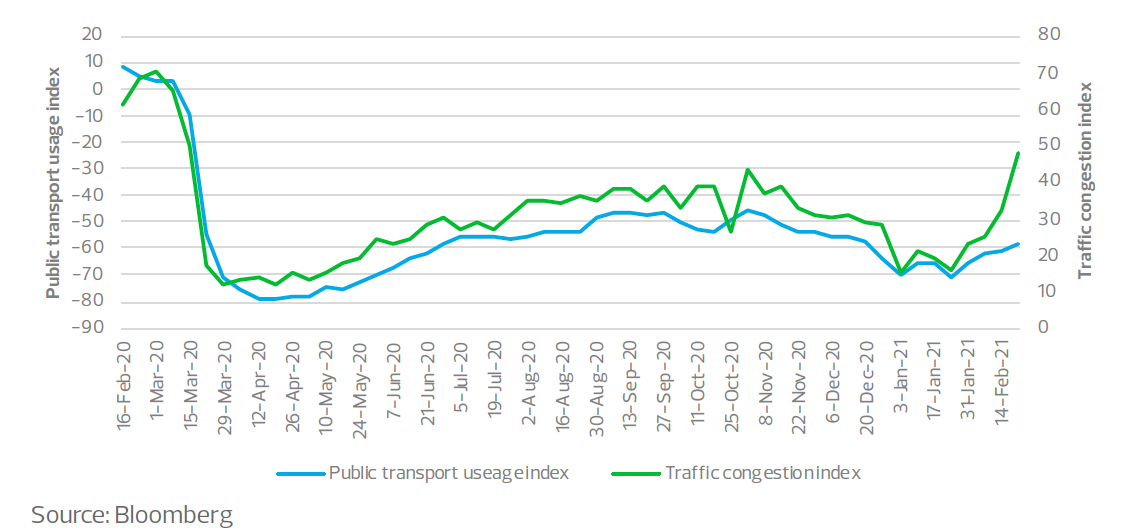

Usage of public transportation has been hit particularly hard, which of course has affected farebox revenues. Last September, the Toronto Transit Commission estimated a net financial impact of nearly a quarter billion dollars as a result of COVID-19. It is likely that public transportation ridership will take time to fully recover. This decline may force municipalities, which often operate transit systems, to make some difficult decisions about cuts to service. Doing so would disproportionately affect lower-income Canadians.

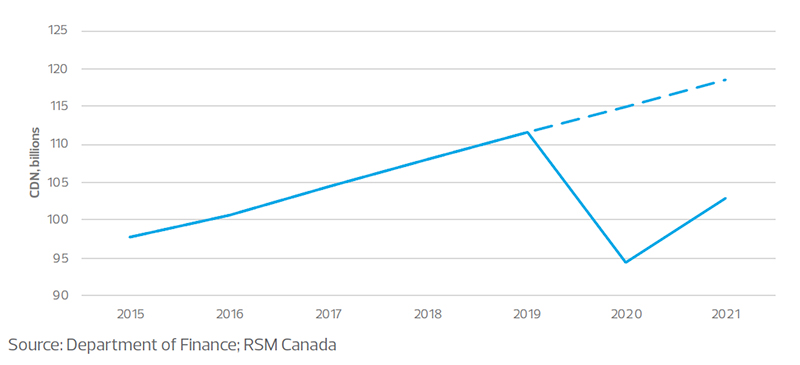

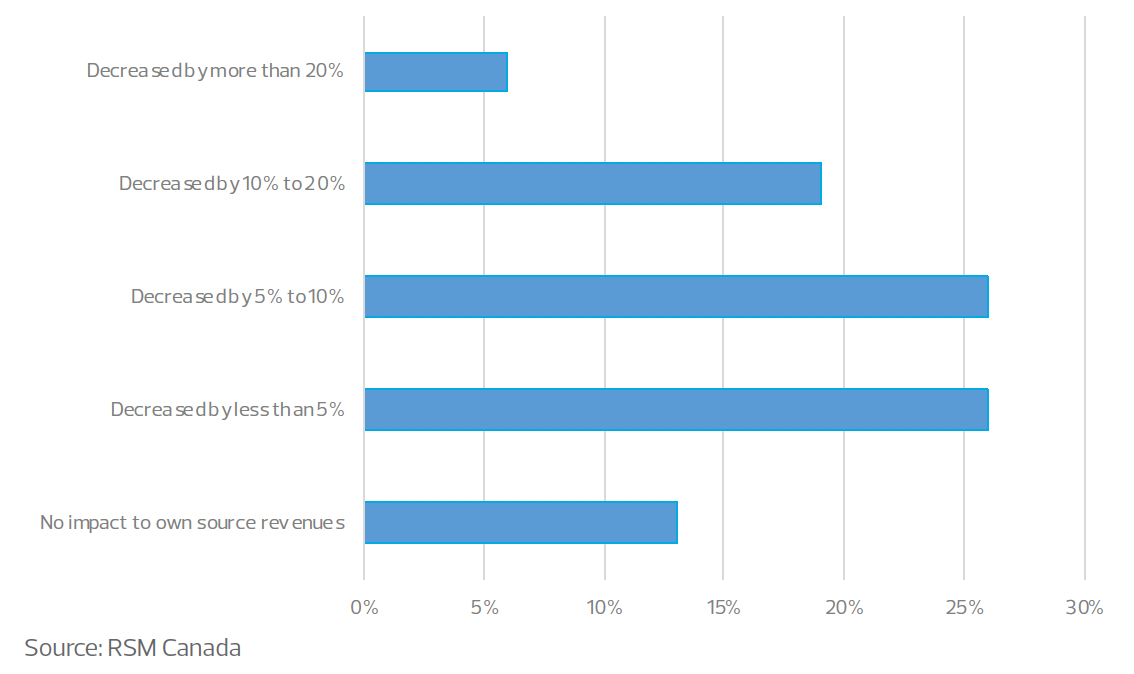

While the economy has improved significantly along with the vaccination rate, it is likely that some level of social distancing will prevail, which could continue to impair the fiscal position of municipalities. Indeed, a model we developed suggests that COVID-19 will decrease cities’ own source revenue (for example, nongovernment grant revenues) by about 15 per cent, from $112 billion in 2019 to $94 billion in 2020.

We do not anticipate that these source revenues will fully recover in 2021. Our model assumes an impact to both user fees and a small impact on property taxes. We have not fully taken into account the impact, however, of the booming real estate market in certain parts of Canada (namely Toronto) where municipalities earn significant revenues from land transfer taxes. On the flip side, the estimates do not take costs into consideration.

Municipal/local government own source revenues

PROPERTY TAXES, USER FEES AND OTHER NON-GRANT REVENUE SOURCES