Fragile global supply chains are facing another round of port closures, factory shutdowns, production halts and labour shortages as the delta variant spreads.

These disruptions will almost certainly delay the return of full production in the global economy until the middle of next year and create the conditions for further price volatility until the temporary roadblock that is the delta variant eases.

Middle market firms should prepare for disruptions as they build inventories ahead of the critical holiday season. Finding alternative domestic suppliers and adopting dynamic pricing strategies will probably present firms embedded in the real economy with the best approaches to contend with rising prices and the shifting composition of supply and demand.

All of these challenges come on top of the need to invest in productivity-enhancing software, equipment and intellectual property that can help firms manage those higher prices and the surging demand. There is no other credible alternative for middle market firms.

The Canadian equation

These supply chain disruptions are having a significant effect on the Canadian economy. Canada's imports from Asian trading partners like China have declined since March as the delta variant has also become a challenge in the region.

Imports from China, Canada's second-biggest trading partner, dropped 30.9 per cent to $3.9 billion in July, from the record high of $5.6 billion in March.

Also, container shipping costs to North America have risen. In Vancouver, Canada's largest port, costs have spiked since March as the delta variant spread and began to become a major head wind.

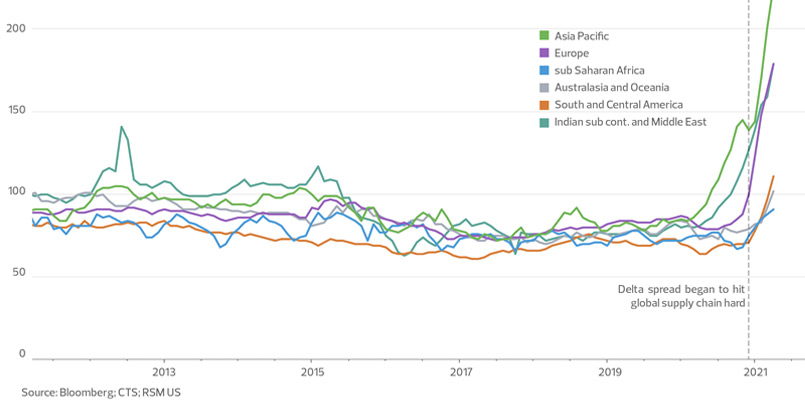

The average price level to ship a container from Asia Pacific, which accounts for about 68 per cent of all monthly shipping volume to North America, increased by 63 per cent in the March-to-July period, while the same cost from Europe increased by 79 per cent.

India, one of the hardest-hit countries by the delta variant, also contributed to a 41 per cent increase in container shipping prices from the Indian subcontinent

and Middle East in the same period.

Regions that share smaller incoming container volumes to North America like Australasia and Oceania, Latin America, and sub-Saharan Africa have also experienced significant upticks in price levels, up by 29 per cent, 56 per cent and 21 per cent, respectively.

A short-term challenge

As jarring as these numbers are, middle market firms should know that this mismatch of supply and demand is not a permanent condition. It is likely to be more similar to the experience of last year, early in the pandemic, when businesses and consumers contended with shortages of everything from masks to toilet paper, and also dealt with volatility in food prices.

Those shortages were quickly relieved by the supply responses from Asia, the world's biggest factory floor, and the North American supply chain. While it will be some time before the current disruptions ease, this too shall pass.

In the near term, though, there is no getting around the constraints in the supply chain and they are hitting all of North America, not just Canada. Middle market companies that rely on imports must prepare for two major issues that will last well into the first half of next year until Asian supply chains get back to full production: rising international transportation costs and depleted inventories.