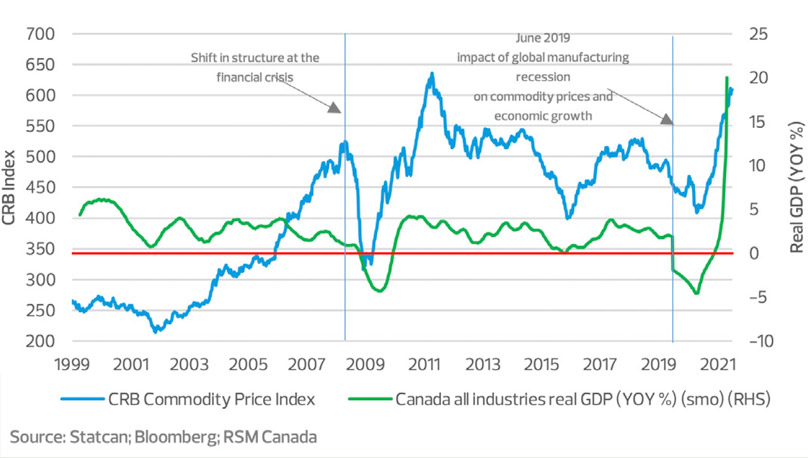

The progress in the economy comes amid the stability in the financial markets created by the Bank of Canada’s policies. The RSM Canada Financial Conditions Index continues to indicate reduced levels of risk being priced into the commodity, equity, bond and money markets. That reduction in risk sets the stage for long-term investments in the new economy, leading to increased productivity and competitiveness, and higher rates of employment and spending.

Because central banks have determined that monetary policy is transmitted to the economy through financial conditions, we created the RSM Canada Financial Conditions Index to measure the degree of risk or accommodation priced into financial assets. A value of zero indicates a normal degree of risk. Values below zero indicate abnormal levels of risk that would tend to limit investment. Values above zero indicate an accommodative environment conducive for investment.

Our composite index has been at least 1.0 standard deviation above neutral over the past 13 weeks and now stands at more than 1.2 standard deviations. This is particularly significant because much of the recent improvement has been outside the commodity markets. (Financial conditions excluding the commodity markets have moved from neutral to 1.0 standard deviation above neutral over that same period.)

Our proprietary RSM Canada Financial Conditions Index shows that the stage is set for an economic recovery in the months ahead.

That implies that overall financial conditions are conducive for an economic recovery in the months ahead. The economic data appears to be responding to the joint efforts by the monetary authorities, who have kept the financial sector functioning, and by the fiscal authorities, who have maintained household income streams and responded effectively to the health crisis.

In the next sections, we’ll discuss the health of the economy and the role of the commodity market in that recovery and in future iterations of economic growth.

RSM Canada Financial Conditions Index