The Canadian economy has been remarkably resilient amid elevated inflation and interest rates.

Key takeaways

RSM has lowered Canada’s probability of a recession over the next 12 months to 60% from 75%.

RSM sees Canada avoiding a recession this year.

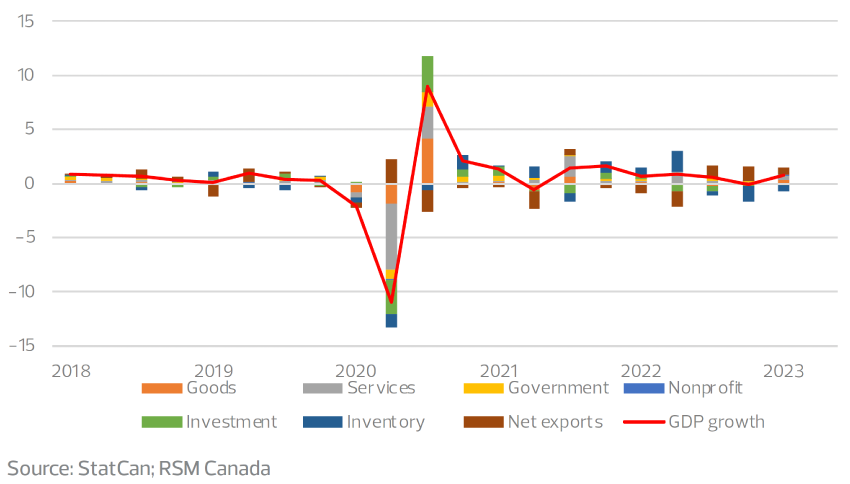

The Canadian economy has displayed remarkable resilience this year, defying expectations of a downturn.

In our updated economic forecast, we have lowered Canada's recession probability over the next 12 months to 60 per cent from 75 per cent.

A 40 per cent probability of a soft landing is nontrivial thanks to strong labour demand, healthy consumer spending and a housing market that is still robust. These factors are in part fuelled by Canada's ambitious immigration policy as well as healthy household savings from the pandemic.

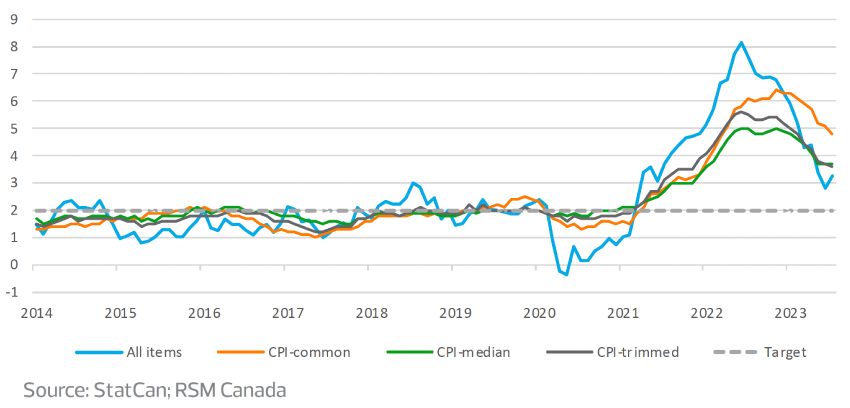

Inflation has declined to 2.8 per cent, the lowest among G7 countries. The decline is an encouraging sign that a rate peak is in sight for the Bank of Canada.

While the Canadian economy will muddle through the rest of the year with slower growth, we believe Canada will avoid a recession this year.

In our forecast, the economy will expand by 0.4 per cent in the third quarter and remain steady in the last quarter, with a slowdown continuing into the first half of next year.

Contributions to GDP growth (per cent)

The housing market is on solid ground after a brief lull at the beginning of the year as demand continues to outpace supply, leading to high rental and purchase prices despite high interest rates.

That said, a major exogenous shock risks sending food and fuel prices upward and pushing the economy into a recession.

Bank of Canada to hold

Falling inflation and signs of cooling labour demand might be enough for the Bank of Canada to hold its policy rate at 5 per cent. However, one more hike is possible if emerging data tells a different story.

One can breathe a sigh of relief with headline inflation now below 3 per cent. The decline has occurred much faster than anticipated, thanks to lower energy prices.

Consumer Price Index (per cent)

Despite trending downward, core inflation measures have remained sticky because of the high prices of services. In addition, businesses still plan on raising prices faster than before the pandemic.

Data on gross domestic product and jobs could send mixed signals during the year's second half as the economy absorbs a series of temporary shocks such as strikes and forest fires.

The Bank of Canada will closely monitor core inflation, labour demand and consumer spending as it tries to walk the fine line to restore price stability while not over-tightening.

Regardless, the Bank of Canada's first rate cut will not come before next year's second quarter.

One reason is that the central bank is keen on taming inflation expectations among consumers and businesses alike. Officials will want to see inflation remain low for an extended period before slashing rates.

On the flip side, sustained higher rates translate into higher borrowing costs for businesses, which hurt business investments, especially in high-risk sectors such as tech.

Immigration fuels economic growth

Immigration has played a pivotal role in helping Canada avoid a recession by not only adding to the labour supply but also boosting consumer demand.

Without immigration, Canada would have a declining population and a shrinking workforce. Instead, Canada now has the highest population growth since 1957 and one of the highest growth rates among the developed economies.

However, immigration is not without its drawbacks, such as straining the already tight housing supply in cities and adding to price pressures. Still, immigration will help the economy overall into next year.

Labour market moderates

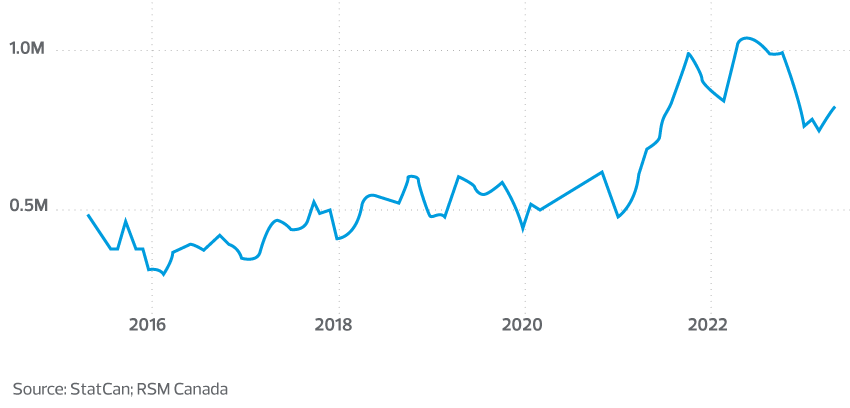

Labour demand remains strong but is showing early signs of moderating. The economy added 290,000 jobs during the year's first six months, though most of the concentrated growth was in the first quarter.

Job vacancies

While job vacancies remain elevated above pre-pandemic levels, they have decreased to the lowest level since May 2021. That decline indicates a cooling labour market and is a trend we expect to continue through the year's end.

As an indicator of resilient labour demand, real wages have been growing but could stagnate into next year as the economy slows.

We expect the unemployment rate to creep up to 5.6 per cent by the year's end, which is still below the pre-pandemic average of 5.7 per cent.

When we look at the big picture, businesses are often concerned with the long-term economic outlook beyond the next month or quarter.

To this end, in the long run, a pain point for Canada is its labour productivity, which has flattened and even decreased in recent years.

Canada risks falling behind its peers in the global economy and short-term fixes would not be enough. Instead, it would require an economy and policies that encourage innovation, more openness and less protectionism to ensure long-term prosperity.

Household spending to taper

Consumer spending has been surprisingly resilient, keeping the economy buoyant. But a closer look reveals that consumer spending is likely financed by a drawing down of savings.

Savings from the pandemic have given households a buffer, but this will most likely wind down amid the dual challenges of inflationary pressures and rising interest rates.

At the same time, Canadian households' debt levels have ballooned, standing at 180 per cent of income. According to the Bank of Canada, over a third of mortgage borrowers have seen their interest payments rise, with more to come as more mortgage terms expire.

When households pay more for housing, they have less money to spend on goods and services.

This means monetary policies are working as intended: to cool consumer demand and the economy. Whether or not they can cool the economy without pushing it into recessionary territory remains to be seen.

The takeaway

The data through the end of the year will paint a mixed picture with alternating months of GDP growth and contraction, of job gains and losses. But one thing is clear: the Canadian economy will slow down.

At the same time, solid consumer demand, a robust labour market and strong housing sector are all tailwinds for the economy. Those tailwinds might just be enough to push the probability of a soft landing to 40 per cent, which, if achieved, will be no small feat for the Bank of Canada.

RSM contributors

More from this edition of The Real Economy, Canada

Want more economic insights?

Subscribe to our quarterly newsletter