Roughly 85 per cent of the $1.9 trillion in the American Rescue Plan is dedicated to addressing the pandemic. As the pandemic goes, so goes the economy. About 75 per cent of the overall package consists of one-time spending and nearly $1.16 trillion of it is designed to be spent this year. Inside that, roughly half of the $680 billion in income transfers this year will be in the form of stimulus checks.

All of this stimulus spending, coupled with an accommodative monetary policy, is why we upgraded our growth forecast for the American economy this year to 7.5 per cent, up from 6.1 per cent, with the real possibility of growth that is faster than that. It will be the fastest economic expansion since the 1980s, and perhaps since World War II.

Canada can expect a similarly strong trajectory. As the American economy improves, U.S. businesses will need to import more energy from Canada to fuel their factories and American businesses and consumers will buy more goods and services from Canada. It is all part of the benefit—and the drawback at times—of being one of America’s largest trading partners.

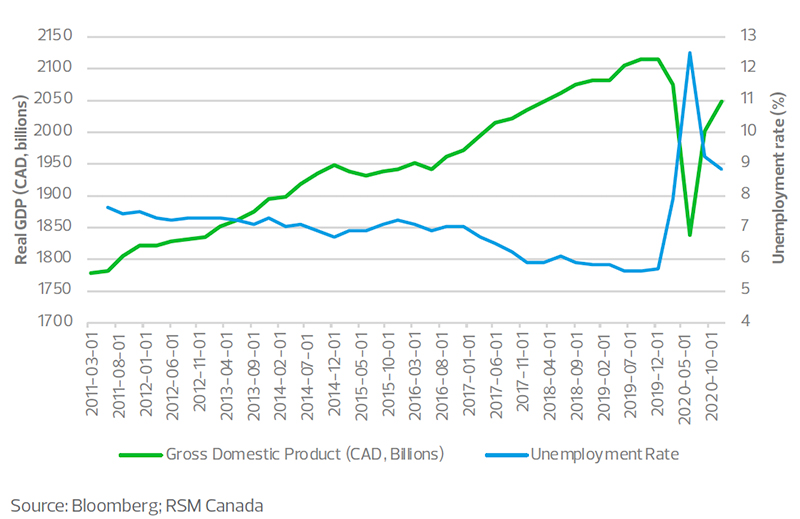

For this reason, we now expect economic growth this year to be 6.5 per cent in Canada, which is less than that in the United States partly because of Canada’s slower vaccination rate. Risks to our outlook include the potential reinstitution of lockdown measures as a result of a third wave of the coronavirus and lagging vaccination rates.

The other risk is related to fiscal policy. Some commentators have suggested that it is time for the federal government to rein in fiscal spending. But given the potential for the reinstitution of lockdown measures, this may not be warranted.

American spending

A big question, though, is to what extent Americans will spend their stimulus checks, as opposed to saving that money or paying down debt (which could foreshadow more spending later).

An initial assessment by the National Bureau of Economic Research found that Americans spent 40 per cent of the one-time $1,200 payments provided under the CARES Act last spring; the rest was saved or used to pay down debt.

But the savings of American households have since swelled and their balance sheets have improved, leaving them flush with cash just as they are itching to return to a normal life—and spend.

There is also the question of job losses, and to what extent the cash flowing to Americans will be offset by unemployment as the pandemic continues and economic activity is curtailed. As scarred as the labour market is, we project a period of significant hiring in the second half of the year as vaccines are distributed, businesses reopen and consumers open their wallets.

It all goes to the confidence of American consumers, who account for about 70 per cent of American gross domestic product. As the prospect of herd immunity from the coronavirus becomes more real, this confidence is poised to grow.

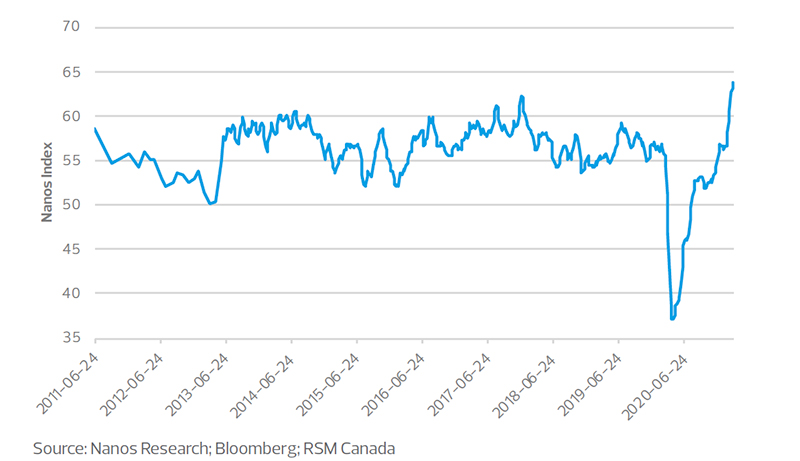

In Canada, the economic mood as measured in the Nanos Economic Mood Index hit its highest level ever, signifying that Canadian households are optimistic about the state of the economy and the recovery. Household spending, which is yet to fully recover from the pandemic, is poised for significant growth over the next couple of years.

Economic mood