The energy sector

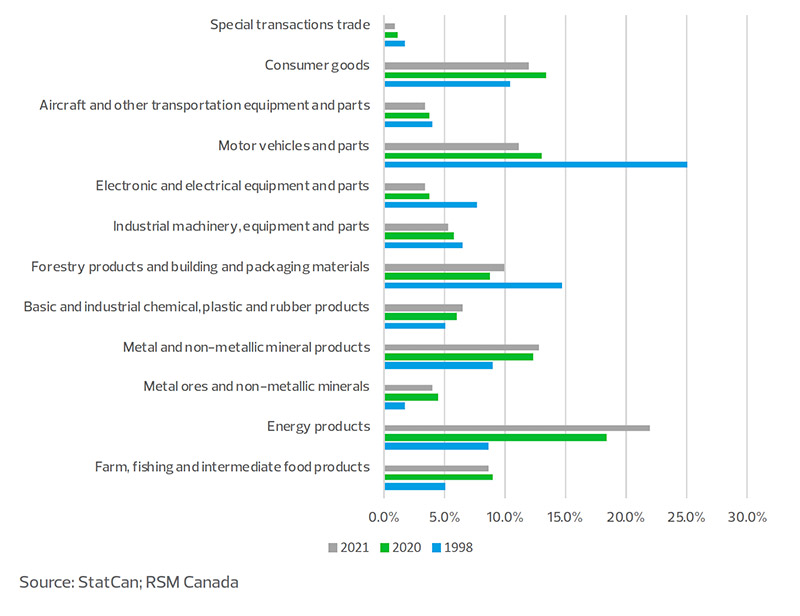

The energy sector is a case in point. Despite the push to reduce carbon emissions, the energy sector, and especially the oil and gas industry, is still vital to Canada. If anything, the sector’s importance to the Canadian economy has increased over the past several years. In 2020, energy products comprised 18.4 per cent of Canada’s total exports to the United States, up from 8.7 per cent in 1998. And over the first four months of 2021, that ratio has grown even further, with energy products accounting for 21.9 per cent of Canada’s total exports to the United States.

There is little sign that the Biden administration will offer any relief. The president wasted little time in cancelling the Keystone XL pipeline project, which was not too surprising because he campaigned on the issue.

MIDDLE MARKET INSIGHT: The energy sector’s importance to the Canadian economy has increased over the past several years. In the first four months of 2021, energy products accounted for 21.9 per cent of Canada’s total exports to the United States.

What has been more surprising, though, is Biden’s lack of action on the shutdown of Enbridge’s Line 5 pipeline by Michigan Governor Gretchen Whitmer despite the pipeline’s importance to the U.S. economy. Enbridge reports that shutting down Line 5 would result in a shortage of approximately 45 per cent of existing demand for gas, diesel and jet fuel in an area that includes Ohio, Pennsylvania, Michigan, Ontario and Quebec.

Adding to the uncertainty, a recent executive order by the Biden administration targeting consolidation across industries could put the pending merger of Canadian National Railway and Kansas City Southern in question. The merger held the promise of providing a more integrated rail network throughout North America for crude shipments from Canada to the Gulf of Mexico and refined products to Mexico. But the administration has expressed concern about further consolidation in the industry, saying it could raise prices on freight shipments and stymie passenger rail service.

The tariffs question

Then there is the lumber industry. The Biden administration doubled tariffs on Canadian softwood, which was originally proposed under the Trump administration. Indeed, in 2017, Trump originally intended to impose a nearly 20 per cent tariff on Canadian softwood before settling on approximately half that rate. Forestry products, and building and packaging materials, comprised 8.7 per cent of Canada’s total exports in 2020 (9.9 per cent through in the first four months of 2021).

Interestingly, Biden imposed these tariffs when the price of lumber surged as a result of increased demand from housing construction and supply challenges wrought by the pandemic.

Manufactured products, which include motor vehicles and parts (13 .1 per cent of exports to the United States in 2020); industrial machinery, equipment and parts (5.8 per cent); electronic and electrical equipment and parts (3.8 per cent); and other categories, also face challenges in the wake of Biden’s executive order increasing enforcement of Buy American provisions.

Considerable uncertainty exists with regard to what extent these provisions will apply to the president’s infrastructure spending package.

The return of industrial policy

The return of industrial policy in the United States could very well be another area of friction in the coming years. Biden recently signed into law one of the largest industrial bills in U.S. history focused on the semiconductor and technology manufacturing sector in a bipartisan effort to remain competitive with China. But industrial policy measures like the one passed by the Senate can also act as non-tariff barriers. While Canada may not have been the target, it could be affected nonetheless if it, too, fails to keep pace with the United States.

MIDDLE MARKET INSIGHT: The return of industrial policy in the U.S. could very well be another area of friction in the coming years.

Canada’s response

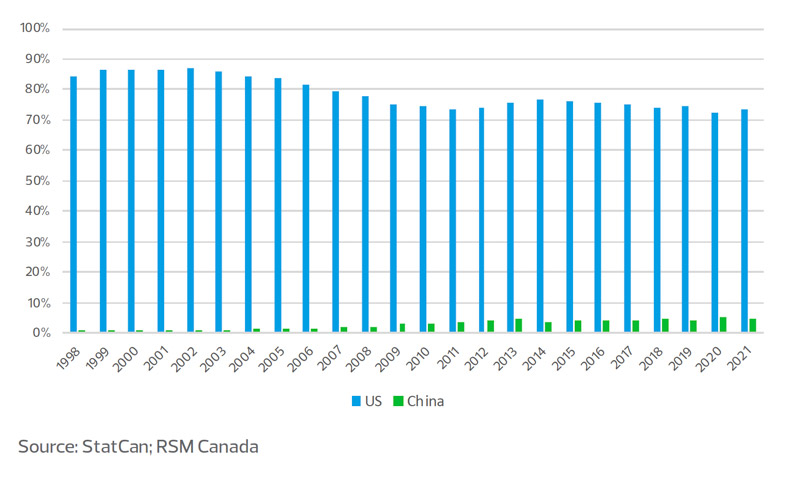

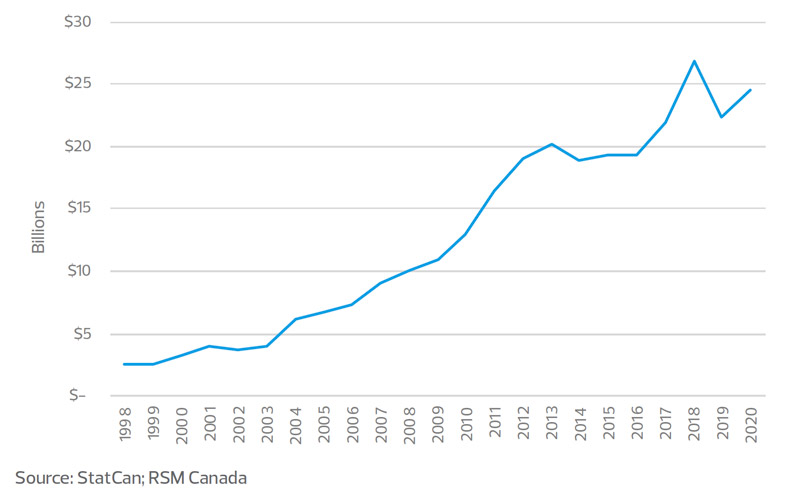

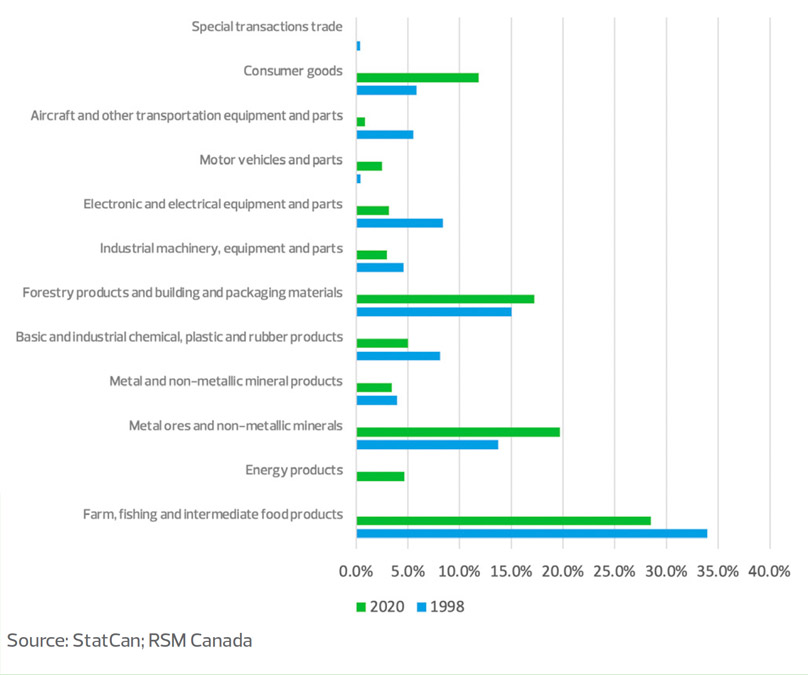

Canadian policymakers have long been concerned about Canada’s reliance on the U.S. economy, even before the original Canada-United States Free Trade Agreement was signed in 1987. Accordingly, several Canadian governments have promoted trade diversification, which has manifested itself in Canada’s aggressiveness in negotiating and signing free trade agreements and tapping into the fast-growing Asia-Pacific region, namely China.

Canada exports to China, 1998 to 2020