The Bank of Canada is maintaining its overnight target rate of 25 per cent and has stated that it will retain its current policy of accommodation for as long as necessary to ensure its inflation target is sustainably achieved.

Expectations are that the effects of COVID-19 will have dampened economic growth during the first quarter, even as a successful distribution of vaccines is creating the conditions for a broad-based economic recovery this year.

In addition, an unemployment rate of 7.5 per cent implies a labour market with a long road back to full employment.

With an inflation rate near the bottom of the central bank’s target range of 1 per cent to 3 per cent, implying a lack of demand, the Bank of Canada is going to be patient on the path of monetary policy as the economy heals.

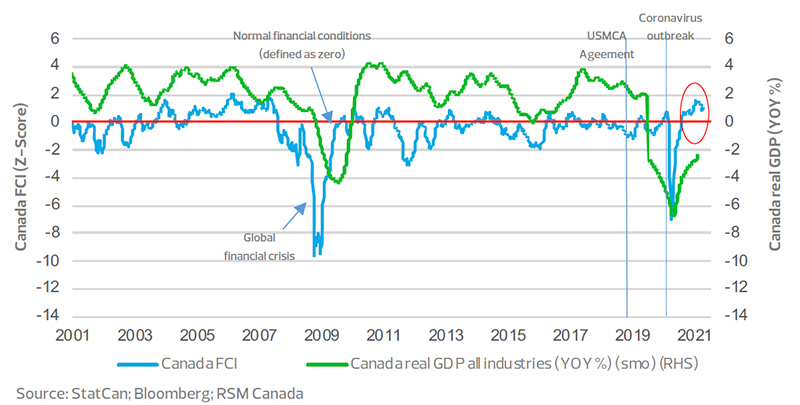

That said, during March, our RSM Canada Financial Conditions Index reached as high as 1.5 standard deviations above neutral before retreating to 1.0 standard deviation as oil prices came off their highs. That implies that financial conditions are conducive to economic activity and solid recovery this year.

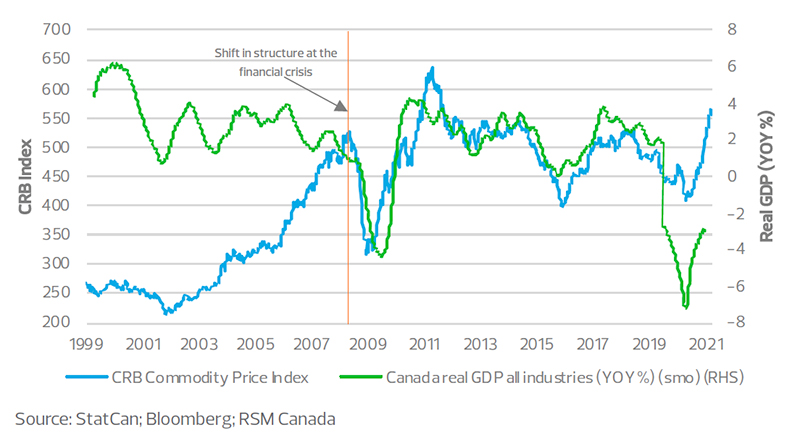

Excluding oil and commodity prices, the index stands just above neutral. For this reason, the Bank of Canada should remain accommodative to ensure that the improvement in the energy-based economy is matched by that in the domestic real economy.